- The AUD/USD moves strongly to mixed economic data and monetary policy expectations.

- Australian retail sales do not comply with forecasts, but the fall in inflation in the US limits losses.

- The AUD/USD looks for technical levels of historical movements to find direction.

The Australian dollar (AUD) is consolidating against the US dollar on Friday, since the new internal data and monetary policy expectations for the Bank of the Australian Reserve (RBA) and the Federal Reserve of the USA (FED) continue to boost the price action.

At the time of writing, the Aud/USD is struggling to find direction, retained by a combination of weak economic foundations and a technically limited range.

Australia’s economy shows signs of weakness while inflation in the US is softened

Australian economic data published on Friday were weaker than expected in key sectors. Construction permits fell by 5.7% intermensual in April, a more pronounced drop of the expected extended by the revision of 7.1% of March.

Retail sales also fell 0.1%, without complying with the forecasts of an increase of 0.3%. While private sector credit increased marginally, the broader conclusion is that demand remains weak and unequal recovery.

Meanwhile, the US economy continues to show signs of resilience. Friday’s data confirmed that the underlying inflation of personal consumption spending (PCE) remained stable at 0.1% intermencing in April, with interannual figures moderating from 2.7% to 2.5%.

The trade deficit of goods was significantly reduced to -87,620 million dollars, and Michigan’s consumer’s feeling rose to 52.2, its highest level since January.

These data points reinforce the divergent monetary policy trajectories, with the Fed remaining in a way of “waiting and seeing”, without showing urgency to cut, while the RBA seems increasingly cornered towards relaxation.

The technical levels of the aud/USD form a firm confluence range, increasing the potential of a breakout

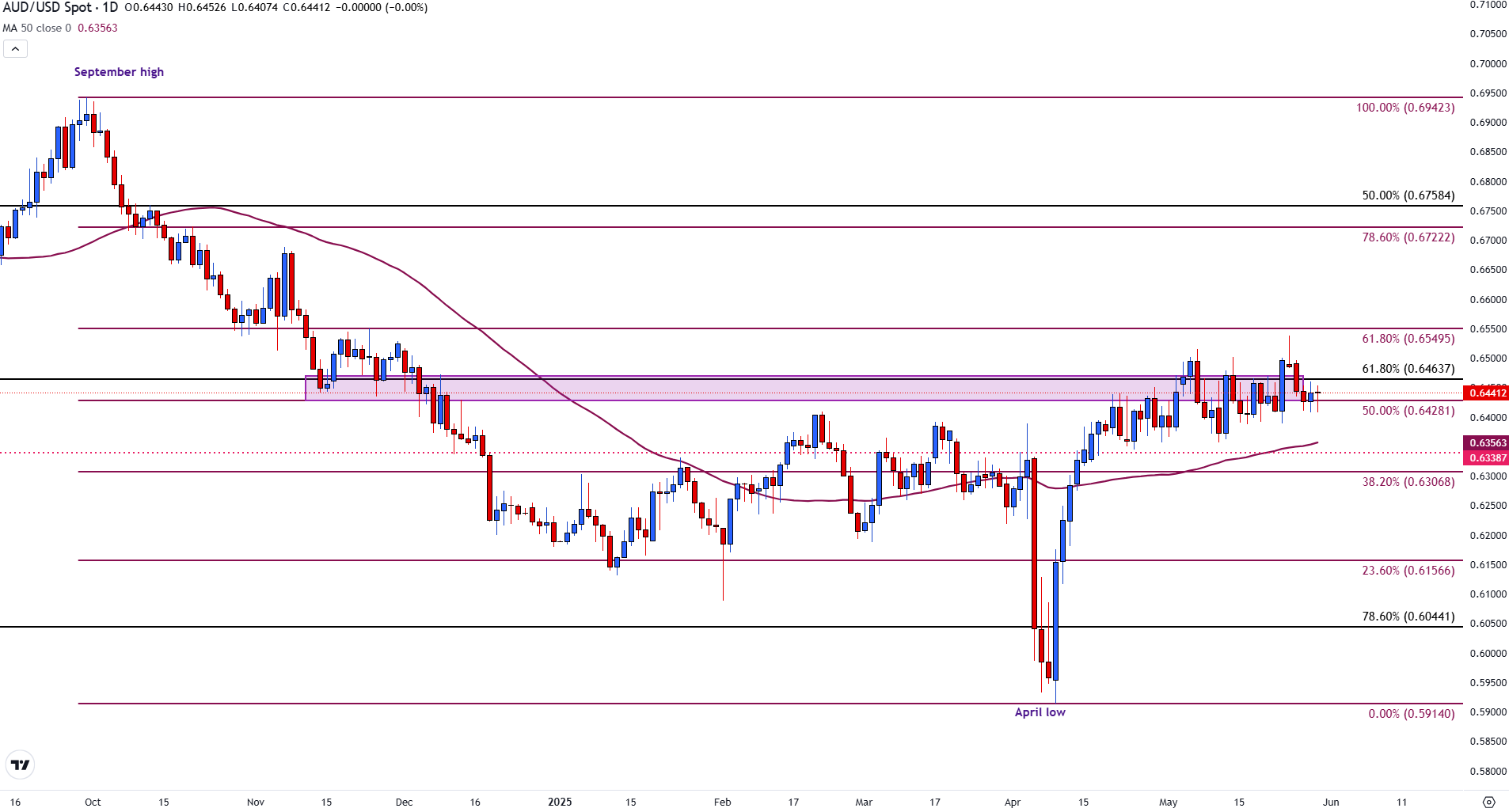

Despite the bassist macro background, the aud/USD remains limited in a range and technically undecided. The torque is currently around 0.6440, stagnant just below the 61.8% level of the Rally of 2020-2021, staying at 0.6464.

Aud/USD Daily Graph

In the last month, the pair has failed to maintain the impulse above 0.6549, while it has also found support just above the midpoint of the fall from September to April at 0.6428. The single mobile average (SMA) of 50 days, which now rises towards 0.6356, offers close dynamic support in case the bearish pressure resumes.

A rupture below 0.6428 would increase the downward risk towards the 0.6338 and potentially 0.6307 area (38.2% of the September-April movement). On the positive side, a closure would be required above 0.6463 to challenge the upper range and potentially try 0.6550 again.

Faqs Australian dollar

One of the most important factors for the Australian dollar (Aud) is the level of interest rates set by the Australian Reserve Bank (RBA). Since Australia is a country rich in resources, another key factor is the price of its greatest export, iron mineral. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and commercial balance. The feeling of the market, that is, if investors are committed to more risky assets (Risk-on) or seek safe shelters (Risk-Off), it is also a factor, being the positive risk-on for the AUD.

The Australian Reserve Bank (RBA) influences the Australian dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of the interest rates of the economy as a whole. The main objective of the RBA is to maintain a stable inflation rate of 2% -3% by adjusting the interest rates or the low. Relatively high interest rates compared to other large central banks support the AU, and the opposite for the relatively low. The RBA can also use relaxation and quantitative hardening to influence credit conditions, being the first refusal for the AU and the second positive for the AUD.

China is Australia’s largest commercial partner, so the health of the Chinese economy greatly influences the value of the Australian dollar (Aud). When the Chinese economy goes well, it buys more raw materials, goods and services in Australia, which increases the demand of the AU and makes its value upload. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian dollar.

Iron mineral is the largest export in Australia, with 118,000 million dollars a year according to data from 2021, China being its main destination. The price of iron ore, therefore, can be a driver of the Australian dollar. Usually, if the price of iron ore rises, the Aud also does, since the aggregate demand of the currency increases. The opposite occurs when the price of low iron ore. The highest prices of the iron mineral also tend to lead to a greater probability of a positive commercial balance for Australia, which is also positive for the AUD.

The commercial balance, which is the difference between what a country earns with its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly requested exports, its currency will gain value exclusively for the excess demand created by foreign buyers who wish to acquire their exports to what you spend on buying imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the commercial balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.