The terms of service for US clients no longer include state insurance of exchange deposits. The privilege has been in effect since 2019, when Binance US officially announced that all US deposit accounts of the exchange are insured up to $250,000.

Binance US’s updated terms of service now state that users must first convert fiat dollars into stablecoins or other cryptocurrencies before withdrawing funds from the exchange. The change is due to the fact that Binance no longer holds US dollars on its balance sheet, so withdrawals require conversion to, for example, BUSD.

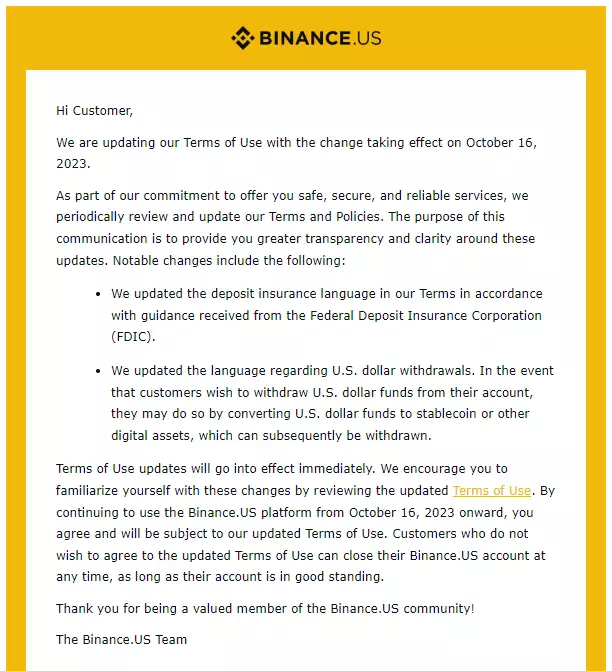

Back on Monday, October 16, the exchange notified clients of the forced conversion of all dollar deposits into stablecoins into BNB/BUSD:

The waiver of Binance US customer deposit insurance does not apply to users of the competing American crypto platform Coinbase. Current Coinbase Customer Escrow Account Terms and Conditions saved

carries an FDIC protection limit of $250,000 per depositor. However, the availability of FDIC pass-through insurance “is dependent on Coinbase having correct information about you as a customer.”

On October 16, Binance posted a message stating that the exchange was no longer accepting new users from the UK.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.