According to analysts, the reduction in retail activity, the growing corporate demand and the resumed flow of funds to the exchange funds serve as more accurate signals of the supply deficiency, which is able to display bitcoin to a new historical maximum.

“The struggle for the accumulation of bitcoin acquires an increasingly expressed competitive character. Now about 80 companies have a total of about 700,000 BTC, which is about 3.4% of the maximum possible volume of 21 million coins, ”Bernstein representatives said.

After almost two months of a lull caused by a drop in Bitcoin, 31% from a record $ 108,000 to just below $ 75,000, the Bitcoin-ETF spotal in the United States began to demonstrate positive dynamics. Over the past week, the funds attracted more than $ 3 billion. This is the largest influx of funds over the past five months and the second largest result in history, analysts said.

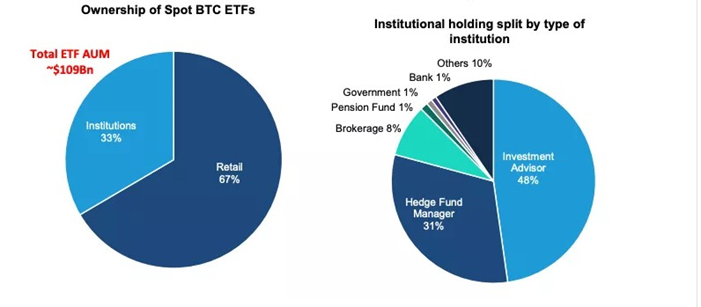

Now the ETF funds have accumulated over 5.5% of the total stock of bitcoins. Of these, almost 33% falls on institutional investors, which is a significant increase compared to September 20%.

48% of this share are controlled by investment consultants, which probably indicates the diversification of investor portfolios. The remaining 31% are at hedge funds, Bernstein reported. An additional impulse for the further growth of cryptocurrency could give the United States a state reserve of bitcoins.

“We believe that the current impulse is already powerful enough to lead Bitcoin to the new peaks in 2025. However, if the US authorities join the game, this can be a turning point that will launch the world race of states for the accumulation of BTC, ”experts said.

The share of bitcoins on exchanges fell from 16% at the end of 2023 to 13%, which indicates a growing deficit of the sentence, Bernstein analysts believe. They expect that by the end of 2025, bitcoin can reach $ 200,000, and by 2033 $ 1 million.

Analysts suggested that growth will be accompanied by intermediate bearish phases lasting about one year each. According to experts of a brokerage company, it is difficult to maintain a pessimistic forecast for bitcoin with such a dynamics of demand and a limited proposal.

Earlier, representatives of the American company Ark Invest said that by 2030 the price of bitcoin could amount to $ 2.4 million against the background of a growing asset for large investment funds.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.