Bitcoin (BTC) recently experienced significant fluctuations, twice falling to $ 112,500 this month. The fall is mainly related to credit positions and probably will not last long.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Who is to blame for the fall of bitcoin

Activity in the futures market greatly affects the moods around Bitcoin, while onchain and losses remain weak during the recent achievement of historical maximum and subsequent correction.

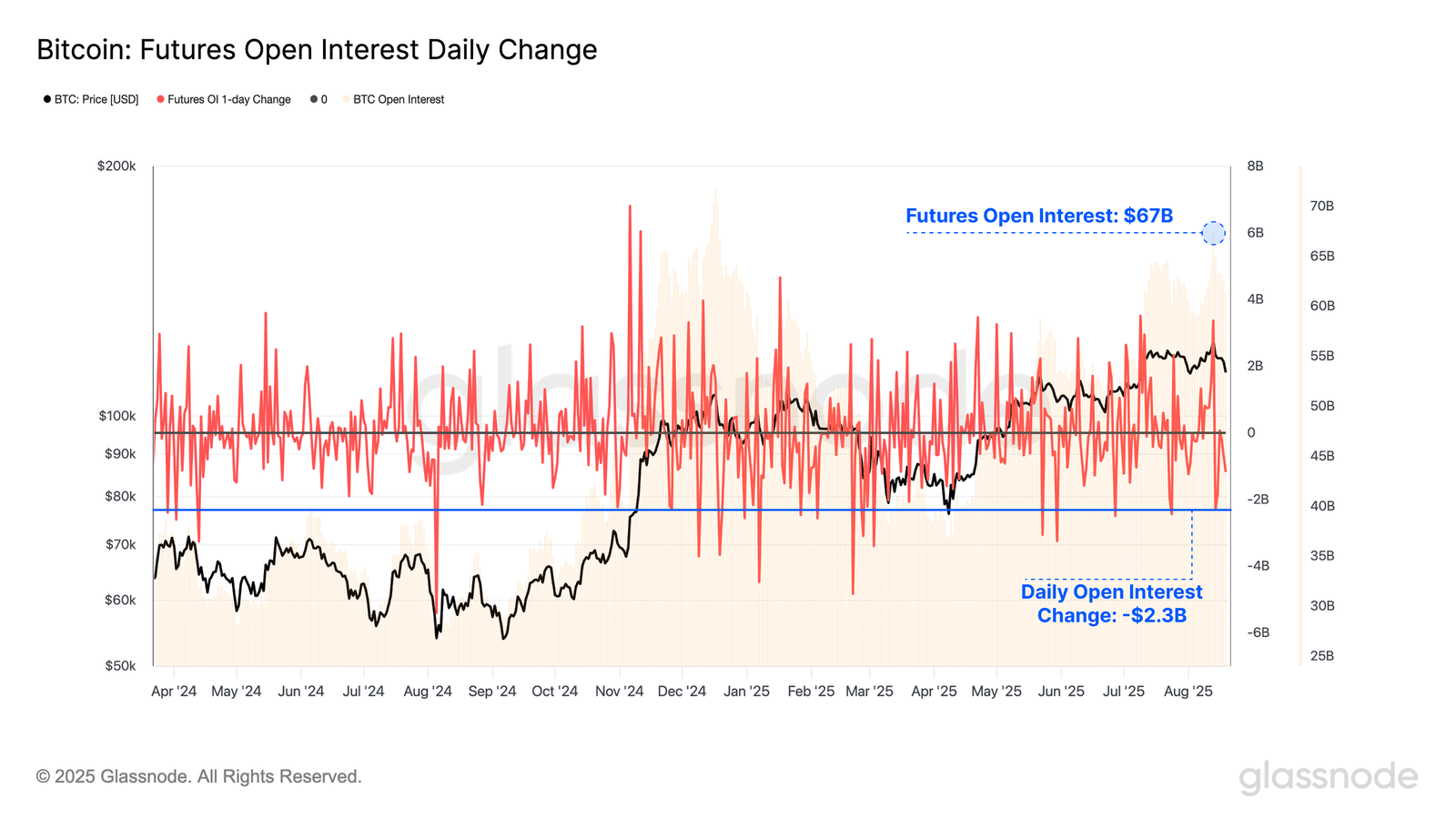

The open interest in BTC futures remains high at $ 67 billion, which indicates the significant use of the credit shoulder in the market. The credit shoulder, although it can make profit, enhances price fluctuations, as we saw in recent movements.

During the recent sale, more than $ 2.3 billion of open interest was liquidated. This is one of the largest reduction. It emphasizes the speculative nature of the market, where even small price changes can lead to a reduction in credit positions.

In recent weeks, an indicator of volatility, adjusted for a clean profit/loss, shows a decrease in profit fixation activity. In previous breakthroughs, for example, at the levels of $ 70,000 and $ 100,000 in 2024, significant volumes of profit fixation testified to the high activity of investors.

At those moments, the market coped with the pressure of sales from BTC holders. However, the last attempt to achieve a historical maximum of $ 122,000 in July was accompanied by smaller volumes of fixation of profit, which indicates a change in market behavior.

One of the explanations of this situation – the market was difficult to maintain growth, despite the softer sales from current holders. The absence of a significant fixation of profit may indicate a weak demand, which explains the current consolidation and limited movement, despite the new price levels.

The price of BTC is restored

At the time of writing this material, bitcoin is traded at $ 114,200, after he bounced $ 112,526 from the support level for the second time this year. It is expected that the restoration will continue, since the reduction is associated with sales due to the use of the credit shoulder. The rebound is likely, taking into account the strength of bitcoin support at $ 112,526.

If the coin overcome the $ 115,000 mark and is entrenched at this level, he will get a chance to rise to $ 117,261. Holding this support is important to continue growth, which can open the way to $ 120,000.

However, if bitcoin cannot overcome $ 115,000 or investors continue to sell, the price may fall below $ 112,526. This can lead to Bitcoin to $ 110,000 or lower, which can be canceled and can signal the long -term bear phase.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.