- AUD / USD struggled to capitalize and hold its modest gains at higher levels in the 0.7300 region.

- Rising US bond yields pushed the USD to new month-long highs and sparked new selling around the pair.

- A cautious sentiment weighs on the higher perceived risk AUD and contributes to the slide.

The pair AUD / USD has dropped almost 50 pips during the European session and has reached daily lows around the 0.7265 region in the last hour.

The pair has continued its struggle to find acceptance above the 0.7300 level and has once witnessed a reversal from near the 0.7315-20 resistance zone on Tuesday. The US dollar has followed a sharp rise in US Treasury yields and it has skyrocketed to the highest level since August 20. This, in turn, has been seen as a key factor that has acted as a headwind for the AUD / USD pair and led to further selling at higher levels.

US bond yields have been climbing higher after the Fed hinted last week that it will soon reduce its asset purchases. In addition, the so-called dot chart showed policymakers’ inclination to raise interest rates in 2022. The prospect of the likely timing of the Fed’s policy tightening pushed the benchmark 10-year US government bond yield to the level. highest since June 17 and continued to prop up the USD.

Apart of this, China’s Evergrande Group’s Unresolved Debt Crisis Concerns weighed on investor sentiment. This was evidenced by a cautious mood around equity markets, further benefiting the safe-haven USD and moved away the higher perceived risk AUD monetary flows. Despite the pullback, the AUD / USD pair has, so far, managed to stay within a multi-day-old trading range, which warrants caution for bears.

Therefore, it will be prudent to wait for a strong continuation sell before positioning yourself for the resumption of the recent pullback of the 0.7475-80 region, or monthly highs touched on September 3. There is no major US economic data release on Tuesday, leaving the AUD / USD at the mercy of the USD. Aside from this, the broader market risk sentiment could also provide some boost.

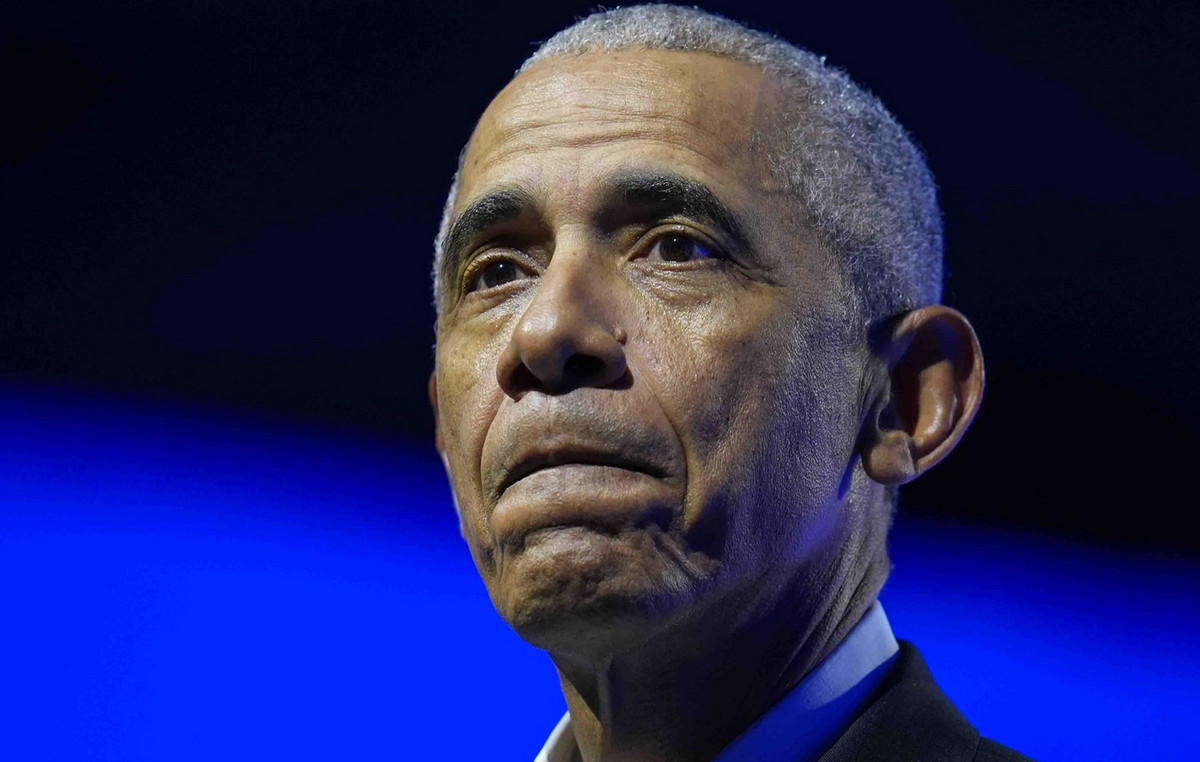

At the start of the American session, investors will take the tracks of the testimony of Fed Chairman Jerome Powell, before the Senate Banking Committee. This, along with US bond yields, will influence the USD and could lead to some significant trading opportunities around the AUD / USD pair.

Technical levels to observe

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.

.jpg)