- The AUD/USD weakens after reaching a new maximum of the year of 0.6564 on Thursday.

- The trade between the US and China raises the feeling of risk, but the benefits and a firmer USD limit the profits.

- The Aud/USD is directed towards 0.6500, with the bullish impulse fading above 0.6550.

The Australian dollar (AUD) is going back from the weekly maximums against the US dollar (USD) on Friday.

At the time of writing, the Aud/USD torque is negotiated about 0.6520, having reached an intradic maximum of 0.6561.

The aud/usd goes back as the USD recovers land and the feeling stabilizes

The US dollar is recovering slightly after falling to a minimum of three years against its peers. On Friday, the Office of Economic Analysis published the latest figures of the Personal Consumption Expenditure Index (PCE). The underlying numbers, which reflect the rhythm to which prices are increasing for goods excluding volatile elements such as food and energy, increased in May. The annual rate increased 2.7%, greater than 2.6% estimated above, with the monthly figure rising 0.2 percentage points.

The preferred inflation measure of the Federal Reserve (FED) is closely monitored in search of possible clues about the trajectory of monetary policy. However, with President Trump pressing the Fed to reduce rates before the September meeting, investors were also observing the numbers of the Michigan’s feeling index, which reflected a slight increase in optimism in June.

Despite the publication of macroeconomic data, the decrease in geopolitical tensions this week has been an important engine of the increase in the price of the AUD/USD.

With the high fire between Israel and will increase the demand for risk assets, safe refuge flows had been reduced, exerting additional pressure on the dollar. The news that China and the United States were ending a commercial agreement on Friday provided additional support for the AUD/USD, which was anxious to re -test the level of 0.6600 key psychological resistance.

As the markets continued to digest recent developments and prepared to close, an increase in benefits sent to the AUD/USD down.

Technical rejection at a key level of Fibonacci pushes the Aud/USD downwards

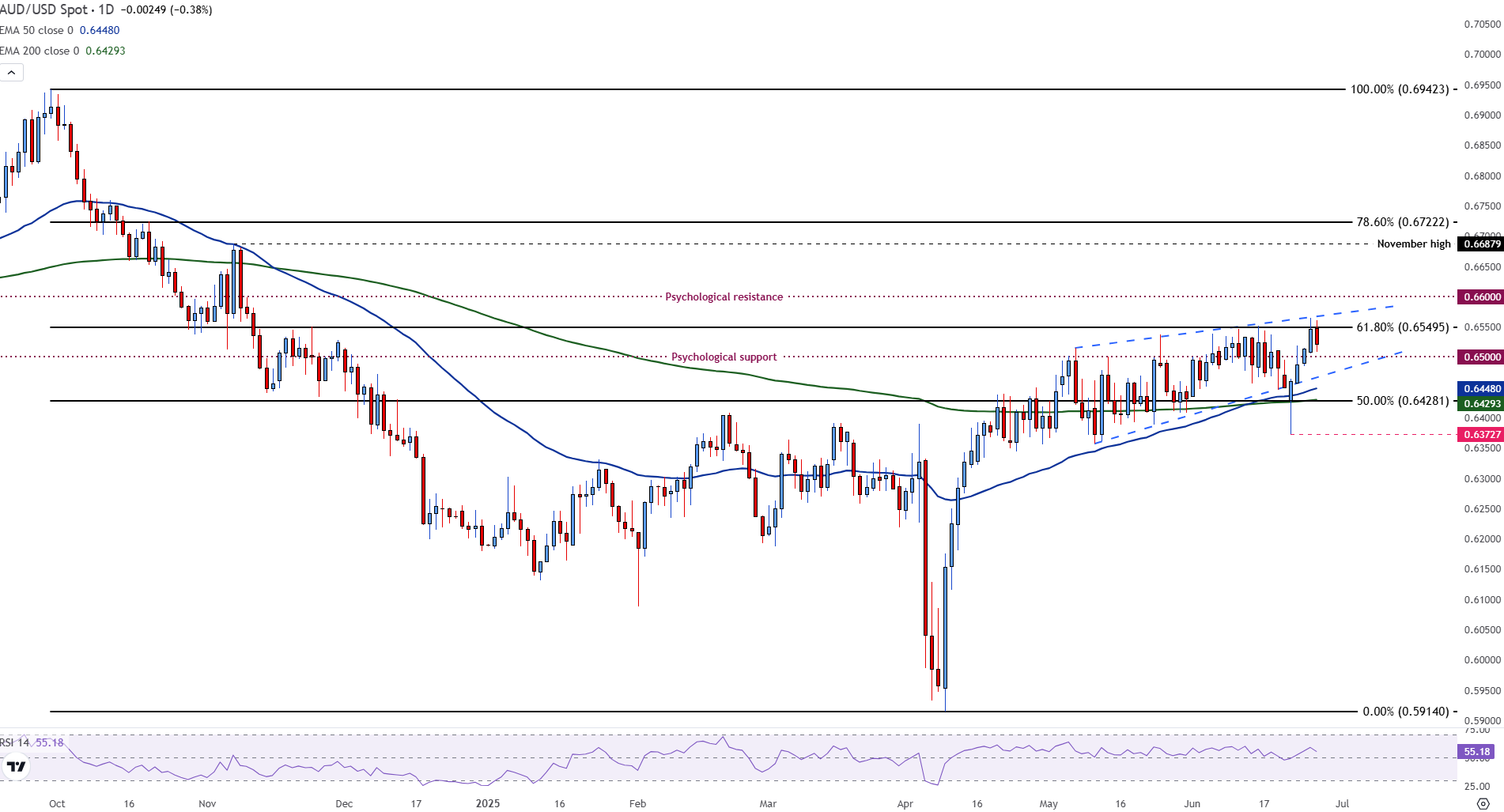

From a technical point of view, the AUD/USD has been negotiating within an ascending wedge pattern, a structure often associated with a possible bearish reversion.

The pair tried to break over the fibonacci setback of 61.8% of the pearl-opening trend around 0.6550, but failed to maintain the impulse.

Aud/USD Daily Graph

The rejection at this level has triggered a new wave of sales, with immediate support now seen in the 50 -day exponential mobile average (EMA) about 0.6448. Below that is the 200 -day EMA at 0.6427, whose rupture could expose the minimum of Monday of 0.6372.

Meanwhile, the relative force index (RSI) is 55 and points down, indicating a fading of the bullish impulse. The short -term perspective for the AUD/USD is still cautious. While the improvement improved earlier this week raised to the torque, the inability to exceed key levels of resistance and the resurgent demand of the US dollar could point out the potential of additional risks down.

US dollar FAQS

The US dollar (USD) is the official currency of the United States of America, and the “de facto” currency of a significant number of other countries where it is in circulation along with local tickets. According to data from 2022, it is the most negotiated currency in the world, with more than 88% of all global currency change operations, which is equivalent to an average of 6.6 billion dollars in daily transactions. After World War II, the USD took over the pound sterling as a world reserve currency.

The most important individual factor that influences the value of the US dollar is monetary policy, which is determined by the Federal Reserve (FED). The Fed has two mandates: to achieve price stability (control inflation) and promote full employment. Its main tool to achieve these two objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the 2% objective set by the Fed, it rises the types, which favors the price of the dollar. When inflation falls below 2% or the unemployment rate is too high, the Fed can lower interest rates, which weighs on the dollar.

In extreme situations, the Federal Reserve can also print more dollars and promulgate quantitative flexibility (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is an unconventional policy measure that is used when the credit has been exhausted because banks do not lend each other (for fear of the default of the counterparts). It is the last resort when it is unlikely that a simple decrease in interest rates will achieve the necessary result. It was the weapon chosen by the Fed to combat the contraction of the credit that occurred during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy bonds of the US government, mainly of financial institutions. Which usually leads to a weakening of the US dollar.

The quantitative hardening (QT) is the reverse process for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the wallet values that overcome in new purchases. It is usually positive for the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.