The course of the first cryptocurrency lost more than 3% per hour after the threats of US President Donald Trump to impose duties on 50% of the EU from June 1.

At the moment, Washington is negotiating with Brussels after the introduction of the so-called 90-day tariff truce. According to Financial Times, current progress does not correspond to US expectations.

The head of the White House called the prevailing deficit in mutual trade with the EU of $ 250 billion ($ 250 million in the original).

Trump mentioned restrictions, including non -humorous nature, VAT, corporate fines, exchange rate manipulations, as well as court claims against American companies.

Shortly before that, the US President warned Apple that the company’s products would be taxed 25%if it continues to produce it abroad.

Trump’s activity led to a sharp deterioration in risk appetites in world financial markets. The shares of the European car concerns collapsed by 3.3-4.5%, which pulled the local stock market and worsened the mood for Wall Street before the opening. Futures on S&P 500 decreases by 1.5%.

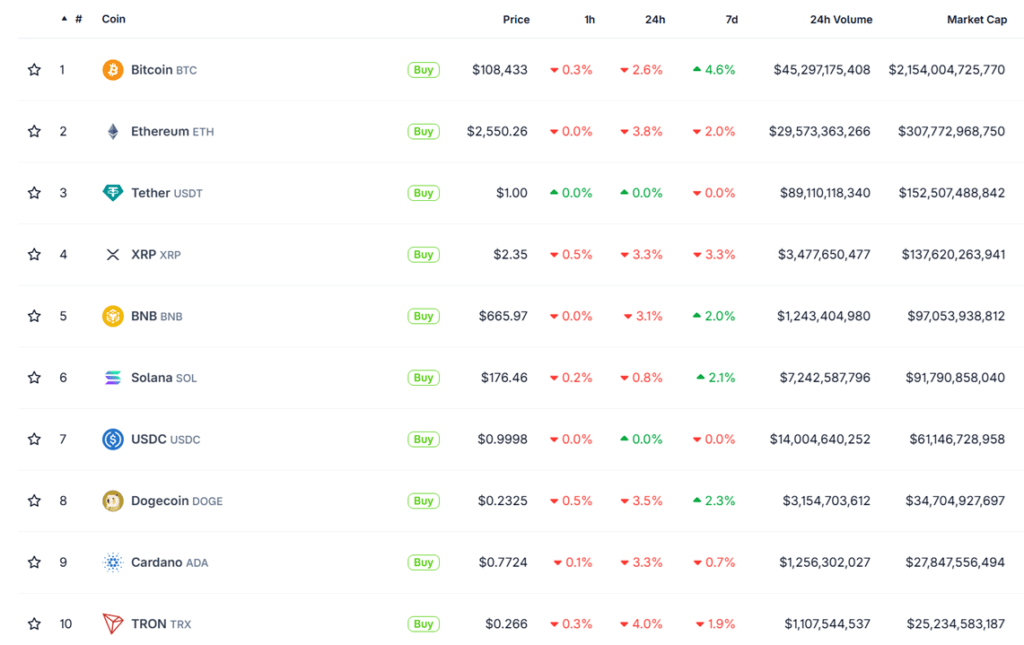

Against this background, gold rose by 2%, there is a demand for sovereign bonds of developed countries. Bitcoin failed 3% and at the time of writing is traded at $ 108 430.

The rate of reduction in the TOP-10 in capitalization of digital assets varies in the range from 2.6% to 4%.

The volume of liquidations over the past 24 hours reached $ 541.5 million, of which almost $ 400 million fell on Longs. The volume of forced positions in Bitcoin is comparable to Ethereum.

On May 22, Bitcoin updated the maximum on the approaches to $ 112,000 against the background of conservation of significant revenues in ETF.

JPMorgan noted the high chances of the first cryptocurrency in the “competition” with gold until the end of the year, including thanks to corporate purchases.

Additional support continues to provide purchases of public companies. On the same day, Strategy Michael Saylor sent to the SEC an application for preferred shares for $ 2.1 billion. The company uses revenue to finance general celebration purposes, including the acquisition of digital gold.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.