Bitcoin (BTC) is traded 10% below its historical maximum due to a significant fixation of profit, which has reduced its value from August 14

Now the leading cryptocurrency costs about $ 110,000, and the signal onchain warn of a possible deepening of correction.

BTC futures traders retreat, sales continue

Onine-data show that the pressure from the sellers is growing, threatening to lower the BTC below the psychological mark of $ 110,000.

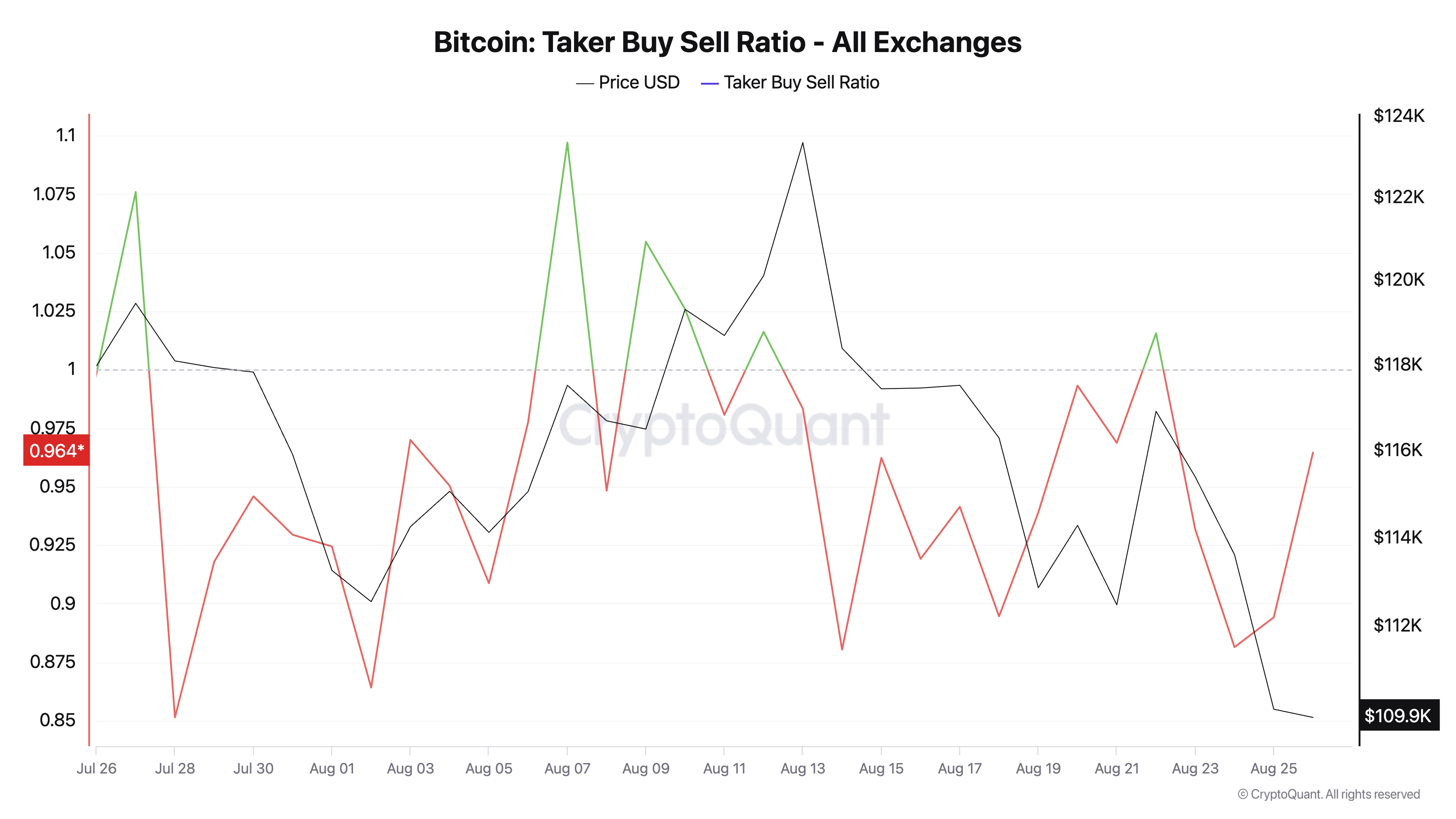

One of the key indicators is Taker-Buy Sell Ratio, which since July is mostly negative. At the time of publication, it is 0.96 according to Cryptoquant, which indicates the prevalence of orders for sale over orders for the purchase in the futures market.

The Taker Buy-Sell Ratio ratio shows the ratio between the volumes of purchases and sales in the futures market of the asset. The values above the unit indicate a larger amount of purchases, and below – the prevalence of sales.

For BTC, futures traders refuse aggressive growth rates, which enhances pressure on the market. This indicates a lack of confidence among the traders of derivatives that Bitcoin will recover soon.

Bitcoin’s spot traders become sellers

The same trend is observed in the spot market. According to Cryptoquant, Spot Taker CVD Bitcoin (cumulative volume delta in 90 days), which tracks the pure activity of buyers and sellers, has changed from the “neutral” on August 18.

Since then, he constantly shows red bars, which indicates the dominance of sellers in the spot market.

The transition to the dominance of sales for BTC reflects a decrease in demand and a weak absorption of increasing supply. With an increase in the number of sellers in the spot market, the imbalance enhances the risk of further decline.

BTC support at $ 110,000 under threat

A decrease in demand in the spot and futures markets puts BTC at risk of falling below $ 110,000. In this case, the price may decrease to $ 107,557, the next level of support.

If buyers again take over and start rally, they can raise the BTC price to $ 111,961. A breakthrough of this level can lead to a movement to $ 115,892.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.