Bitcoin

Bitcoin rose slightly by 0.42% from July 19 to July 26, 2024. This indicates that buyers and sellers were equal last week. The maximum that Bitcoin managed to reach was $68,486.

Source: tradingview.com

Investors are largely awaiting what Republican candidate Donald Trump will say at a Bitcoin conference in Nashville, which must will end on Saturday, July 27. In the meantime, it has become known that the former (and possibly future) US President was able to collect $4 million in donations in cryptocurrency.

Sponsored His campaign includes some well-known figures in the crypto industry: co-founders of the Gemini crypto exchange Tyler and Cameron Winklevoss, CEO and founder of the Kraken trading platform Jesse Powell, and former CEO of the Messari analytics platform Ryan Selkis.

All this happened against the backdrop of the current US President Joseph Biden leaving the election race. The new candidate from the Democratic Party

most likely will become Vice President Kamala Harris. On the back of this news, Bitcoin has been rising in price throughout the first half of the week.

But it is not just politics that determines the course of events in the crypto market. This week marked the end of a series of days when there was an inflow of funds into Bitcoin spot ETFs. The period lasted twelve days between July 5 and 22. On July 23, the outflow of funds amounted to $77.97 million. However, on the 24th and 25th, money began to flow again: the inflow of funds reached $44.51 million and $31.16 million, respectively. If we look at the weekly breakdown, there has been no outflow since June.

Source: sosovalue.com

Mining company Marathon Digital (NASDAQ: MARA) announced the acquisition of $100 million worth of bitcoins, bringing its portfolio to 20,000 BTC. On this occasion,

spoke out CEO Fred Thiel: “The full adoption of the accumulation (HODL) strategy reflects our confidence in the long-term value of Bitcoin.”

From a technical analysis point of view, Bitcoin is slowly developing a bullish trend. This is supported by the price fixing above the 50-day moving average (marked in blue). However, if we look at the ADX, the trend is still weak, as the indicator value is only 24.52. Support and resistance levels are $63,424 and $68,486, respectively.

Source: tradingview.com

Fear and Greed Index

increased compared to last week by eight points. Current value = 68. This indicates the prevalence of greed among Bitcoin investors.

Ethereum

Unlike Bitcoin, Ethereum has fallen in price over the week. The fall was about 7%. At the same time, in the first half of the week, the second-largest cryptocurrency by capitalization managed to consolidate above $3,500. However, two trading sessions, on Wednesday and Thursday, marked negative dynamics.

Source: tradingview.com

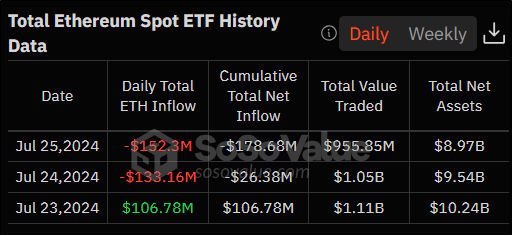

The main news for investors was the launch of spot ETFs on ether on July 23. A total of nine exchange-traded funds from eight companies were admitted to trading. The reaction on the first day was positive: the inflow of money amounted to $106.78 million. However, then the situation changed. On July 24 and 25, an outflow of funds in the amount of $133.16 million and $152.3 million was recorded. This, in fact, could have served to reduce the price of ETH.

Source: sosovalue.com

The negative dynamics are also influenced by the behavior of large players (whales). In the last two weeks, that is, including before the launch of spot ETFs for the second-largest cryptocurrency by capitalization, they sold off about 840,000 ETH. Obviously, large capital

expected a decline in the price of Ether, similar to what we saw after the launch of Bitcoin ETFs in early 2024.

But artificial intelligence is positive

evaluates ETH growth prospects. The ChatGPT-4o neural network made short-term and long-term price change forecasts. In the next three to six months, the artificial intelligence expects the price to be between $4,500 and $5,000, that is, 23% to 53% higher than now. In the long term, from six months to a year, ChatGPT-4o expects growth to $6,000 – $7,000, or, what is the same, by 84% to 115%.

According to technical analysis, bears prevail among Ethereum investors. The price is below the 50-day moving average (marked in blue), and the RSI value is below 50. The support and resistance levels are the minimum and maximum of the previous week: $3,087.7 and $3,562.6, respectively.

Source: tradingview.com

TRON

The TRON cryptocurrency rose by 2% in seven days from July 19 to July 26. The first half of the week turned into a decline: the cryptocurrency fell below $0.131. However, starting on Tuesday, bulls prevailed among TRON holders, which determined the weekly dynamics.

Source: tradingview.com

The network has been showing quite strong performance lately. On July 25, the number of transactions on the network per day reached its historical maximum – 7.2 million. Interestingly, a year ago the figure was only 4.8 million. Thus, in twelve months

managed to achieve 50% increase.

In terms of the total number of transactions, TRON was able to surpass Ethereum. Moreover, the growth

turned out to be more than threefold: 8.1 billion versus 2.45 billion. This was mainly achieved due to the USDT stablecoin. It’s just that TRON has much lower fees than the Ethereum network.

And there was also something else during the week

announced about the network’s cooperation with the fintech company Mobilium. It is going to issue payment cards for TRON users. Registration will be free. Mobilium has already stated that their cards are available everywhere where Visa and Mastercard can be used.

From a technical analysis perspective, TRON continues to have a bullish trend. This is evidenced by the fact that the cryptocurrency is trading above both the 50-day (marked in blue) and 200-day (marked in orange) moving averages. Last week, they formed a golden cross – the faster line crossed the slower one from below. This is a strong bullish support. The nearest resistance level is around $0.142, and the support level is around $0.131.

Source: tradingview.com

Conclusion

In summary, the global crypto market is gradually taking shape as a bullish trend. The exception is Ether. The approval of spot ETFs for the second cryptocurrency only caused an initial stir, after which an outflow of funds began.

This material and the information in it are not individual or any other investment recommendation. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.