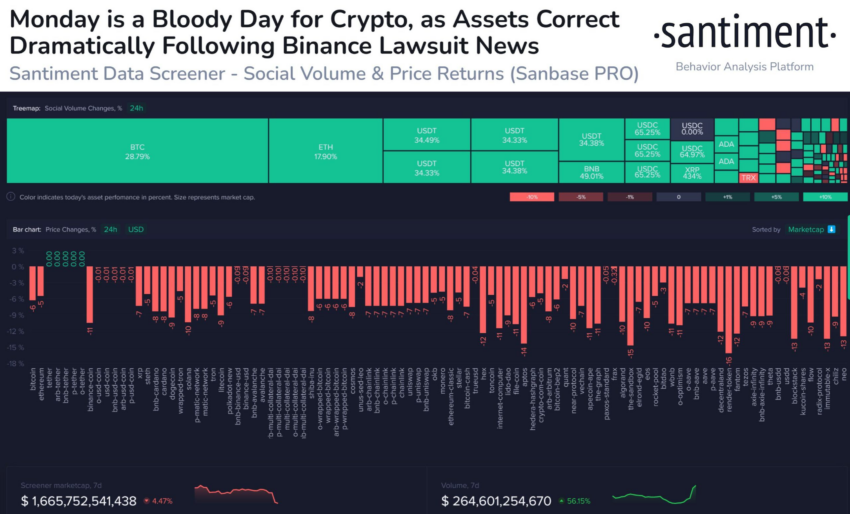

Over the past 12 hours, the capitalization of the crypto market has sank by more than $50 billion. This happened after the news that the largest digital asset exchange Binance again became the object of the wrath of the regulator and received a lawsuit from the US Securities and Exchange Commission (SEC).

The outflow of funds from the platform at the same time made up only 10,000 BTC, or approximately 1.5% of the balance: in the chart below Glassnode it can be seen that the decline in March 2023 was much more significant.

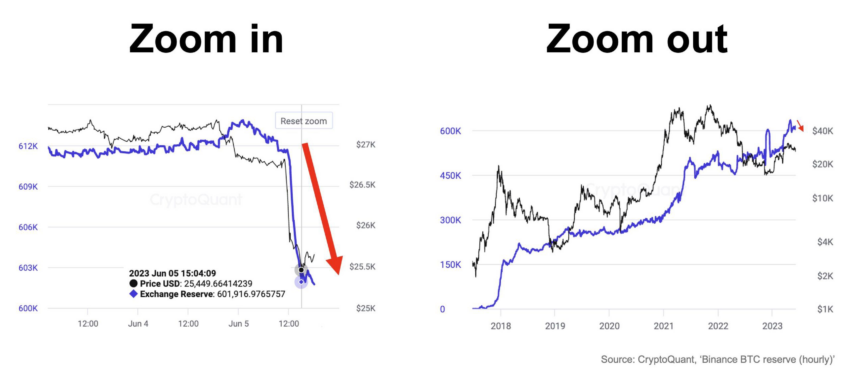

The founder and CEO of the analytical service CryptoQuant, Kee Young Joo, also published a couple of charts to show the statistical significance of “the biggest BTC outflow from Binance this year.” And although the figure of 10,000-12,000 BTC looks scary, when you zoom in, it becomes clear that this event should not be given such a huge importance.

SEC Actions on Binance Resulted in $300M in Liquidations

Binance CEO Changpeng Zhao commented tweet by Gary Gensler announcing his latest salvo in the war against cryptocurrencies.

“I wonder if he ever reads the comments under his post from the consumers he is supposed to be protecting,” he wrote.

There is definitely logic in the words of the crypto mogul. The actions of the Commission, which calls the protection of investors its main goal, have caused huge financial losses. According to the data CoinGlassover the past 24 hours, 111,545 transactions were forcibly closed on exchanges, and the total amount of liquidations amounted to $301.3 million. The lion’s share of liquidations – almost $292 million, fell on long positions.

Named securities altcoins have suffered the most

At the time of writing, the market has rebounded slightly. Total capitalization fell 4.5% on the day to $1.13 billion, Bitcoin sank 4.2% to $25,742, and Ethereum lost 3.2% to $1,812.

However, altcoins, which the SEC considered securities, suffered more than others. The price of the native Binance BNB token fell by 8.4% to $276, while Cardano (ADA), Solana (SOL), Polygon (MATIC), Algorand (ALGO) and Cosmos (ATOM), among others, lost an average of 7-8% .

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.