The price of bitcoin is restored after a recent fall, which temporarily shaken the confidence of investors. Brading above key support, the coin continues to strengthen its long -term upward trend.

However, historical data show that BTC may first adjust a little before reaching a new historical maximum (ATH).

Bitcoin should fall, then grow

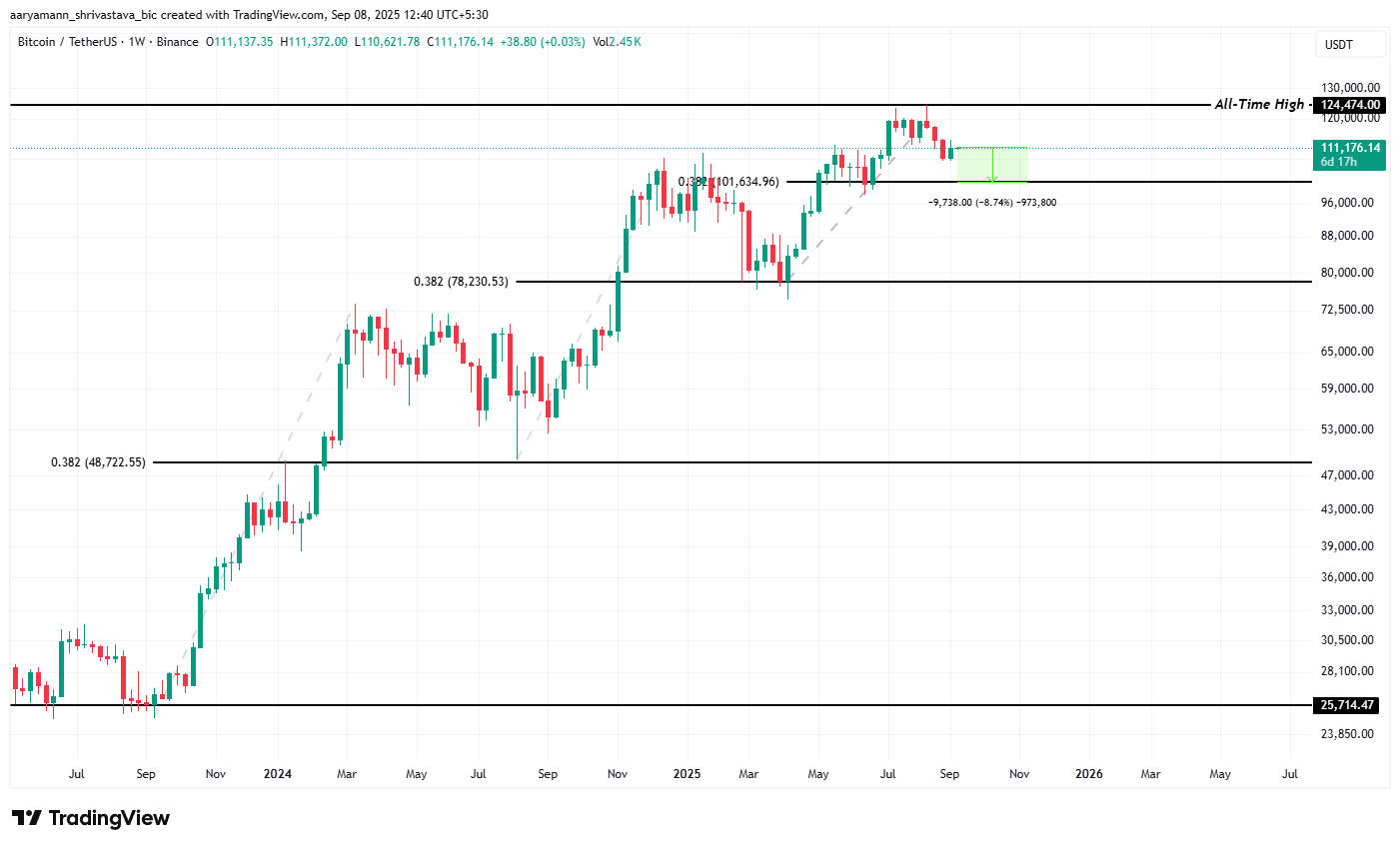

Bitcoin’s path to a new record may require a reduction by 8.7% in the coming days. The level of $ 101 634 contains a line of 38.2% of Fibonacci correction, which historically served the start point. Each rebound from this level in previous rally caused a rapid increase in the cost of BTC.

A similar situation can now be formed. If Bitcoin rolls back to this important level, this may become the basis for the next strong rally. Historically, such movements helped restart a market impulse and created the basis for sustainable growth, potentially withdrawing BTC beyond the limits of current maximums.

A wide impulse requires caution. The ratio of the cost of the network to transactions (NVT), often used to evaluate, shows whether Bitcoin is overestimated regarding onchain-active, is reduced. Typically, NVT growth coincides with overheating conditions and precedes the drop in prices. The cooling of the indicator indicates the restrained activity.

This dynamics reduces the likelihood of a sharp fall, which complicates the BTC to achieve the level of Fibonacci correction. Without a rollback, the historical script may not turn around, as it was expected to be delayed by the Bitcoin movement towards the new ATH.

BTC price can continue to increase

At the time of writing, Bitcoin is traded at $ 111,340, confidently holding above the support of $ 110,000. This stability strengthens the four -month upward trend and signals possible short -term profits. The impulse persists, and BTC is aimed at higher levels.

If the trend continues, bitcoin can rise above $ 112,500 and go to $ 115,000. However, in order to reach a new historical maximum, BTC may first fall to $ 101,634, creating conditions for a stronger breakthrough.

If the fixation of the profit intensifies, the BTC can quickly go down to the level of correction. However, if sales against the backdrop of fear are prevailing, the price risks falling below $ 100,000, which will cancel the bull forecast and extend the correction phase.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.