Financial analyst and CEO Whalewire Jacob King drew attention to the alarming situation on the Bitcoin network. The fact is that the Foundry USA mining pool in a row got eight blocks at once. According to the expert, this is a sign of dangerous centralization in the ecosystem of cryptocurrency.

We tell you that not so with the obtained Foundry USA blocks and why Jacob King is sure that the decentralization of bitcoin melts before our eyes.

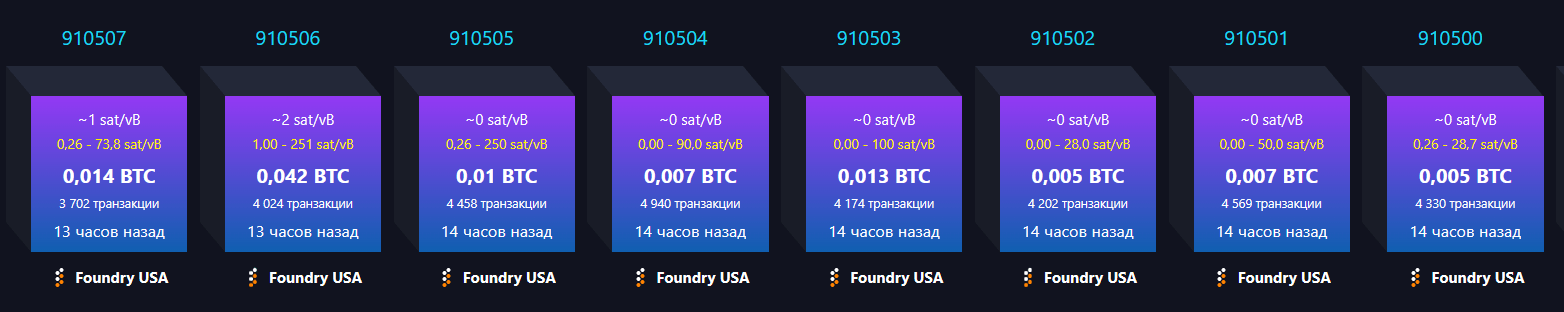

The financial analyst called the extraction of eight blocks in a row by the Foundry USA miners the next evidence that Bitcoin is becoming less decentralized. King recalled that for many years he has been warning of the concentration of power in the hands of a limited number of miners and insiders.

Recall that the concentration of a large volume of computational options in the hands of one miner or combining miners can lead to an attack of 51%. For example, in August, for this reason, the participants of the Quobic pool intercepted control over the network of the largest anonymous Monero cryptocurrency.

Another alarming signal, the analyst called a decrease in the load on the blockchain. According to his observations, empty blocks are increasingly appearing, and the commission for transactions collapsed to the level of 1 sat/vb. This indicates low demand for operations:

In a row, eight blocks in a row with one pool in itself is not a violation of the network rules, but causes concern in the context of the stability of bitcoin to centralization. At the same time, a low commission indicates a decrease in competition for the inclusion of transactions in the blocks. This factor can both delight users (cheap translations) and disturb investors (decrease in network activity).

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.