Crypto exchange Bitfinex introduced a new analysis on-chain metrics and investor behavior. He points to clear signs of a bull market.

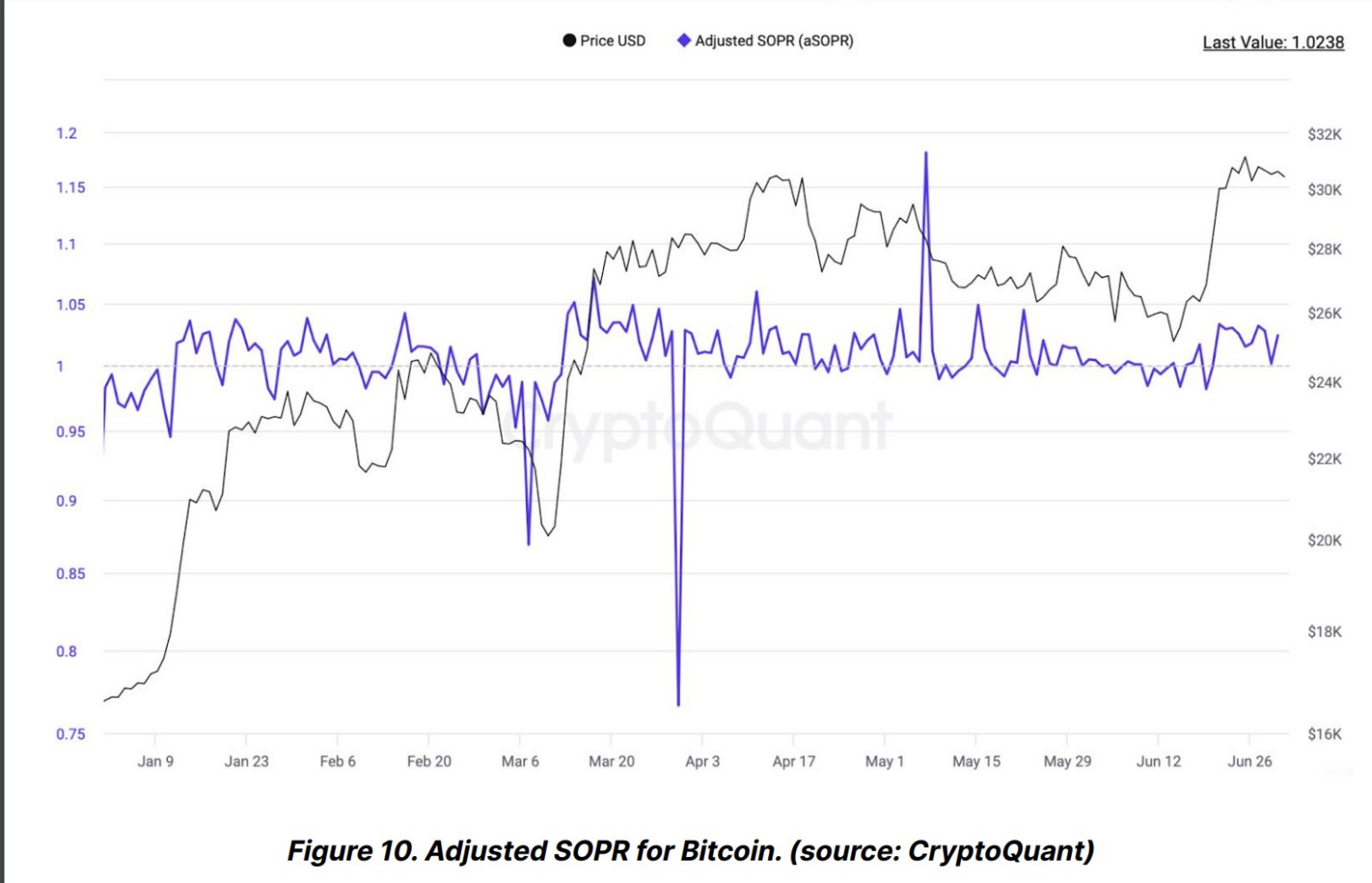

The experts built their report on the SOPR (Spent Output Profit Ratio) indicator. It reflects the efficiency of selling bitcoin over a certain period of time. When SOPR is below 1, most trades are unprofitable and the market sees price declines.

At the moment, the BTC rate is moving sideways at $30,000. This means that the SOPR of the asset remains above 1.

Experts conclude that market participants are in no hurry to sell bitcoins at a loss, as they are confident in their spot positions.

The SOPR indicator has remained above 1 for the last two weeks. It started after bitcoin broke the important $29,500 level.

However, the market continues to struggle between bullish and bearish sentiment. The sell and buy order data are in balance and the coming days will determine the direction of the trend.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.