- AUD/USD is still up 0.37% on the week.

- The upbeat mood, soft US dollar and rising commodity prices supported AUD/USD.

- Fed members backed a 75 basis point rate hike, saying the US economy is strong.

On Friday, the AUD/USD remains almost unchanged, amid a positive tone in the market, as US stocks rise, but remain on the verge of falling, due to the sudden change in market sentiment after the June employment report in the US. US to beat expectations, indicating recession fears are overblown. At the time of writing, the AUD/USD is trading at 0.6837.

Upbeat mood and US dollar weakness a tailwind for AUD/USD

The risk appetite boost extends to the currency space as risk sensitive currencies rise. The US Department of Labor reported that June’s nonfarm payrolls added 372,000 jobs to the economy, more than an estimate of 268,000. Despite a favorable report, the unemployment rate was unchanged at 3.6%, as wage growth held firm. Traders sold stocks in reaction that could prompt the Fed to continue to hike rates aggressively to rein in inflation.

AUD/USD reacted lower, posting a daily low around 0.6791, but bounced back as investors dissected the report, breaking towards fresh three-day highs around 0.6870. In addition, rising commodity prices have supported major companies, as the Bloomberg commodity index shows, which is up 0.88%, as opposed to iron ore prices, which are down 1.22%. , at $113.74 per ton.

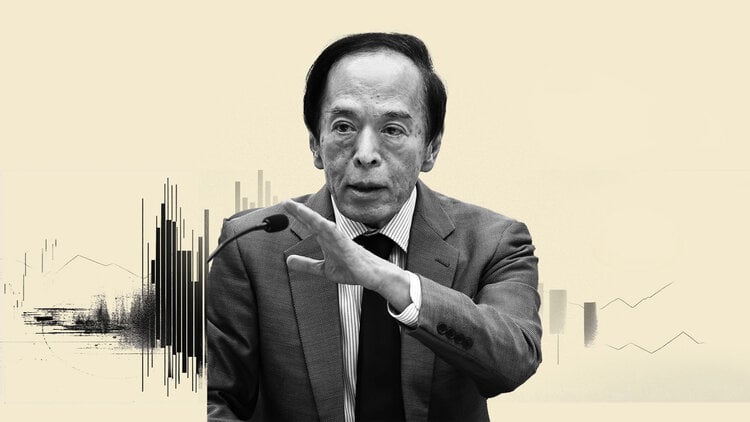

At the time of this writing, New York Fed President John Williams stated that the central bank is 100% committed to the targets and expects GDP to grow less than 1% this year.

On the other hand, a group of Fed speakers, namely Waller, Bullard and Bostic, reiterated their view of supporting a 75 basis point rate hike at the July Fed meeting. They also expressed that the US economy is strong and can withstand higher rates, while downplaying recession fears.

What to watch out for

The Australian economic calendar will include June NAB Business Confidence, July Consumer Confidence and June Employment Report. In the United States, the consumer price index (CPI) for June, the producer price index (PPI) and consumer sentiment from the University of Michigan (UoM) will update the situation of the US economy.

Additionally, Fed spokespeople will make statements before entering the lock-in period for the July monetary policy meeting.

AUD/USD Key Technical Levels

AUD/USD

| Panorama | |

|---|---|

| Last Price Today | 0.6853 |

| Today’s Daily Change | 0.0015 |

| Today’s Daily Change % | 0.22 |

| Today’s Daily Opening | 0.6838 |

| Trends | |

|---|---|

| 20 Daily SMA | 0.6913 |

| 50 Daily SMA | 0.7018 |

| 100 Daily SMA | 0.7186 |

| 200 Daily SMA | 0.7215 |

| levels | |

|---|---|

| Previous Daily High | 0.685 |

| Previous Daily Minimum | 0.6764 |

| Previous Maximum Weekly | 0.6965 |

| Previous Weekly Minimum | 0.6764 |

| Monthly Prior Maximum | 0.7283 |

| Previous Monthly Minimum | 0.685 |

| Daily Fibonacci 38.2% | 0.6817 |

| Daily Fibonacci 61.8% | 0.6797 |

| Daily Pivot Point S1 | 0.6784 |

| Daily Pivot Point S2 | 0.6731 |

| Daily Pivot Point S3 | 0.6698 |

| Daily Pivot Point R1 | 0.6871 |

| Daily Pivot Point R2 | 0.6904 |

| Daily Pivot Point R3 | 0.6957 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.