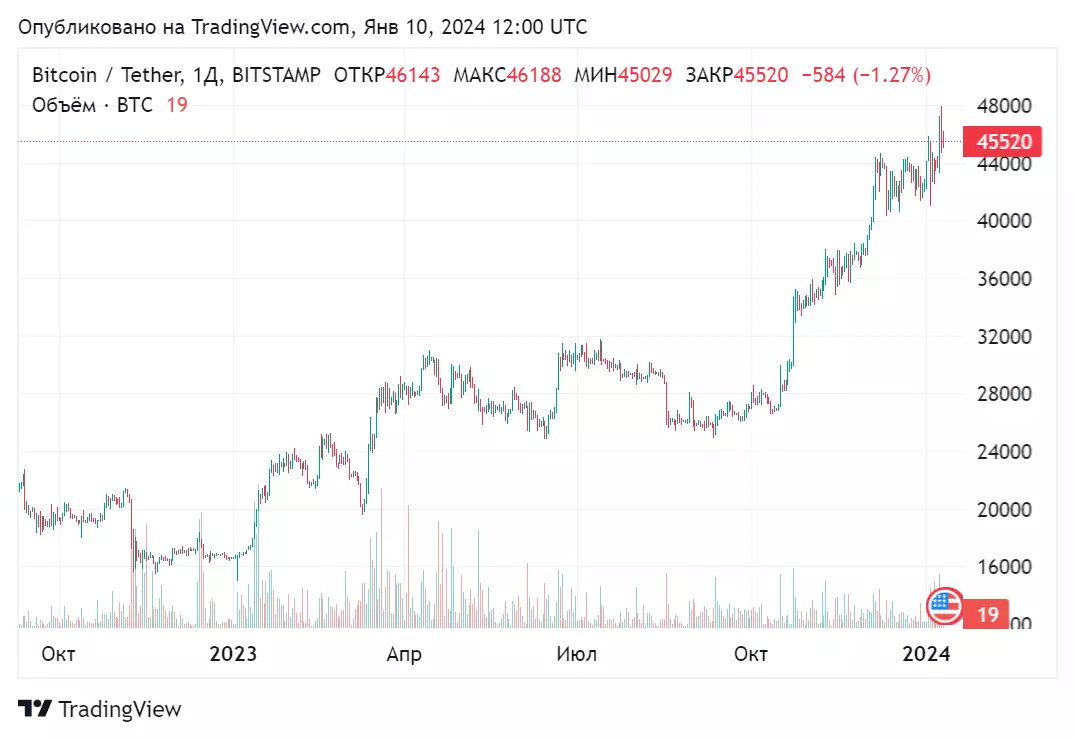

The price of Bitcoin soared by more than 15% within minutes of the release of a fake tweet from the US Securities and Exchange Commission (SEC), which claimed that the US agency had approved spot Bitcoin ETFs. At one point, the price of Bitcoin jumped to around $48,000, but fell to below $45,000 less than half an hour later.

The release of the SEC's retraction triggered a cascading liquidation traders' long positions amounting to more than $900 million over the next 24 hours. On Wednesday afternoon, January 10, the market capitalization of Bitcoin fluctuates at $887 billion. The market price revolves around $45,370-$45,600 per BTC.

Over the past 24 hours, Bitcoin has lost about 2.5% of its market value. However, on the weekly timeframe, the asset’s growth remains within 4%.

The incident sparked criticism among digital asset market participants towards the SEC, which positions itself as protecting investors from digital scammers, but itself cannot set up two-factor identification for its Twitter account. The SEC declined to say whether an investigation into the account compromise had begun and whether the incident would affect the timing of approval of spot Bitcoin ETFs.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.