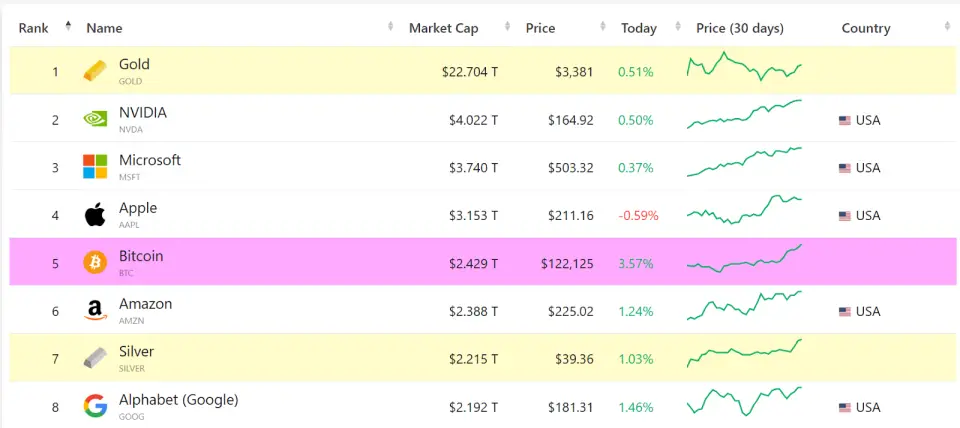

July 14, market capitalization of the first cryptocurrency Reached $ 2.42 trillion. Amazon capitalization, according to Companiesmarketcap, now is about $ 2.38 trillion.

Head of the Sygnum Bank Research Department Katalin Tischhauser reported Cointelegraph, that the upward bitcoin trend can be “caused by its perception as a hedging tool.” According to the analytical data Platforms Farside Investors, during July 10, the spotcoin-etf sport Bitcoin-ETF attracted about $ 1.17 billion, which was not only the seventh day of continuous large investments in the derivative asset, but also a sign of “long-term confidence” from bitcoin investors.

Capriole Investments Charles Edwards said that the growth of bitcoin capitalization increases the legitimacy of digital assets and attracts the attention of new investors. However, according to Edwards, the growth of BTC capitalization also increases the risks of correction of the value of the asset due to the possible fixation of profit by large holders-this can increase the volatility of the flagship cryptocurrency in the short term.

The Director General of 10x Research, Marcus Thielen, suggested that the growth of the first cryptocurrency was caused by investors’ concerns about the possible financial crisis against the backdrop of an increase in the US state budget deficit.

Earlier, the Japanese investment company Metaplanet announced the purchase of 797 BTC for $ 93 million at the average price of a coin $ 117,451. By mid -June, Metaplanet had 16 352 BTC and occupied The fifth line according to the volume of accumulated reserves among public companies.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.