In October-November, the crypto market will begin to grow after the end of macroeconomic and political uncertainty in the United States. This is the opinion presented CIO Bitwise Matt Hougan.

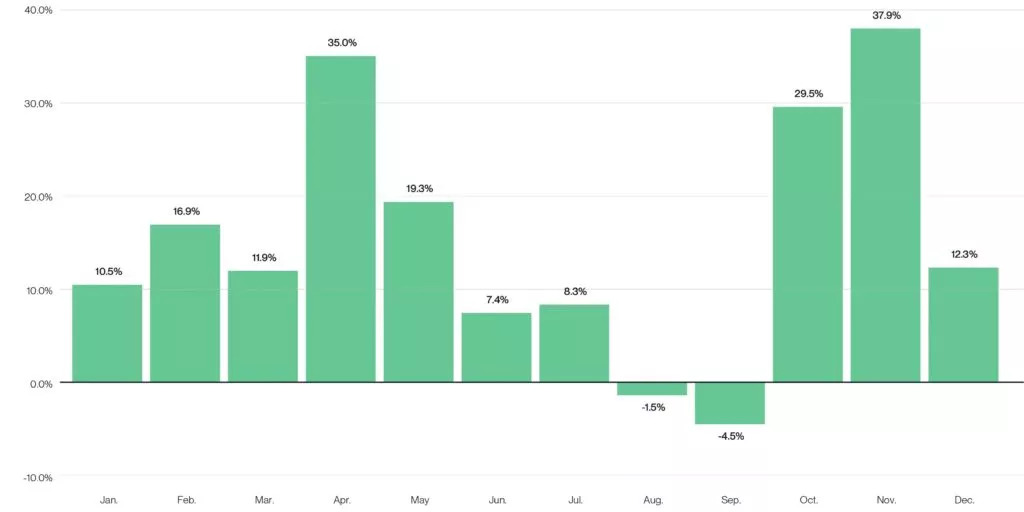

September is historically the worst month for Bitcoin dynamics with an average price drop of 4.5%. In 2011, quotes fell by 41.2%, the expert emphasized.

Bitcoin price dynamics on average by month. Data: Bitwise.

Bitcoin price dynamics on average by month. Data: Bitwise.

According to him, the “back-to-school blues” effect is affecting all high-risk assets, including the first cryptocurrency. For example, this year, in the first week of September, digital gold lost 7%, and the Nasdaq-100 index lost almost 6%.

Digital asset industry under additional pressure from enforcement activity SEC. The agency’s reporting period ends in September, and lawyers are trying to close open cases, the expert noted. For the 2024 fiscal year, the Commission collected a record $4.8 billion from crypto startups, Social Capital Markets calculated.

To the listed seasonal factors, Hougan added uncertainty in the markets, which is caused by:

- US presidential elections;

- the timing and scale of the reduction in the key rate Fed;

- mixed picture of flows into spot Bitcoin and Ethereum ETFs.

The price of Bitcoin could reach $90,000 by the end of the year if Donald Trump wins the election, or test $30,000 if the opposite happens, Bernstein analysts predicted.

Meanwhile, during the first round of debates, the candidates did not touch on the topic of cryptocurrencies.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.