In May, the consumer price index in the United States increased by 0.1% versus 0.2% in April. In annual terms, without seasonal adjustment, CPI grew to 2.4%.

The main contribution to inflation was provided by real estate – the housing price index added 0.3% per month (3.9% per year). A similar increase has demonstrated food. Energy and gasoline costs in May decreased by 1% and 2.6%, respectively.

The data published by the US Federal Labor Statistics Bureau (BLS), the data turned out to be lower than the expectations of analysts. Experts predicted CPI values of 2.5%.

🚨 Just in: May US CPI Annual Inflation RISES 2.4%, In Line with Expectations of 2.5%.

Core CPI Inflation Increased 2.8% Y/Y, BELOW FORECASTS for A Gain of 2.9%. pic.twitter.com/khqz1j5nxs

– Jesse Cohen (@jessecoheninv) June 11, 2025

Core CPI for May also turned out to be lower than consensus prognosis-2.8% in fact against 2.9%.

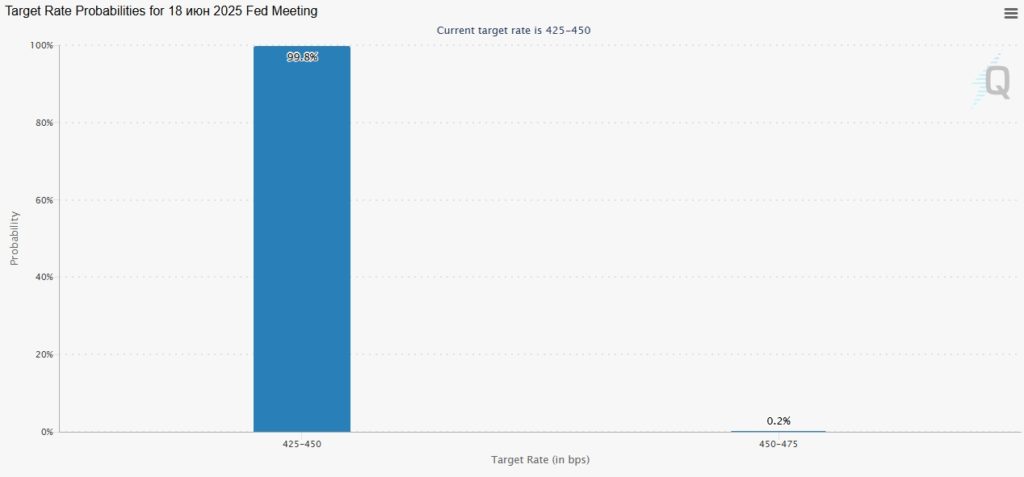

Swap and options markets are almost completely sure of maintaining the Fed’s range of the key rate of 4.25-4.5% according to the results of the meeting on June 18. The probability of this scenario is estimated at 99.8%.

It is traditionally believed that increasing the availability of liquidity positively affects the quotes of risk assets like bitcoin and other digital currencies.

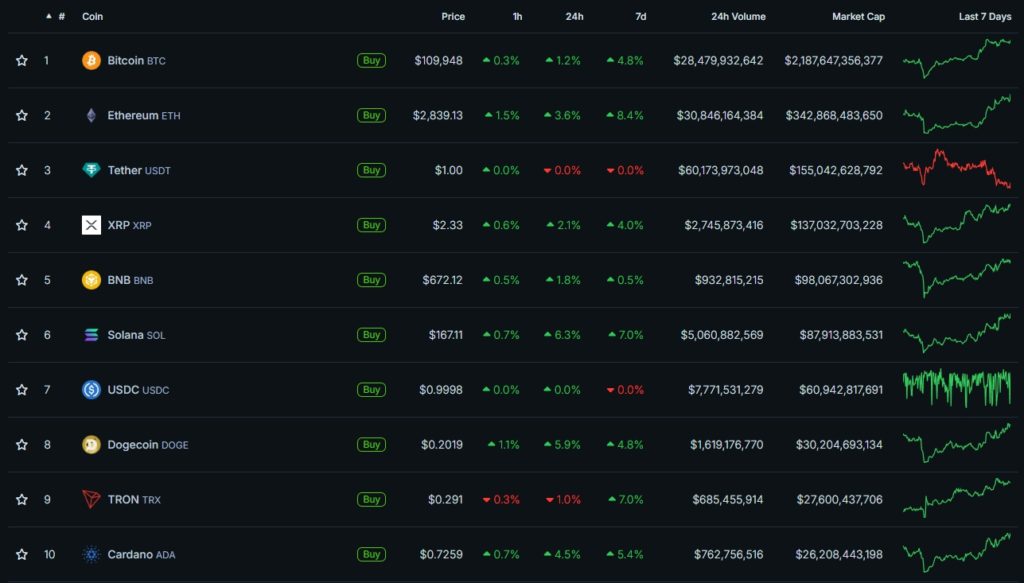

The cryptocurrency market as a whole poorly reacted to the data published by BLS. Bitcoin quotes in the moment exceeded $ 110,000, the price of Ethereum rose above $ 2800.

According to Coingecko, all digital assets from the TOP-10 in capitalization at the end of the day were in the Green Zone. Only Tron was noted by a fall by a fall of 1% in the last hour.

The stock market responded even less significant growth. By the time of preparation of the material, the NASDAQ Composite index increased by 0.27%, S&P 500 – by 0.28%, Dow Jones indicated 0.18%.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.