- AUD/USD bulls may be about to throw in the towel on a test of 0.6700.

- Bears watch the risks of a move lower at the Federal Reserve.

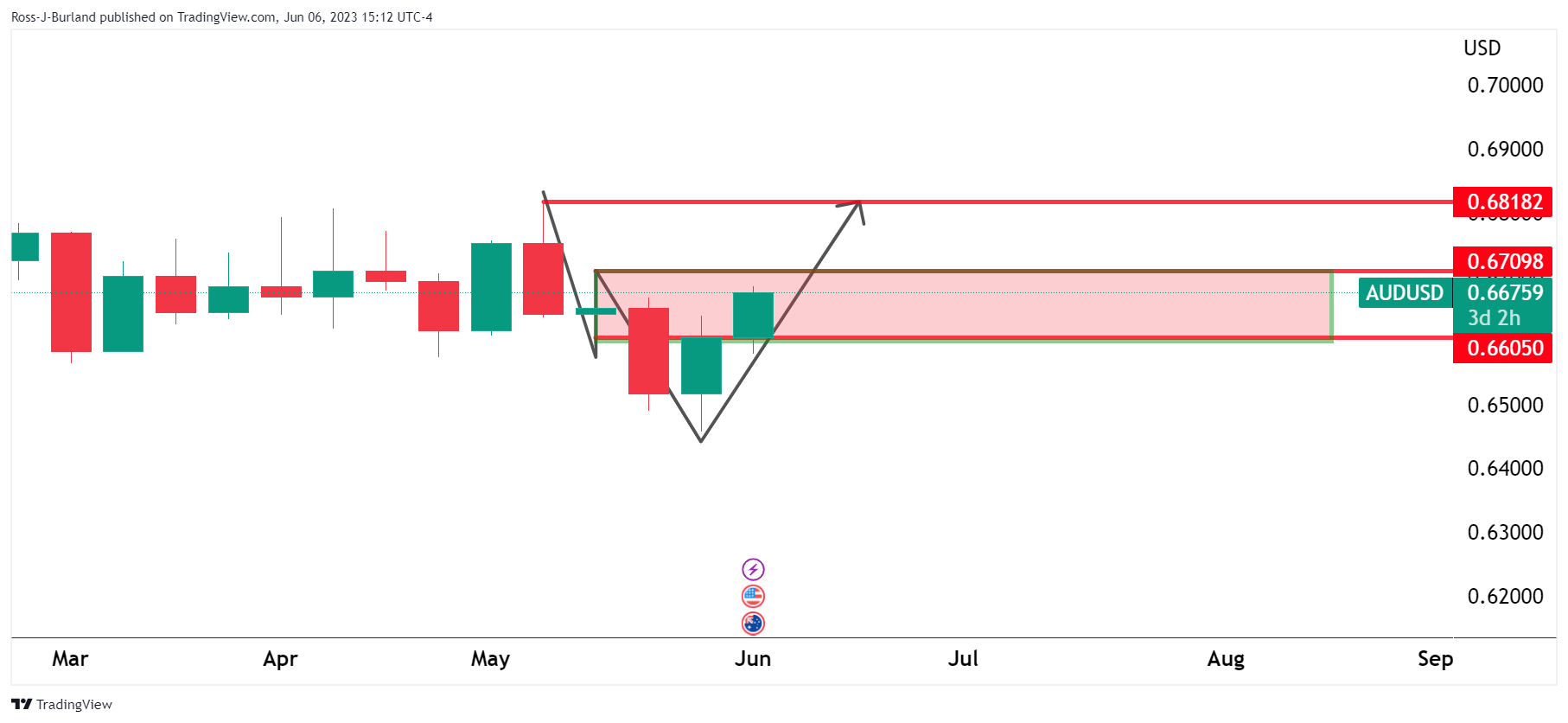

The AUD/USD pair has reached its highest level since mid-May following the Reserve Bank of Australia (RBA) meeting at which interest rates were raised. The cash rate now stands at 4.1%, its highest level in 11 years. The technical outlook is bullish, but there is a risk of a correction, as shown below. The main catalyst, if there is to be any further hikes, will be the June 14 Federal Reserve rate decision and its outcome. A dovish decision is expected to support AUD/USD bulls on their bullish path.

AUD/USD weekly chart

The weekly trajectory is W-shaped bullish with the last leg being long-traveled as it is currently facing the neckline/resistance line:

AUD/USD daily chart

Zooming in, the daily chart shows price in a W formation as well, but this could be about to complete with a pullback to reaffirm the bulls’ commitment. A momentum statement with a progressive correction leading up to the Fed meeting could follow.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.