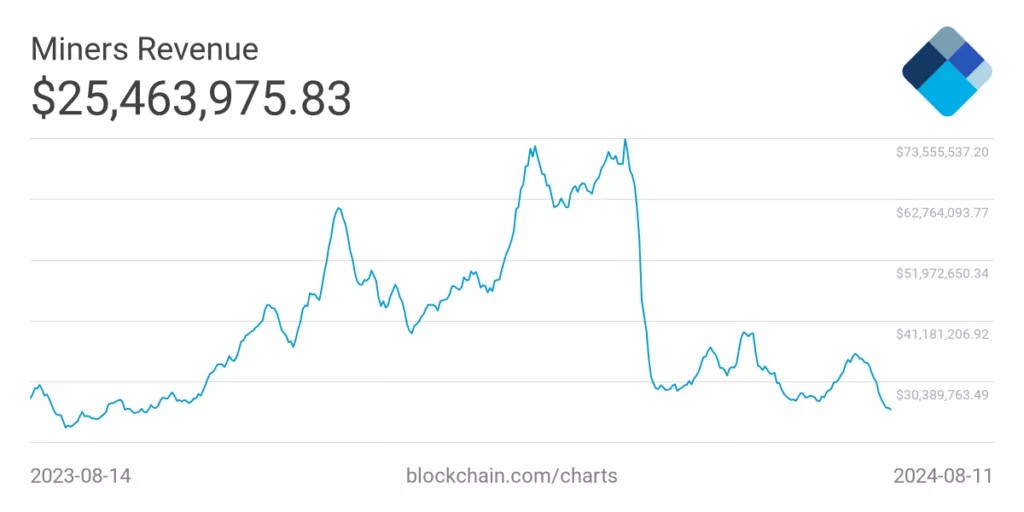

On August 11, the daily income of miners of the first cryptocurrency (smoothed by a 7-day moving average) fell to ~$25.5 million, updating the 2024 minimum.

After the April halving, the indicator fell from levels above $60 million in the run-up to the event by about half. Figures comparable to current values were last recorded in August-November 2023, when Bitcoin traded in the range of about $26,000-28,000.

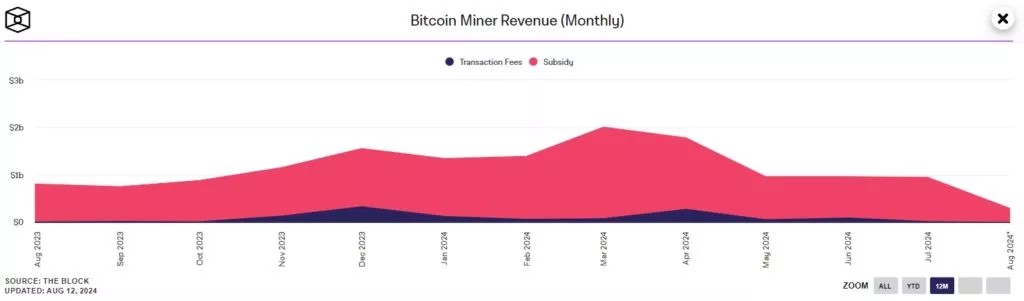

The April 20 block reward cut from 6.25 BTC to 3.125 BTC led to a drop in cryptocurrency production that month. In May and June, miners were unable to restore digital gold production.

At the same time, in April, their income was supported by the growth of commission volumes amid the excitement around the Runes protocol. Network fees brought miners ~$281.5 million with a total revenue of $1.79 billion.

However, in the following months, miners’ transaction revenues dropped significantly, reaching $24.9 million in July, compared to $926.2 million received in subsidies per mined block.

Against this backdrop, in June some experts suggested a capitulation of miners, which would involve switching off equipment that had become unprofitable. Glassnode analyst James Check disagreed with such opinions. He noted that the bitcoin hashrate had decreased by only 9% compared to the pre-halving level.

However, CryptoQuant noted a reduction in miners’ cryptocurrency reserves to 2021 levels. In early July, the company’s experts returned to the topic of miners’ capitulation.

The restoration of the network’s computing power over the course of a month led to an increase in mining difficulty, first by 3.2%, and then by 10.5%. The indicator is at a record high, putting pressure on the profitability of digital gold mining.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.