- The AUD/USD pair fell from 0.6760 on the explosive rise in US Treasury yields.

- Claims for unemployment benefits in the US continued their downward trend, with numbers below estimates.

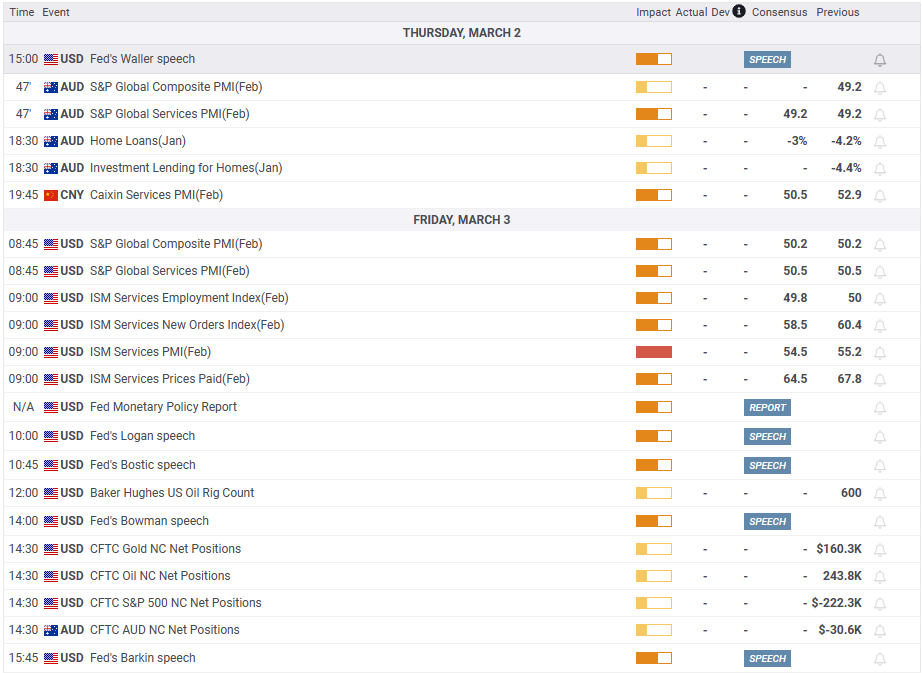

- What is there to watch out for? Australian PMIs, US services PMIs and Fed member statements.

The pair AUD/USD It found resistance around 0.6760, and lost almost 0.40% on Thursday after the release of strong US economic data. The tightness of the labor market and last week’s inflation figures in the US suggest that the US Federal Reserve (Fed) still has some way to go to curb inflation. The AUD/USD is trading around 0.6735.

AUD/USD to end Thursday session with losses

Wall Street will close Thursday’s session with solid gains. However, in the currency space, risk currencies such as the Australian dollar (AUD) took their toll on rising US Treasury yields, with the bond yield at 2.5 and 10 years, remaining above the threshold of 4.08%. Consequently, the greenback rose, with the US Dollar Index (DXY) rising 0.57% to 104.965.

The US agenda revealed that Initial Claims for Unemployment Benefits for the week ending February 25 stood at 190,000, below the 195,000 estimated by analysts. Following the release, US Treasury yields soared above the 4% mark, with 2-year Treasury yields topping out at 4.90%, while the DXY hit a daily high of 105,180.

AUD/USD cut ground and hit a daily low of 0.6706; sellers failed to extend their decline below the daily R1 pivot point of around 0.6707. AUD/USD did recover some ground, however, after Atlanta Fed President Raphael Bostic said the Fed may be in a position to pause by mid-summer.

Bostic added that he expects the Federal Funds Rate (FFR) to peak around 5.00% – 5.25% and reiterated that it will stay there “well into 2024.”

What must be considered?

S&P World Services PMI will be released on the Australian calendar, while data from China with Caixin Services PMI will also weigh on the Australian dollar (AUD). In the US, the Fed data will be released alongside the release of the ISM and S&P Global Services PMI indices.

AUD/USD Technical Levels

AUD/USD

| Overview | |

|---|---|

| Last price today | 0.6732 |

| Today Daily Variation | -0.0022 |

| today’s daily variation | -0.33 |

| today’s daily opening | 0.6754 |

| Trends | |

|---|---|

| daily SMA20 | 0.6879 |

| daily SMA50 | 0.6896 |

| daily SMA100 | 0.6739 |

| daily SMA200 | 0.6796 |

| levels | |

|---|---|

| previous daily high | 0.6784 |

| previous daily low | 0.6695 |

| Previous Weekly High | 0.6921 |

| previous weekly low | 0.6719 |

| Previous Monthly High | 0.7158 |

| Previous monthly minimum | 0.6698 |

| Fibonacci daily 38.2 | 0.675 |

| Fibonacci 61.8% daily | 0.6729 |

| Daily Pivot Point S1 | 0.6705 |

| Daily Pivot Point S2 | 0.6656 |

| Daily Pivot Point S3 | 0.6617 |

| Daily Pivot Point R1 | 0.6794 |

| Daily Pivot Point R2 | 0.6833 |

| Daily Pivot Point R3 | 0.6882 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.