- The strength of the US dollar was the main cause of the fall in AUD/USD.

- US inflation continues to cool while consumer sentiment deteriorated in March.

- The TDS analyst expects the RBA to keep rates on hold at the April meeting.

- AUD/USD Price Analysis: Soft in the near term, pending RBA decision.

the australian dollar (AUD) It pulls back after reaching a weekly high of 0.6738, driven by the recovery of the US dollar (USD), as it was bolstered by weekly, monthly and quarterly flows. Wall Street will end the week with gains, while US inflation data could cement the case for a pause in the Fed’s tightening cycle. AUD/USD is trading at 0.6684, shedding 0.43% from its opening price.

AUD/USD falls below 0.6700 on the strength of the US dollar.

The Fed’s preferred inflation gauge, core PCE published by the US Commerce Department, rose 4.6% year-on-year, below forecasts and the previous month. Headline inflation was 5%, a sign that the Fed’s tightening measures continue to curb inflation.

Susan Collins, president of the Federal Reserve Bank of Boston, expressed approval of the news, but stressed that the Fed still has work to do.

The University of Michigan (UoM) Consumer Sentiment in its final reading for March was 62, worse than expected. At the same time, inflation expectations fell. For the one-year horizon, US consumers expect inflation to be 3.6%, while for the 5-year horizon, inflation estimates are down to 2.9%.

Lately, New York Fed President John Williams has stated that uncertain economic outlook and economic data will drive monetary policy. Williams expects inflation to fall to 3.5% and Gross Domestic Product (GDP) to contract slightly before rebounding in 2024.

On the inflation data, AUD/USD reacted higher to 0.6718 before reversing course, falling sharply below the 0.6700 figure and hitting a daily low of 0.6670. Since then, the AUD/USD has stabilized around 0.6686.

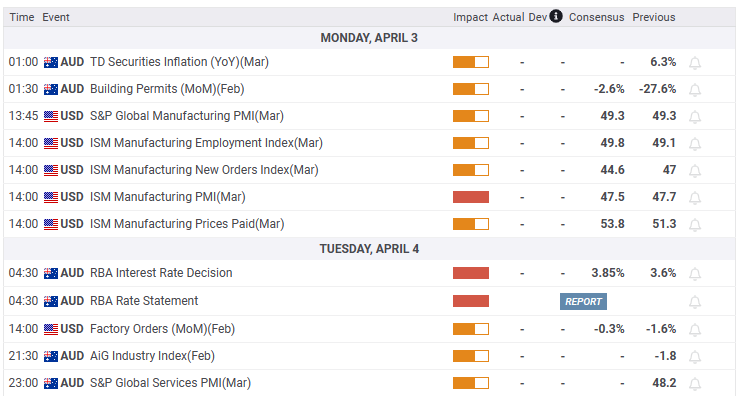

On the Australian front, inflation data would give clues as to the path forward for the Reserve Bank of Australia (RBA). TD Securities Inflation for February was 6.3% YoY, and any reading below the latter may discourage the RBA from continuing to tighten monetary conditions.

TDS expects a pause from the RBA in its tightening campaign

TD Securities analysts say in a note: “April meeting looks close, with mixed sentiment among analysts on the RBA decision and markets not expecting an RBA hike. We now expect the Bank to pause at the April meeting given the low January-February CPI and uncertainty about the prospects for near-term bank turmoil.”

AUD/USD Technical Analysis

AUD/USD is trading sideways as its daily chart shows, albeit skewed lower. For a bearish continuation, sellers need to recapture the March 24 low at 0.6625, exposing year-long lows at 0.6564. Once broken, the path to Nov 10 at 0.6386 is in sight. On the other hand, if buyers break above 0.6700, they might hold out hope that AUD/USD will test 0.6800 in the near term.

What is there to watch out for?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.