Binance Options Platform Launches Binance Volatility Index. This is a tool that monitors the volatility in the cryptocurrency market.

Clients can use BVOL to gauge market sentiment, better manage risk and make smarter trading decisions when trading options.

Volatility indicates the rate of change in the price of an asset over a period. The higher it is, the more the price can change and the riskier the investment in this asset.

BVOL tool simple in reading. A high index indicates that the market expects significant price fluctuations. Low BVOL predicts a steady course.

The BVOL metric currently measures the two key cryptocurrencies BTC and ETH.

More information about BVOL can be found on the platform’s official page.

Volatility and cryptocurrencies

Price volatility has become the main hallmark of crypto assets. This is the cornerstone in many disputes. On the one hand, bitcoin and altcoins are scolded for the instability of the exchange rate. On the other hand, it is this feature that allows traders to earn more than on classic assets.

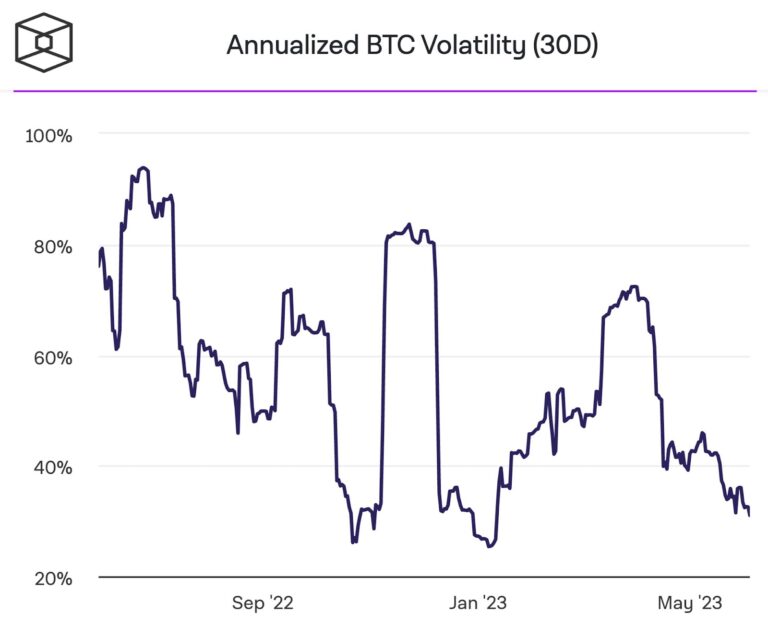

By the way, in 2023 BTC volatility is lower than that of Meta and Amazon stocks. But higher than gold and Apple. This is evidenced by the average 30-day volatility for the year as of June 2023.

Gold had an index of 15, BNB had an index of 21, Bitcoin had an index of 29, and Amazon stock had an index of 40.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.