Tuesday morning began with the price of Bitcoin (BTC) sharply falling below $67,500. Just a day earlier, the first cryptocurrency by capitalization was trading around $71,200.

Spot Bitcoin ETFs in the US broke a record 19-day streak of inflows, leading to a market drawdown.

The series of tributaries was interrupted

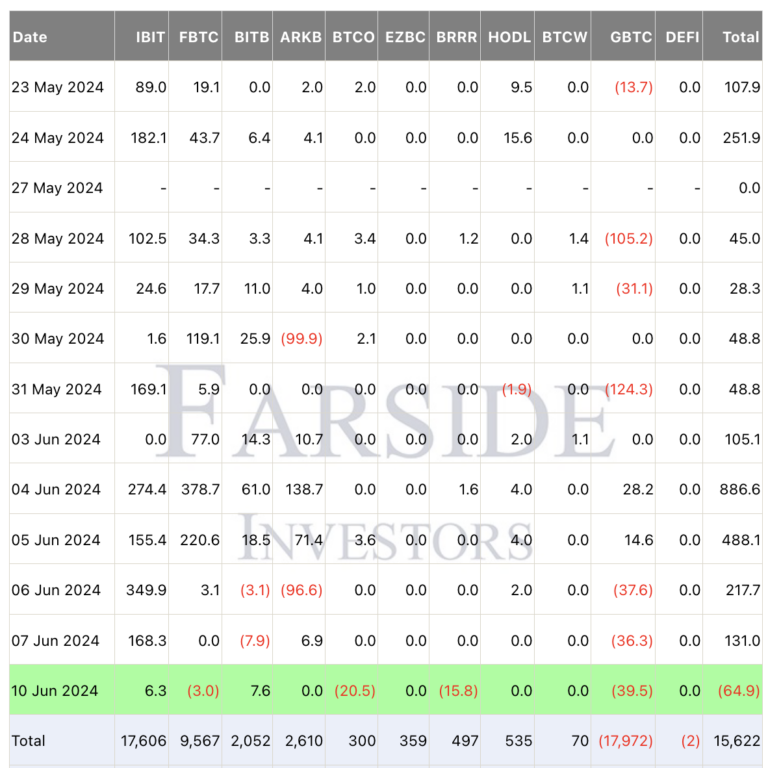

According to Farside Investorson the last trading day, $3 million was withdrawn from Fidelity Wise Origin Bitcoin Fund (FBTC). Similar dynamics were observed in Invesco Galaxy Bitcoin ETF (BTCO) and Valkyrie Bitcoin Fund (BRRR), the outflow of which amounted to $20.5 million and $15.8 million respectively.

The Grayscale Bitcoin trust, GBTC, suffered the greatest losses. As a result of yesterday’s trading session, capital outflow from the fund reached $39.5 million.

The current sector leader, BlackRock’s iShare Bitcoin Trust (IBTC), meanwhile continues to attract investors. The influx of funds amounted to $6.3 million. Bitwise Bitcoin Fund (BITB) also showed positive dynamics. The spot Bitcoin ETF of the investment company Bitwise received $7.6 million.

The total net outflow from American funds exceeded $64.9 million. The last time negative dynamics were recorded was on May 10.

Fund flows into spot Bitcoin ETFs. Source: Farside Investors

Fund flows into spot Bitcoin ETFs. Source: Farside Investors

Market liquidations exceeded $100 million

Against the backdrop of negative inflows, the Bitcoin rate dropped to $67 thousand. According to CoinGeckoat the time of writing, the asset is trading at $67,094, having fallen in price by 3.3% over the past 24 hours.

Meanwhile, the amount of liquidations on the crypto market over the past 12 hours amounted to $101 million. Of this amount, $94.43 million came from long positions and $6.57 million from short positions.

However, the crypto community remains positive despite the latest market volatility. Thus, the author of the bestseller “Rich Dad Poor Dad” Robert Kiyosaki once again noted that Bitcoin is a strategic path to wealth.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.