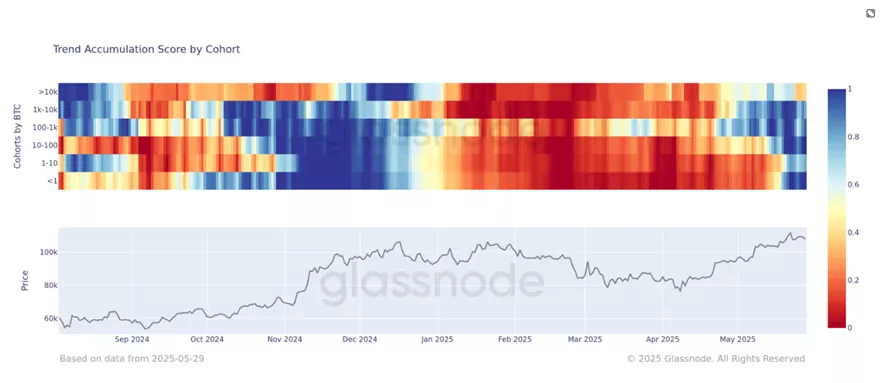

Owners of wallets with balances of at least 10,000 BTC moved from purchases to the distribution of coins, while investors with lower positions continue to accumulate digital gold. This is written by Coindesk.

Such conclusions follow from changes in the Accumulation Trend Score indicator, which demonstrates the dynamics of the degree of accumulation in various categories of addresses.

For the largest holders, the value of the indicator fell to 0.4. The metric varies in the range from 0 (dominance of sales) to 1 (predominance of purchases).

Whales began to increase positions in April, when the price of bitcoin dropped to $ 75,000. The current transformation reflects the desire of the market participants to fix the profit near ATH and protect themselves if the growth of the quotations is stopped.

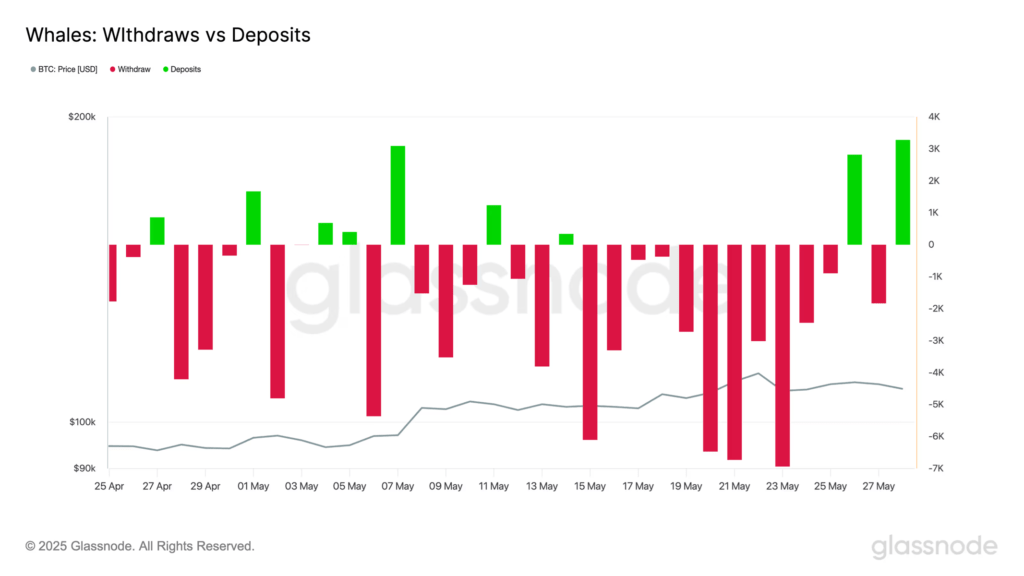

Onchain-analysis complements the dynamics of streams of coins of large players from exchanges to non-codial wallets. In two of the last three days, whales began to again introduce bitcoins to accounts in CEX, which is usually associated with the upcoming sale.

According to analysts, the increase in prices for ATH caused a jump in unrealized profit above two standard deviations. Historically, this signaled about the entrance of the market into the phase of euphoria.

In the future, investors faced short -term bursts of volatility and a fall in the metric to equilibrium values - only in 16% of all trading days the “paper” profit exceeds this limit.

Currently, the pace of coins sales has not yet reached extremes. According to experts, the net sale of profit (7 DMA) is inferior to the values of 14.4% of all trading days.

The SOPR indicator also signals the presence of a margin of move to extremums. By the current moment, the average realized profit reached 16%. Only 8% of trade days in history, the metric rose to higher values.

The derivatives market shows the growth of Leverja among investors. Since April, the volume of open interest in bitcoin fiction has increased by 51%, reaching $ 55.6 billion against $ 36.8 billion earlier. The options recorded an increase of 126% – from $ 20.4 billion to $ 46.2 billion.

These data reflect the expansion of the database of participants using derivatives, which may indicate both increasing confidence in the prospects of the market and increased risks associated with higher levels of borrowed capital.

In conclusion, experts determined potential levels of resistance and support. In the case of correction, the rate may fall into the area of $ 91 800-95 900, where 111 DMA, 200 DMA are located and an assessment of the “cost” of short-term investors. Another such level is $ 100,200 (0.5 standard deviation from MVRV).

The “ceiling” of quotes can occur on the approaches to $ 119,400 (one standard deviation from the aforementioned indicator).

On May 30, the Deribit platform will expose the options for digital gold with a nominal value of $ 10.1 billion. Based on the current metrics, the first cryptocurrency may encounter a sharp change in quotations.

In the contracts with execution in June-July, activity in collages with fees of $ 115,000 and $ 120,000 prevails.

Earlier in Coindesk, six graphs of various indicators confirming a strong foundation for the release of bitcoin above $ 100,000 were given.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.