- The odds of a Bank of England rate cut remain divided.

- Disinflationary pressure in the UK stalled in June.

- GBP/USD seems to be supported so far by the 1.2800 region.

The consensus among market participants seems quite divided around the Bank of England’s (BoE) impending interest rate decision due on Thursday. It is worth recalling that the central bank has kept its policy rate unchanged at 5.25% over the past seven meetings, although the new reassessment by investors seems to favour a possible 25 basis point rate cut this week.

BoE MPC vote expected to be very close

The Bank of England’s policy decision is expected to be a close call, with market valuation now pricing in a 63% chance of a quarter-point cut, and the Monetary Policy Committee (MPC) vote could be as tight as 5-4 in favour of a central bank rate cut.

Recall that at the June meeting, the MPC decided to keep rates unchanged by a vote of 7-2. However, those who voted to hold rates indicated that their decision was “finely balanced,” hinting at the idea that a rate cut could be on the horizon.

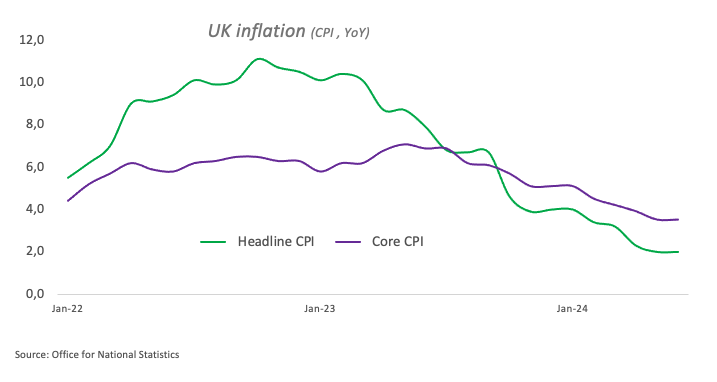

Disinflationary pressure appears to have hit a wall in June after the headline Consumer Price Index (CPI) rose 2.0% over the past 12 months, matching May’s reading. The core CPI, which excludes food and energy costs, also matched the previous month’s figures, advancing 3.5%.

In line with this, services inflation rose 5.7% year-on-year and remains well above the central bank’s projection of 5.1%.

Still on inflation, BoE chief economist Huw Pill argued that the bank was close to making a decision to cut interest rates, even though services price inflation and wage growth remained worryingly high. It is worth noting that Pill joined the majority of his colleagues in June in voting to keep interest rates at 5.25%.

Her colleague Catherine Mann emphasised the strong price pressures on the UK economy, saying she was unlikely to support an interest rate cut in August. Mann added that the recent fall in domestic inflation was merely “uncertain” and predicted that inflation would likely exceed that rate for the rest of the year.

In favour of a rate cut this week, Rabobank senior macro strategist Stefan Koopman said: “We anticipate a 25 basis point cut in the bank’s rate, taking it to 5.00%, marking the start of a gradual easing cycle with 25 basis point cuts every quarter. However, there is a risk that policymakers will want to see another month of data first.”

Furthermore, TD Securities analysts argued: “We expect a 25 basis point cut at the MPC meeting in August, with a tight 5-4 vote. That said, uncertainty is high, not only due to persistent services inflation numbers, but also due to changes in the composition of the committee. The message will likely be cautious, as the MPC should not want to signal consecutive cuts at this stage.”

How will the BoE interest rate decision impact GBP/USD?

Even though disinflationary pressures lost momentum in June, market participants seem to be leaning towards a rate cut at the BoE’s policy meeting on August 1 at 11:00 GMT.

FXStreet Senior Analyst Pablo Piovano sees the British Pound under renewed downward pressure in the event of a rate cut, as such a scenario is only partially supported by market forecasts.

Pablo adds that the GBP/USD rally experienced in the first half of July that lifted Cable to fresh 2024 highs near 1.3050 was almost exclusively due to the accelerating weakness of the US Dollar (USD) following investors’ reassessment of a rate cut by the Federal Reserve (Fed) in September.

Against that backdrop, further losses could motivate GBP/USD to break below the weekly low of 1.2806 (July 29) and challenge the provisional support at the 55-day and 100-day SMAs at 1.2776 and 1.2682, respectively. A break of that region exposes a likely drop to the July low of 1.2615 (July 2), which appears reinforced by the proximity of the key 200-day SMA (1.2836).

On the upside, Pablo sees the initial stop for the bulls at the 2024 peak of 1.3044 (July 17).

Economic indicator

BoE interest rate decision

He Bank of England sets the interbank interest rate. This interest rate affects a range of interest rates set by commercial banks, building societies and other institutions towards their own savers and borrowers. It also tends to affect the price of financial assets such as bonds, shares and exchange rates, which affect consumer and business demand in a variety of ways.

Next post: Thu Aug 01, 2024 11:00

Frequency: Irregular

Dear: 5%

Previous: 5.25%

Fountain: Bank of England

Pound Sterling PRICE Today

The table below shows the exchange rate of the British Pound (GBP) against major currencies today. The British Pound was the strongest currency against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.06% | -1.13% | -0.24% | 0.27% | -0.51% | -0.13% | |

| EUR | -0.09% | -0.02% | -1.21% | -0.34% | 0.17% | -0.59% | -0.22% | |

| GBP | -0.06% | 0.02% | -1.24% | -0.33% | 0.18% | -0.55% | -0.20% | |

| JPY | 1.13% | 1.21% | 1.24% | 0.94% | 1.41% | 0.62% | 1.04% | |

| CAD | 0.24% | 0.34% | 0.33% | -0.94% | 0.50% | -0.27% | 0.11% | |

| AUD | -0.27% | -0.17% | -0.18% | -1.41% | -0.50% | -0.77% | -0.38% | |

| NZD | 0.51% | 0.59% | 0.55% | -0.62% | 0.27% | 0.77% | 0.38% | |

| CHF | 0.13% | 0.22% | 0.20% | -1.04% | -0.11% | 0.38% | -0.38% |

The heatmap shows percentage changes of major currencies. The base currency is selected from the left column, while the quote currency is selected from the top row. For example, if you choose the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change shown in the chart will represent the GBP (base)/USD (quote).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.