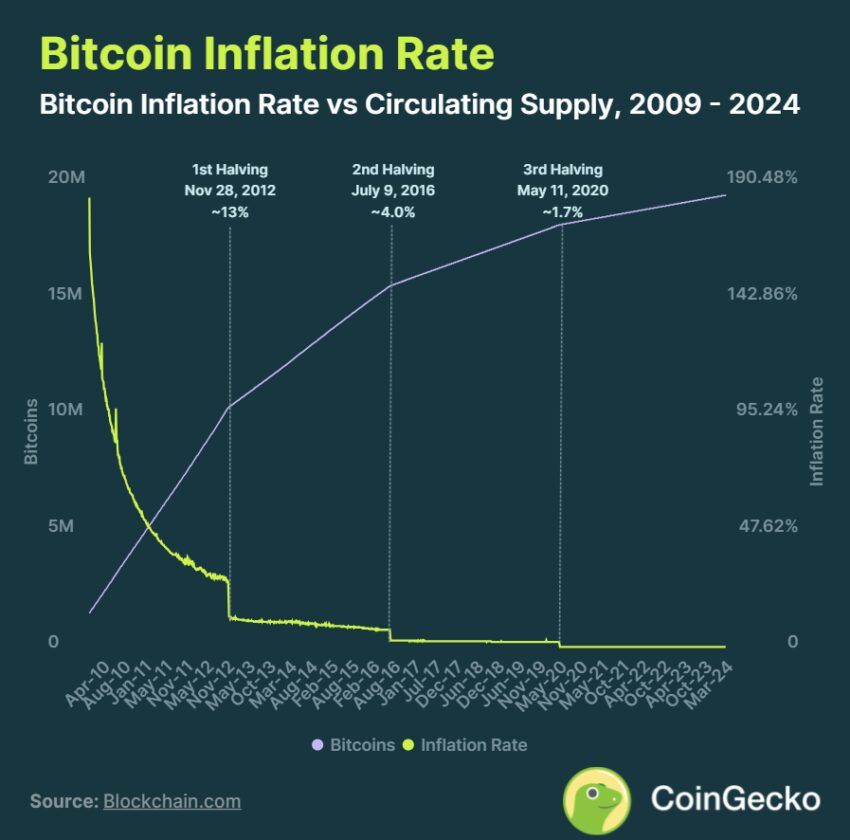

Bitcoin (BTC) has already experienced three halvings. This event occurs once every four years and reduces the reward for a mined block in the network of the first cryptocurrency by half, thereby curbing inflation. The next halving will happen very soon, on April 20th.

In less than two weeks, the long-awaited Bitcoin halving will take place. Data aggregator CoinGecko published a study on the price dynamics of the first cryptocurrency after each of the events.

The Bitcoin main network launched on January 3, 2009. At that time, the reward for a mined block on the network was as much as 50 BTC.

First halving occurred on November 28, 2012. Then, accordingly, the miners’ reward decreased to 25 BTC. After this, the price of Bitcoin increased over the year from $12 to $1,075, or by 8,858%. Inflation, meanwhile, rose from 25.75% to 12%.

Second Once the reward was divided in half on July 9, 2016 – up to 12.5 BTC. In the 12 months since the halving event, the price of the first cryptocurrency jumped from $650 to $2,560, or by 294%. Inflation fell from 8.7% to 4.1%.

AND most recent — May 11, 2020. For the mined block, miners began to receive 6.25 BTC, and the Bitcoin rate soared from $8,727 to $55,847 over the year, or by 540%. Inflation fell from 3.7% to 1.8%.

Impact of halving

The appearance of new coins in circulation is slowing down. The supply of bitcoins is not endless – the total issue of the first cryptocurrency is 21 million BTC.

To date, miners have mined 93.3% of the total number of Bitcoins that will ever exist. This percentage is 19.6 million with an inflation rate of 1.74%.

According to experts, all this means that the value of the first cryptocurrency increases when demand exceeds the level of supply increase. The same will happen after the fourth halving on April 20, if demand outpaces inflation, which falls below one percent.

Additional factors

Halving is just a base point for predicting the price of Bitcoin after the event. A number of additional factors also influence where the rate of the first cryptocurrency will go, including:

- sales pressure;

- Bitcoin perception;

- global market liquidity;

- regulation of cryptocurrencies;

- macroeconomic conditions;

- events on the crypto market.

After the remuneration was halved in 2020, all of the above factors played a role. Experts cited as an example Elon Musk’s message that Tesla cars can be bought for Bitcoin. A month after this, the price of the cryptocurrency broke through $65 thousand.

And the opposite dynamics were observed when the billionaire called BTC not environmentally friendly enough. After this statement, the value of the asset collapsed. The liquidity situation was exacerbated by events such as the collapse of FTX, as well as the cycle of interest rate hikes by the US Federal Reserve (Fed).

What to expect from the fourth halving

On the eve of the fourth halving, Bitcoin updated its all-time high at $73,737.94. This was facilitated by the approval of spot Bitcoin ETFs.

As of April 8, issuers of exchange-traded funds for the first cryptocurrency accumulate more than 4% of the total BTC supply.

However, it is still unclear whether the hype around the new tool will be able to withstand sales pressure from Grayscale in the future. At the time of writing, investors have withdrawn more than $15 billion in cryptocurrency from the asset manager's Bitcoin trust.

In addition, experts also admit the possibility of additional sales by miners due to rising costs of BTC mining. Two more events can have a negative impact:

- distribution of 200,000 BTC (~$13.9 billion) by bankrupt exchange Mt. Gox between creditors;

- the Fed's expected interest rate cut in May or June of this year.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.