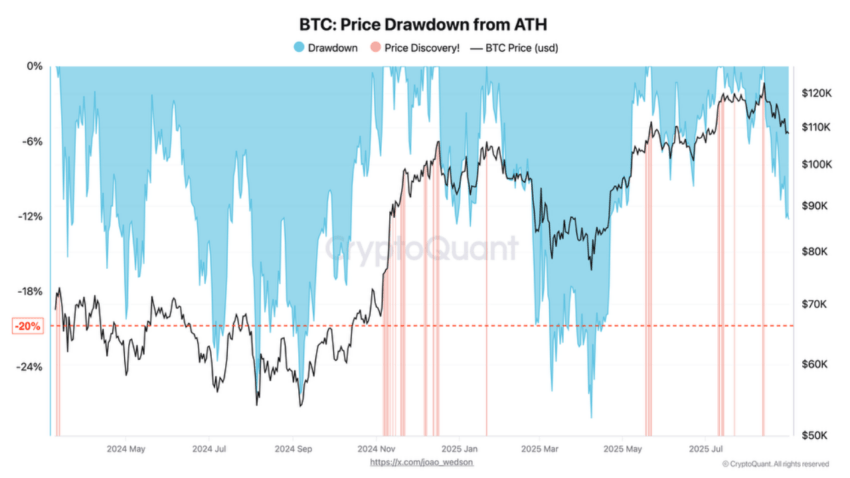

A recent analysis of onchain-data shows that bitcoin (BTC) is experiencing a regular price correction and approaches the state of reserving.

The analyst Cryptoquant Darkfost published his analysis on Wednesday, noting that the price decreased within two weeks after the historical maximum reached $ 123,000, falling by about 12%. He claims that this movement corresponds to the normal range according to historical data.

Healthy pattern in the bull market

This analysis refutes the recent assumptions about the completion of Bitcoin bull cycle. He notes that from the moment of overcoming the previous historical maximum in March 2024, Bitcoin experienced price fluctuations, including the fall by 28%. Typically, “deep” correction is considered to be a drop of 20-25% on average.

He described such corrections as a healthy and frequent phenomenon in the bull market, which helps to reduce an excessive credit shoulder from derivatives and provides new opportunities to enter long -term investors.

Bitcoin: Is the market resold

The analysis shows that Bitcoin is resold, since its price has repeatedly bounced down, not lowering below $ 107,000. Frank, quantum investor, active on X, said: said:

He noted that this signal appeared three times over the past two years.

The first time this happened during Carrie Trade with Jena in August 2024. The second time – during the US trade war in April this year. The third is the current correction.

Bitcoin Vector, Cryptoinfluenser on X, noted that the level of $ 110,000 was a strong resistance point during this correction, holding bitcoin in the price range. He believes that the pressure on the decrease weakens and the rising impulse will return if the daily price closes above $ 111,000.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.