Bitcoin

Bitcoin added in price from 4 to 11 July, 2025 a little more than 8%. The largest cryptocurrency finally updated its historical maximum, having reached on Friday, July 11, the notes of $ 118 839. It was possible to set record importance due to the breakthrough undertaken by the BTC in the second half of the week.

Source: TradingView.com

One of the main reasons for the growth was mass purchases of bitcoins by large customers-legal entities. In April – June alone, various companies replenished their reserves for 159 107 BTC (over $ 17.6 billion). In percentage, the volume of bitcoin at the disposal of large businesses increased by 23.13%over three months. According to the investment company BitWise Asset Management, the number of companies that create bitcoins reserves has increased: 125 by the beginning of July, total plus 46 for three months.

Bitcoin’s sp – the largest support for Bitcoin. A series of tributaries of funds to exchange funds reached six trading sessions in a row. It is noteworthy that on Thursday, July 10, the ETF was replenished immediately by $ 1.18 billion. This day became the most successful for exchange funds in 2025 and the second most successful in history – after November 7, 2024, when the flow of money amounted to $ 1.38 billion.

Source: sosovalue.com

Bitcoin has already grown well, but analysts

Platforms Glassnode see the further potential for the rise in the cost of the main crypto -sea. Experts pay attention to the MVRV Z-Score metric. Now its value is about 2.4. These indicators are much smaller than those that were achieved during the last peaks of bull cycles in 2017 and 2021. Then, in both cases, MVRV Z-Score exceeded 7. It was on this basis that in Glassnode

They thinkthat the growth of bitcoin will continue.

Source: TradingView.com

From the point of view of technical analysis, the trend of BTC is ascending. This is evidenced by the fact that the price exceeds a 50-day sliding average (indicated by blue colors). At the same time, the trend is still quite weak: the ADX indicator only slightly exceeds the value of 15. The assumption of Glassnode analysts that the growth of bitcoin will continue, is seen very believable. The nearest levels of resistance and support on the day schedule: $ 118 839 and $ 112,000, respectively.

Source: TradingView.com

Index

Fear and greed Compared to last week, he fell by two points. The current value is 71. This indicates the predominance of greed over fear in the mood of the crypto -investors.

Ethereum

Air in seven days, from July 4 to 11, increased by more than 18.5%. At the moment, ETH was traded above $ 3,000, which has not been happening for more than six months from the second capitalization of cryptocurrency. As in the case of Bitcoin, the first half of the week was calm, and the growth fell on the second.

Source: TradingView.com

One of the catalysts for raising the price of the ether was the increased activity of traders in the derivatives market. According to the Glassnode analytical platform, the intra -day volume of trade in futures on ETH amounted to $ 62.1 billion,

Overlining Even bitcoin with it is $ 61.7 billion.

In addition, the demand from institutional investors increased on the air, as well as Bitcoin. For example, the Bitmine Immersion Technologies mining company

announced On the creation of the ETH reserve for $ 250 million. The marketing company Sharplink Gaming also reported on increasing its reserves to 205,634 coins. She not only actively acquires the second in capitalization of cryptocurrency, but also constantly

Uses Various protocols of stake and resting, which have already brought more than 300 ETH.

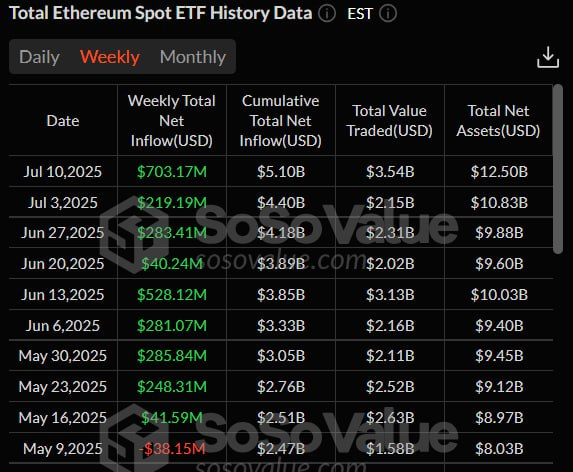

Sprint ETF on the air for the ninth week in a row has been demonstrating an influx of cash. Over the past seven days, it amounted to $ 703.17 million. This is the most successful week for exchange funds in 2025. The larger amount of the flow of funds for a week of spotes ETF on the air was recorded only two weeks in a row in December 2024.

Source: sosovalue.com

From the point of view of technical analysis, the ether is in an upward trend: its price exceeds a 50-day sliding average (indicated in blue). However, there are some alarming points. For example, RSI went into the overwhelming area (above 70), and this may indicate a imminent turn, at least local. Support and resistance levels: $ 2,880.7 and $ 3,450, respectively.

Source: TradingView.com

Hedera

The price of Hedera from July 4 to July 11 increased immediately by 34.67%. This cryptocurrency has reached a cost of $ 0.2 for the first time since May. In the last three trading sessions, from July 9 to 11, Hedera added more than 6%every day.

Source: TradingView.com

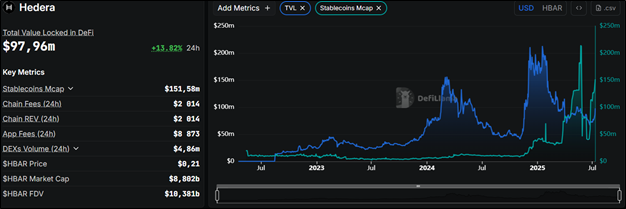

The positive dynamics of HBAR is due to the growth of network indicators of the entire sector of decentralized finance. From June 20, the capitalization of stabilcoins on the blockchain of cryptocurrencies of Hedera has increased more than three times – from $ 40.26 million to $ 131.25 million. And the TVL indicator – the total number of blocked assets – rose from $ 66.65 million on June 23 to $ 97.96 million on July 11.

Source: Defillama.com

In addition, the Hedera staying remains in demand. In terms of assets in HBAR stake

It remains In a top ten with an indicator of $ 2.57 billion. This is quite unique, since Hedera is close to zero – 0.03%.

Another catalyst for demand for HBAR could be a collaboration with the Australian Reserve Bank (RBA). Hedera has joined the Project Acacia project. As part of cooperation, the task is –

researchLike digital money, such as stablecoins, will be able to help the development of the Australian market of tokenized assets.

From the point of view of technical analysis, Hedera in an upward trend. This is evidenced by the excess at the price of a 50-day sliding average (indicated in blue). But the Stochastic oscillator is in the overwhelming area, which speaks in favor of the bears. Given that Coin added more than 30% for a week without visible kickbacks, a small correction is quite likely. Support and resistance levels are located in marks $ 0.18367 and $ 0.2286, respectively.

Source: TradingView.com

Conclusion

Cryptic is stained green. The greatest role in this played, and will also play, the increase in demand for digital assets from the business, which more and more forms reserves in various cryptocurrencies.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.