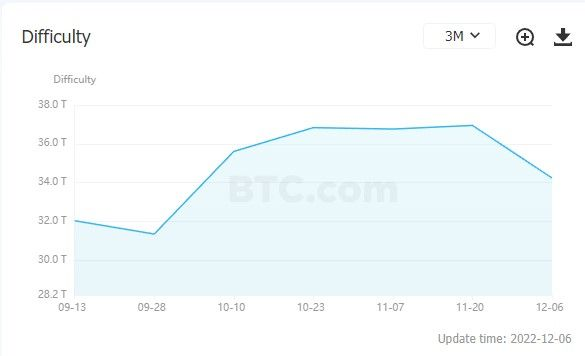

This morning, another recalculation of the complexity of bitcoin mining took place. The indicator fell by 7.2% and amounted to 34.24 terahash. This is the largest drop since July 2021, when mining was banned in China.

Analysts believe that the reason for such a significant decrease in the complexity of mining was the shutdown of obsolete ASIC miners – the fall of the cryptocurrency market and the increase in electricity prices made the use of such devices unprofitable. The average hashrate of the Bitcoin network has dropped from 264 Eh/s to 245 Eh/s.

As William Foxley, director of media and strategy for Compass Mining, noted, in the coming weeks, we should expect a further drop in mining difficulty, as miners continue to turn off unprofitable devices.

At the same time, Luxor COO Ethan Vera believes that the drop in the complexity of mining can help keep the business of some companies – it will be easier to mine bitcoins, which means their profits will increase.

Recall that during the last recalculation of the mining difficulty, the indicator reached a new record and amounted to 36.95 terahashes.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.