The Indian cryptocurrency exchange Bitbns acknowledged the hacker attack of February 2022, although until recently it assured that technical work was being carried out.

The Bitbns exchange was silent about the hacking of the site, which occurred in February 2022. This is during an AMA session. acknowledged CEO of the exchange Gaurav Dahake. The head of Bitbns did not directly disclose either the date of the hack or specify the extent of the incident. Instead, he tried to reassure users by stating that many crypto exchanges have experienced the theft of funds, including Binance.

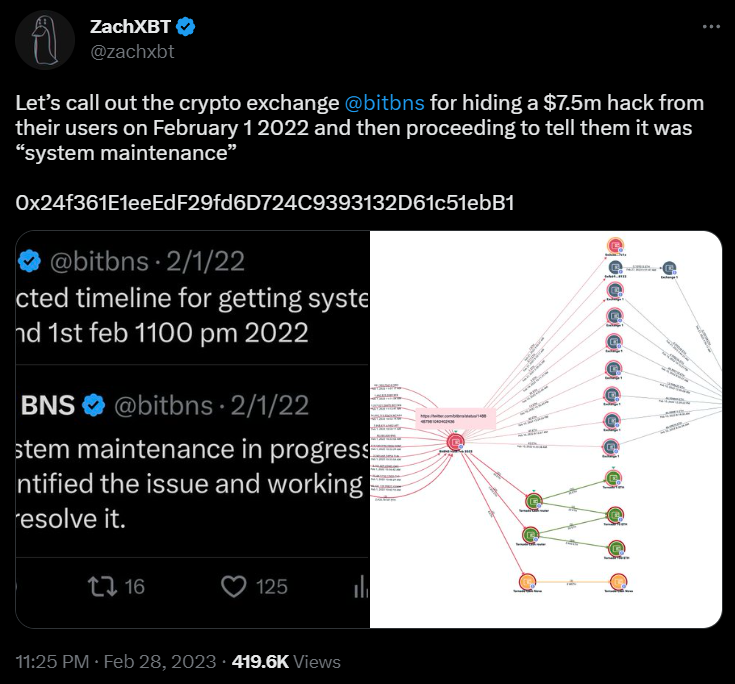

However, it seems that the recognition of the head of Bitbns sounded for a reason. Previously a crypto detective under the pseudonym ZachXBT figured outthat the Indian crypto exchange, under the pretext of “technical work”, hid the fact of hacking the site for a whole year.

According to ZachXBT, the exchange lost about $7.5 million in various tokens, which the hacker converted into ether (ETH) and laundered through Tornado Cash. Part of the stolen funds was laundered through a certain cryptocurrency exchange, but the crypto detective decided not to disclose its name. ZachXBT called for a boycott of the site due to its silence about the hacker attack.

Against the background of the scandal, Bitbns did not come up with anything better than conduct trading competition with a prize fund. Cryptocurrency community accepted with hostility such actions of the stock exchange. Users demanded from the exchange to restore the efficiency of the withdrawal of cryptocurrencies, as well as to balance the volatility of tokens in the listing.

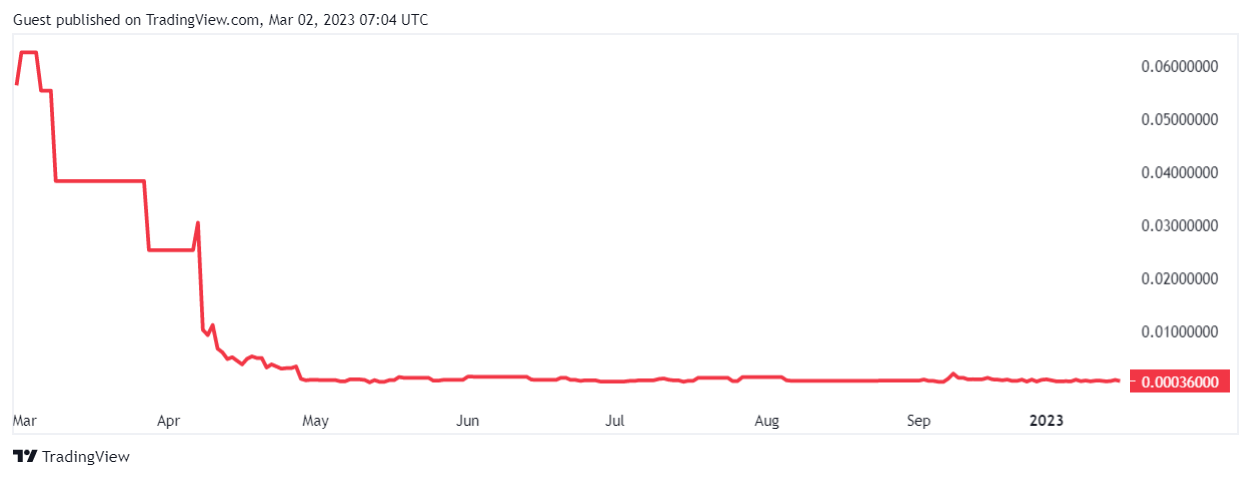

Amid the news, the exchange rate of the BNS exchange token in the BNS/USDT trading pair collapsed by more than 37% to $0.00036, according to data tradingview. At the same time, the trading volume barely exceeds $380,000.

Note that this is not the first trouble for Bitbns. In August last year, the exchange stopped the withdrawal function in Indian rupees. The exchange said that law enforcement agencies were behind the blocking of the bank account. Then Dahake claimed that the reason for the blocking was allegedly too rough legal norms of the local market. However, it is not clear if the blocking is related to the February Bitbns hack.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.