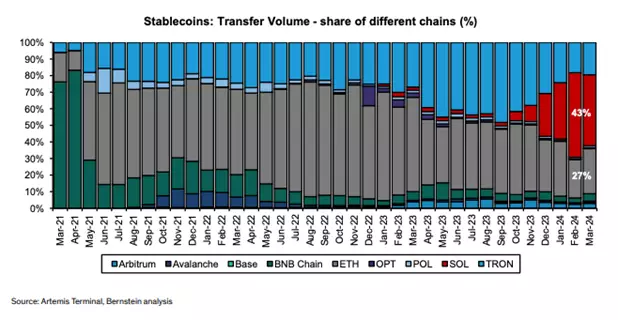

Bernstein analysts Gautam Chugani and Mahika Sapra said in a report that the market share of the Solana network has become dominant in terms of the value of transferred stablecoins compared to market leader Ethereum.

Experts say that the single-layer design of the Solana blockchain, compared to complex L2 networks on Ethereum, provides faster and more direct access to cryptocurrency platforms and applications.

According to Chugani and Sapra, due to high throughput and low transaction costs, the Solana network has seen an increase in stablecoin settlements.

At the same time, experts emphasize that in terms of the volume of native stablecoins issued on the network, Solana is inferior to Ethereum – the figures are $2.2 billion and $26.4 billion, respectively.

Bernstein analysts indicate that Solana has yet to enter the B2B sector and other consumer payment systems. Experts named the problem of network scalability as the main obstacle to mass adoption. According to experts, Solana should increase its throughput by at least 15 times, that is, from 700 to 10,000 transactions per second.

Previously, the Solana blockchain development team stated that the launch of new projects would be suspended while technical problems related to network congestion and transaction errors were resolved.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.