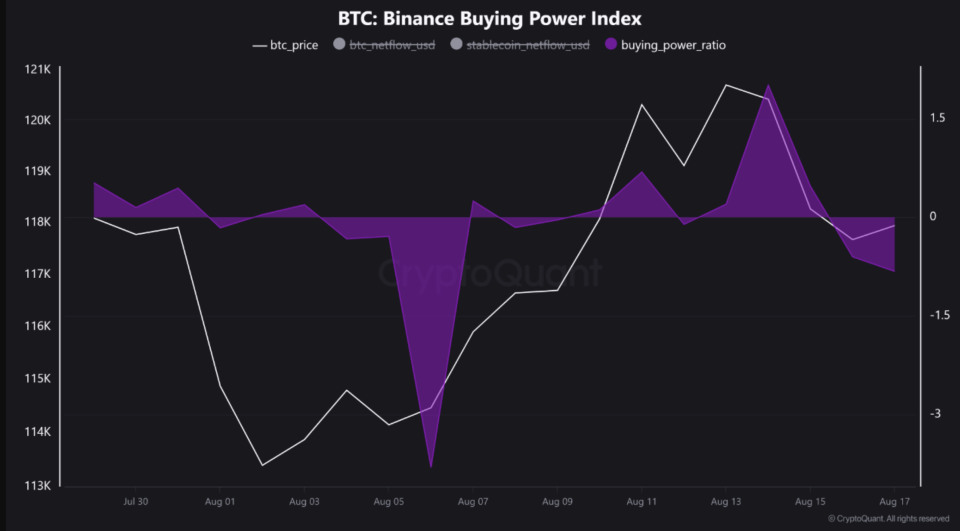

The Buying Power Ratio coefficient is a metric that reflects the balance of the mood of investors. It demonstrates the ratio of the influx of new capital available for the purchase of digital assets to the amount of funds that are withdrawn from the exchange, analysts of Cryptoquant explained.

The coefficient reached its local peak at 2.01 points on August 14. This testified to the growing pressure from the buyers, when the dollar spent for the purchase of bitcoins, more than $ 2 in stabelcoins, explained in Cryptoquant. Against the background of the growth of Buying Power Ratio, the market value of Bitcoin reached a new historical maximum of $ 124,517 per coin.

However, then the dynamics of the purchasing power coefficient changed dramatically and it fell to -0.81 points by August 17. According to experts, Cryptoquant, the indicator signaled the market for the dominance of sellers, which provoked mass elimination of the positions of traders for $ 629 million. Of this amount, about $ 581 million was long for long positions.

The liquidation of the positions of traders and an unexpected turn of the market increased panic among investors, especially beginners who probably counted on a longer continuation of the cost of digital assets and positive dynamics of cryptorrhoids.

The capitalization of the crypto rope fell from $ 4.2 trillion to $ 3.8 trillion. Bitcoin lost about 8% of the achieved historical maximum. In the moment, the cost of the first cryptocurrency fell to $ 114,366 per coin. The cost of the broadcast also fell from a local maximum of $ 4780 and returned to the indicators at the beginning of August in the ranges of about $ 4200 per coin.

Earlier, the analysts of the Santiment platform said that in the short term, Bitcoin will not be able to return to the bull trend, since most investors have begun to fix profit.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.