- The Powell’s hard line tone of the Fed limits the losses of the US dollar while the markets continue to assess a rate cut in September, providing temporary support to US treasure yields.

- Australian inflation is softened, increasing the expectations of a rate cut by RBA in July.

- The AUD/USD remains around 0.6500 while the operators expect the next fundamental promoters.

The Australian dollar (AUD) stabilizes against the US dollar (USD), after a two -day rally that raised the aud/USD above 0.6500.

With the return of appetite due to the risk of markets after the confirmation of Alto El Fuego between Israel and Iran on Tuesday, the Australian dollar has benefited from the decrease in geopolitical tensions.

However, with prices now recovering above the simple mobile average (SMA) of 200 days, the bullish impulse could be beginning to lose strength. As technical and fundamental factors contribute to boosting the price action, the relative performance of the two economies and the expectations of interest rates have once again focused.

The monthly consumer price index (CPI) data in Australia, published on Wednesday, revealed that price pressures continued to decrease.

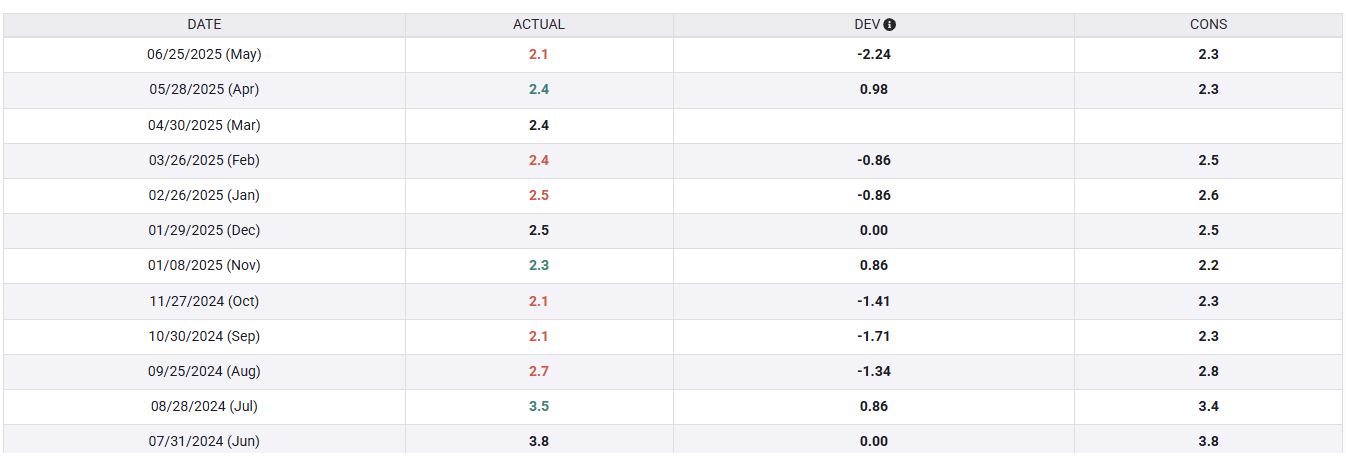

While analysts had anticipated that the annual inflation rate would increase 2.3% in May, the real figure was printed by 2.1%.

Australian monthly inflation data table for the period from July 2024 to May 2025 – FXSTERET SOURCE

The softer inflation figure increased the expectations that the Australian Reserve Bank (RBA) would announce another rate cut in July.

The attention then moved back to the United States, where the markets expected more comments from the president of the Federal Reserve (Fed), Jerome Powell.

While Powell testified to the US Senate Committee on Banking, Housing and Urban Affairs, he continued to express optimism about the US economy. His comments, on Tuesday and Wednesday, have done little to change the projected trajectory for interest rates, at least for now. This leaves the expectations of an Fed rates cut valued for September, which has offered some support to the US dollar and treasure yields.

Although the divergent monetary policy should be raising the US dollar, the current economic uncertainty and the weakest economic data are limiting their profits.

The AUD/USD remains around 0.6500, with prices remaining within the limits of an ascending wedge

From a technical point of view, the AUD/USD continues to negotiate within the limits of ascending wedge formation in the daily chart.

Prices are currently testing an important technical confluence zone around the key psychological level of 0.6500. Support in the simple mobile average (SMA) is being formed at 0.6490, which aligns with the lower limit of the ascending wedge pattern.

A clear rupture of the level of 0.6500 could see the bullies aim at a new test of the Fibonacci recoil level of 61.80% of the fall from September to April about 0.6550.

However, if bassist impulse accumulates, a movement below the support of the ascending trend line could see a deeper setback to the midpoint of the movement mentioned above at 0.6428.

Faqs Australian dollar

One of the most important factors for the Australian dollar (Aud) is the level of interest rates set by the Australian Reserve Bank (RBA). Since Australia is a country rich in resources, another key factor is the price of its greatest export, iron mineral. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and commercial balance. The feeling of the market, that is, if investors are committed to more risky assets (Risk-on) or seek safe shelters (Risk-Off), it is also a factor, being the positive risk-on for the AUD.

The Australian Reserve Bank (RBA) influences the Australian dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of the interest rates of the economy as a whole. The main objective of the RBA is to maintain a stable inflation rate of 2% -3% by adjusting the interest rates or the low. Relatively high interest rates compared to other large central banks support the AU, and the opposite for the relatively low. The RBA can also use relaxation and quantitative hardening to influence credit conditions, being the first refusal for the AU and the second positive for the AUD.

China is Australia’s largest commercial partner, so the health of the Chinese economy greatly influences the value of the Australian dollar (Aud). When the Chinese economy goes well, it buys more raw materials, goods and services in Australia, which increases the demand of the AU and makes its value upload. The opposite occurs when the Chinese economy does not grow as fast as expected. Therefore, positive or negative surprises in Chinese growth data usually have a direct impact on the Australian dollar.

Iron mineral is the largest export in Australia, with 118,000 million dollars a year according to data from 2021, China being its main destination. The price of iron ore, therefore, can be a driver of the Australian dollar. Usually, if the price of iron ore rises, the Aud also does, since the aggregate demand of the currency increases. The opposite occurs when the price of low iron ore. The highest prices of the iron mineral also tend to lead to a greater probability of a positive commercial balance for Australia, which is also positive for the AUD.

The commercial balance, which is the difference between what a country earns with its exports and what it pays for its imports, is another factor that can influence the value of the Australian dollar. If Australia produces highly requested exports, its currency will gain value exclusively for the excess demand created by foreign buyers who wish to acquire their exports to what you spend on buying imports. Therefore, a positive net trade balance strengthens the AUD, with the opposite effect if the commercial balance is negative.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.