- The Minutes showed that some Federal Reserve officials wanted a 50 basis point rate hike.

- The concerns of policy makers are linked to a tense labor market and the inflation risks discussed are tilted to the upside.

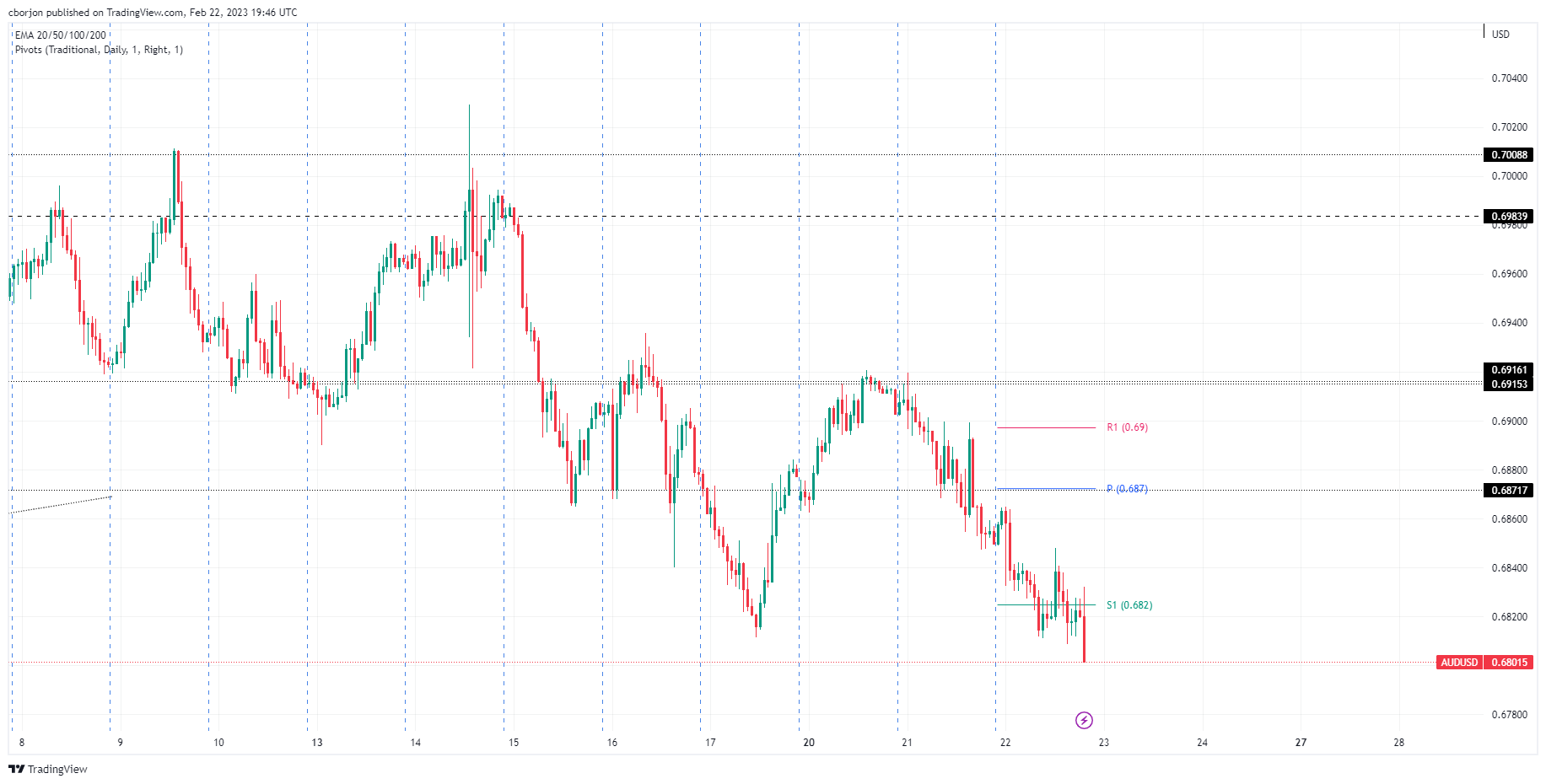

- AUD/USD Price Analysis: It rallied towards 0.6830 before reversing its trajectory and hitting a fresh weekly low around 0.6801.

He AUD/USD extended its losses during the session on Wednesday and fell near the daily low of 0.6808 after the release of the Federal Open Market Committee (FOMC) minutes, which revealed that “few participants” were in favor of a rate hike of 50 bp. At the time of writing these lines, the pair AUD/USD trades at 0.6826.

FOMC Minutes Summary

The FOMC revealed in its minutes that some Federal Reserve officials wanted a more aggressive rate hike, with the minutes citing that “a few participants were in favor of raising rates by 50 basis points.” Furthermore, all Fed board members agreed that more rate hikes were needed to reach the Fed’s target and that balance sheet shrinking would continue according to plan.

Fed officials reiterated that inflation risks remain skewed to the upside, such as China’s reopening and Russia’s invasion of Ukraine, and reiterated that the labor market remains tight. Participants stated that the economic outlook is weighed down, with some participants seeing recessionary prospects in 2023.

AUD/USD Reaction to FOMC Minutes

The 1 hour chart for AUD/USD shows a rally towards 0.6832 before AUD/USD reversed course, breaking south of the daily S1 pivot point at 0.6825. It has to be said that volatility has increased and after hitting a low of 0.6808, AUD/USD is falling hard, with its sights set on a break below 0.6700.

AUD/USD 1-hour chart

AUD/USD Key Technical Levels

AUD/USD

| Overview | |

|---|---|

| Last price today | 0.6803 |

| Today Change Daily | -0.0051 |

| today’s daily variation | -0.74 |

| today’s daily opening | 0.6854 |

| Trends | |

|---|---|

| daily SMA20 | 0.698 |

| daily SMA50 | 0.6891 |

| daily SMA100 | 0.6715 |

| daily SMA200 | 0.6805 |

| levels | |

|---|---|

| previous daily high | 0.692 |

| previous daily low | 0.6848 |

| Previous Weekly High | 0.703 |

| previous weekly low | 0.6812 |

| Previous Monthly High | 0.7143 |

| Previous monthly minimum | 0.6688 |

| Fibonacci daily 38.2 | 0.6875 |

| Fibonacci 61.8% daily | 0.6892 |

| Daily Pivot Point S1 | 0.6828 |

| Daily Pivot Point S2 | 0.6802 |

| Daily Pivot Point S3 | 0.6756 |

| Daily Pivot Point R1 | 0.69 |

| Daily Pivot Point R2 | 0.6946 |

| Daily Pivot Point R3 | 0.6973 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.