The head of the CEE and Central Asia region of Binance, Kirill Khomyakov, commented on Bitcoin overcoming its annual maximum and gave a forecast for 2024.

Bitcoin growth

Khomyakov noted that the growth of the first cryptocurrency over the past 11 months was 140%, which affected market sentiment.

On December 4, 2023, Bitcoin tested the level of $42,000. The last time it demonstrated a similar indicator was in April 2022.

This allowed the market capitalization of the asset to exceed $809 billion, and the total figure of the entire cryptocurrency market reached $1.54 trillion, Khomyakov notes. At the time of writing, Bitcoin’s market capitalization is $821 billion, according to TradingView.

A Binance spokesperson points out that the entire digital asset industry is monitoring applications for spot Bitcoin ETFs in the US. According to Khomyakov, the potential approval of the latter and the likely reduction in rates by the US Federal Reserve will “spur” the excitement in the cryptocurrency market.

The head of the CEE and Central Asia region at Binance paid special attention to technical issues related to the rate of the digital asset. According to the analysis, Bitcoin’s next resistance will be at $42,330, given the continuation of the bullish trend and despite relatively low open interest, he noted.

Binance Research Report

In parallel with the comments of the head of the CEE and Central Asia region at Binance, the analytical department of the Binance cryptocurrency exchange published monthly report on the cryptocurrency market.

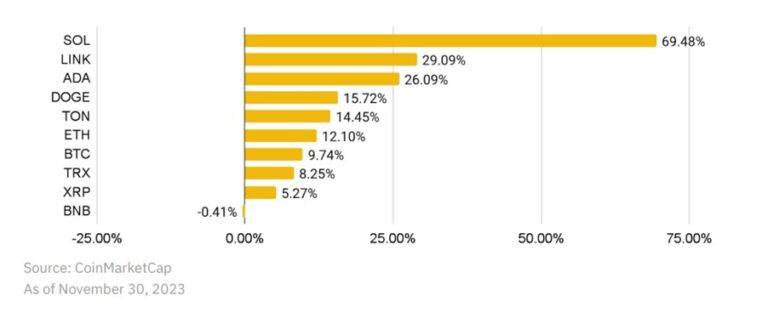

The overall market capitalization of the industry showed an increase of 11% within 30 days. The best dynamics in November 2023 were shown by SOL and LINK tokens. In the first case, the price increased by 69%, while the second crypto asset showed a 29% increase.

Percentage chart of growth in the value of crypto assets on the Binance exchange in November 2023. Source: Binance Research.

Percentage chart of growth in the value of crypto assets on the Binance exchange in November 2023. Source: Binance Research.

Binance analysts noted that transaction fees on the Bitcoin network exceeded those of Ethereum, showing the largest difference in the last two years. According to representatives of the exchange, this indicates a restoration of interest in the Ordinals protocol and growing activity in the network of the first cryptocurrency.

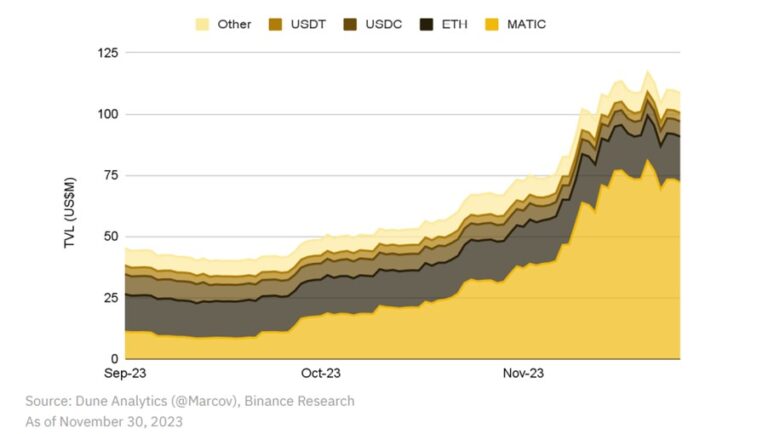

The report paid special attention to the Polygon zkEVM solution. The amount of blocked assets in this network exceeded $107.8 million, Binance experts noted. Thus, the indicator showed an increase of 47.2%, the report said.

TVL MATIC, USDC, USDT, ETH chart. Source: Binance Research.

TVL MATIC, USDC, USDT, ETH chart. Source: Binance Research.

In addition, Polygon co-founder Sandeep Nailwal announced the release of new products. He said that in December the company will present several services and solutions related to RWA assets and the Ethereum ecosystem.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.