In July, Bitcoin can rise to a range of $ 120,000–125,000 if a weak report on employment in the United States will push the Fed to weaken the monetary policy and reduce the key rate. It is reported by The Block with reference to Bitfinex experts.

The stronger in comparison with the expected indicators can lead to a drop in quotes to $ 95,000.

Bitfinex analysts expect signs of slowdown in the labor market in a fresh employment report, which will be published on June 6. According to their forecast, the number of new jobs outside the agricultural sector will be from 125,000 to 130,000, which is significantly lower than the April indicator in 177,000.

It is assumed that unemployment will remain at the level of 4.2%, and the average hourly salary will increase by 0.2–0.3% compared to the previous month.

Weak data on the labor market can strengthen the narrative about the slowdown of inflation and accelerate the decrease in the Fed’s rate. In turn, this will support the interest of investors in risky assets like bitcoin, according to Bitfinex.

A more positive report can delay the reduction in rates, strengthen the dollar and increase pressure on bitcoin. With this scenario, the range of $ 95,000-97,000 will serve as a local bottom-accumulation is already noticeable there, the company noted.

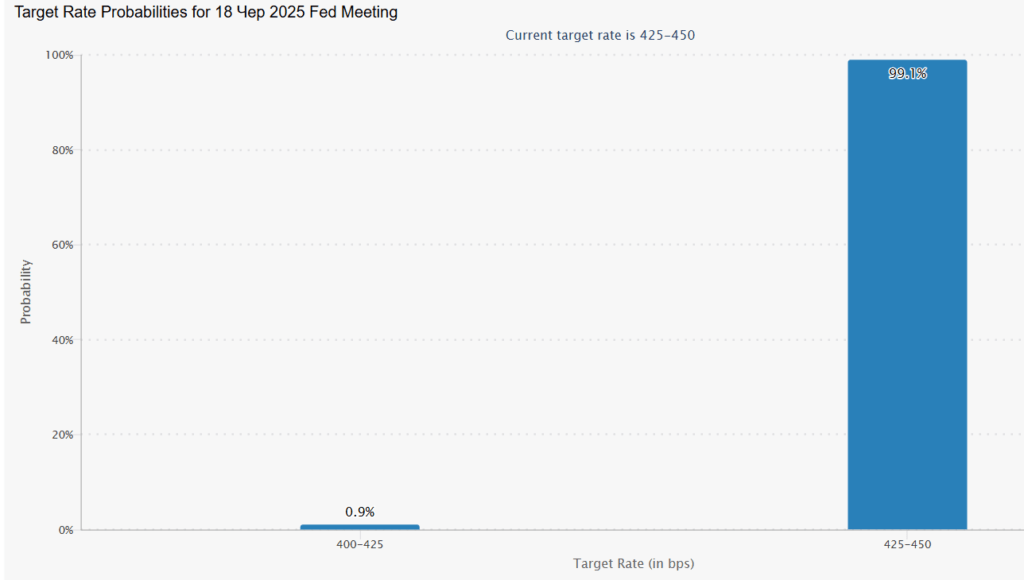

The market expects to preserve the rate in the current range of 4.25–4.5% at least until the end of July. Most traders do not predict its reduction until September.

Bear signals

The host of the BRN analyst Valenten Furnier took a more restrained position. He called on market participants to a defensive strategy against the background of intensifying bear signals.

Among the alarm indicators: a reduction in the influx of funds in the ETF, a weakening of a market impulse and an increase in the number of cryptocurrency IPOs. The latter may indicate the desire of investors to record profit in the short term.

In his opinion, crypto companies consider the current market situation as a window of opportunities to extract benefits from high assessments. In turn, this may indicate expectations of a slowdown in growth or reduction in prices “among insiders”. Recall that Cryptoquant analysts allowed the return of the first cryptocurrency to the level of $ 96,700, which corresponds to the average price of buying short -term investors.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.