By Leonidas Stergiou

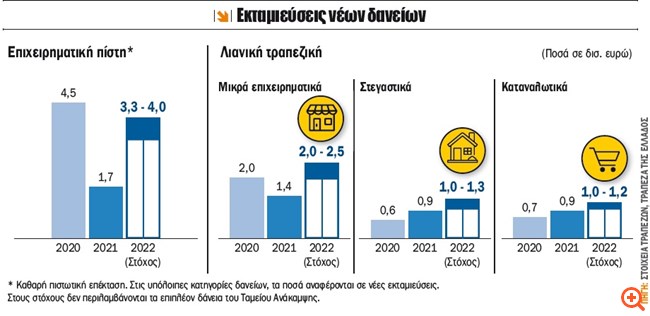

The emergence of the Omicron mutation and overcrowding in mortgages and notaries in the third and fourth quarters of 2021 were the main reasons for the recovery in demand for business and mortgage loans. During the same period, consumer credit continued to run at a high rate, with total disbursements exceeding mortgages and approaching those of small businesses.

Nevertheless, 2021 was the year of retail banking with the purchase of mortgages increasing by 50% and consumer loans by 25%, according to data reported by banks in the Hellenic Banking Association. Banks predict that the same pattern will continue in 2022, with total mortgage disbursements exceeding 1 billion euros (from 884 million euros in 2021 and 600 million euros in 2020), with the prospect of reaching 1 billion , 25 billion euros.

Consumer loans

In consumer credit, the new disbursements in 2021 reached 889 million euros, ie they exceeded those of mortgages by 5 million euros. The forecast for 2022 exceeds 1 billion euros, as the main source of demand comes from the car market (almost 50% of disbursements) and loans to meet personal needs. The latter were significantly strengthened with the appearance of the so-called fast loans through mobile phones for amounts up to 3,000 euros.

The increased demand for personal needs, which is also fueled by housing credit (household equipment, etc.), leads banks to design new consumer credit products. For example, Alpha Bank will enter fast loans via mobile phone, while systems are being prepared that will evaluate the customer and will pre-approve personal loans, which will be available when and if the customer needs them.

Pre-approved loans

In this new product, which includes fast loans and is called pre advised loan, Eurobank has already launched since the fall for amounts up to 7,000 euros. The bank’s systems evaluate the transactions and the financial profile of the customers, discovering valuable customers. In them, depending on the customer relationship, a personal loan of up to 7,000 euros is pre-approved with an interest rate of 11% to 12%. The customer is informed that the loan has been pre-approved, without having to use it. To date, those who have made use, the amounts reach up to 3,000 euros from the 7,000 euros which is the limit.

This is another indication of the conservative profile of the new customer, which is confirmed by all banks. Speaking of all four systems, the average amount of a fast loan is around 600 euros and is used to cover real needs, such as tuition, emergency damage, health issues, etc.

New players

At the same time, new players are appearing in the Greek market that are active in consumer credit. In fact, their presence is going to intensify in the coming months, bringing new models to facilitate purchases by consumers, but also stocks by traders. One such model, known as “buy now, pay later” that extends repayment in consumer markets, is to be launched by neobank TBI Bank, which currently operates mainly in Southeast Europe and recently received a license from the Bank of Greece.

Housing credit

In mortgages, after the decline at the beginning of the year due to the overload of notaries from transfers but also due to structural problems related to mortgages, they begin to show increased demand again. Trends show that disbursements this year will run at a rate of 30% -40%, with fixed-rate mortgages dominating.

Small and large business loans

A small part of retail banking is loans to small businesses. These fell by 27% in 2021 (new disbursements of 1.4 billion from 2 billion in 2020) mainly due to reduced demand. The support measures and mainly the measure of repayable advances were the ones that limited the demand for loans from small businesses, in addition to the programs from the Hellenic Development Bank.

Banks’ forecasts are moderately optimistic about loans to small and medium-sized enterprises, mainly due to the limited number of those that meet the banking criteria, but also for the delays in the presentation of investment plans. For this reason, the banks have already started informative meetings with business clients who are informed by the Recovery Fund, the new Development Law and other programs, including subsidies. Here, a common finding is the lack of information from many small and medium enterprises.

On the contrary, the battle in business credit will be given this year to large business loans and mainly to companies that participate in major development projects and through the Recovery Fund. Here, the target for net valuations by banks has been set for 2022 at 3.3 to 4 billion euros, in addition to the loans of the Recovery Fund. As the bankers have already stated in their presentations to analysts, the battle will be fierce with the main weapon being the competitive pricing policy, ie in the offers of loans with low interest rates.

Interest rate war

The discounts can reach up to 1 unit, which does not leave much profit margin. And this is one of the reasons why they emphasize retail banking, where there is a higher interest margin. This group includes businesses to small and medium-sized enterprises, which will have increased needs for lending with the growth of the economy and the investments of the Recovery Fund. Thus, the battle of shares in business credit, in large loans initially, is of a strategic nature, as from there they will draw customers from the rise of the business cycle, among the smaller companies.

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.