- The Bank of Canada (BoC) is expected to maintain its official interest rate at 5.0%.

- The Canadian dollar remains within a consolidation range.

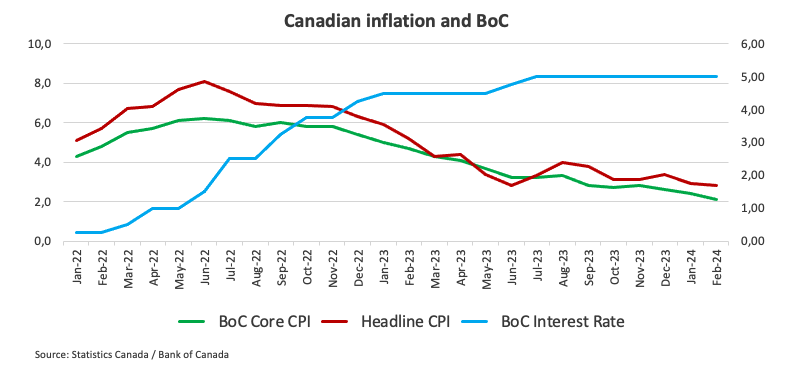

- Inflation in Canada has been losing upward traction since December.

- Investors see a 70% chance of a rate cut in June.

The Bank of Canada (BoC) is expected to keep the policy rate at 5.0% for the sixth consecutive time at its meeting on Wednesday. The bank's interest rate decision will be accompanied by a new monetary policy report with updated economic forecasts, as well as a press conference.

The Canadian Dollar (CAD) has depreciated very slowly against the US Dollar (USD) since the beginning of the year, although since February it seems immersed in a broader consolidative trend.

In the second month of the year, the Consumer Price Index (CPI) recorded a continued downward trajectory in headline inflation, while the Bank of Canada's (BoC) core CPI indicated some persistent price pressures. At the last meeting, the bank's statement predicted that inflation would remain around 3% during the first part of the year before beginning to subside, although at a gradual pace.

Despite the expected caution, the BoC could show some permeability in the face of the current downward trajectory of national inflation. We also see the central bank reiterating the importance of evaluating new data and its sustainability before making interest rate decisions. This outlook coincides with that of most G-10 central banks, such as the US Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England (BoE) and the Bank of the Reserve Australia (RBA).

A moderate surprise?

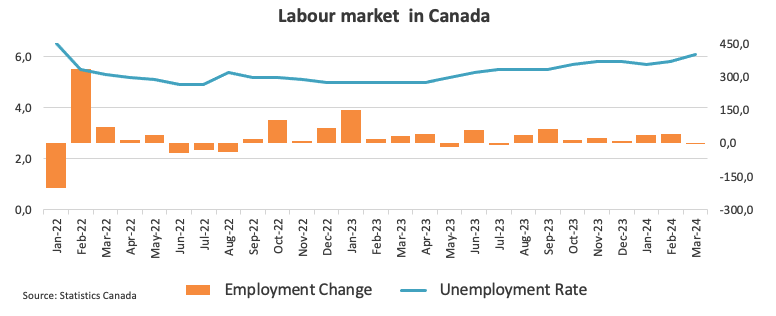

In light of the current downward trend in Canadian inflation and some cooling of the labor market, a soft tone at the BoC event and some bearish message from Governor Tiff Macklem at the subsequent press conference should not be completely ruled out, along with the palpable possibility that the bank could begin its easing cycle at some point in the summer, in tandem with the Fed, the ECB and perhaps the BoE.

Additionally, the BoC is likely to revise its inflation and GDP forecasts, expecting them to decline over the bank's time horizon.

According to the BoC's first quarter business outlook survey, released on April 1, companies saw a slight improvement in business conditions, with an increase across the board across almost all regions, sectors and company sizes. The proportion of companies expecting Canada to enter a recession over the next year decreased to 27%, down from 38% in the fourth quarter. Similarly, 40% of companies expect inflation to remain above 3% over the next two years, up from 54% in the fourth quarter. Furthermore, only 17% of companies believe that inflation will take more than four years to return to 2%, compared to 27% in the fourth quarter. Although wage growth remains high, most companies expect a slowdown: 74% expect wage growth to normalize in 2025.

Regarding inflation, Governor Tiff Macklem stated in his March press conference that “we are seeing progress in the battle against inflation, and we anticipate further progress. However, if measures of core inflation remain stagnant, it is possible that our forecasts for a decrease in general inflation will not materialize. Macklem maintained the belief that the risks associated with the inflation outlook are reasonably balanced. The fact that inflation expectations have remained firmly anchored certainly helps the bank in its effort to bring inflation back under control.

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada will announce its monetary policy decision at 13:45 GMT on Wednesday, along with the Monetary Policy Report. Governor Macklem's press conference is scheduled for 14:30 GMT.

Eliminating possible surprises, the impact on the Canadian currency is expected to be negligible, if at all. Opting for a cautious approach to maintaining current circumstances could result in a brief, reflexive decline in the USD/CAD pair in the near term, although it is unlikely to be substantial in duration or scale. It is noteworthy that a significant part of the upward movement of the exchange rate this year is attributed to the dynamics of the USD.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “the gradual bullish trend in USD/CAD in place since the beginning of the year seems reinforced by the recent surpassing of the key 200-day SMA (1.3506). However, this trend is has so far run into a pretty decent barrier around the year-to-date highs near 1.3650. A sustainable break above this region could motivate the pair to put candles towards the November 2023 high at 1. 3898 (November 1).”

Pablo adds: “If sellers regain control, the 200-day SMA should offer decent containment ahead of the March low at 1.3419 (March 8). Additional weakness from here could open the door for a move lower. weekly low of 1.3358 (January 31).”

economic indicator

BoC decision on interest rates

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled annual meetings. If the BoC believes that inflation will be above target (hawkish), it will raise interest rates to reduce it. This is bullish for the CAD as higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish), it will lower interest rates to give the Canadian economy a boost in the hope that inflation will rise again. This is bearish for the CAD, as it reduces foreign capital flows to the country.

Read more.

Next post: Wed Apr 10, 2024 1:45 PM

Frequency: Irregular

Consensus: 5%

Former: 5%

Fountain: Bank of Canada

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.