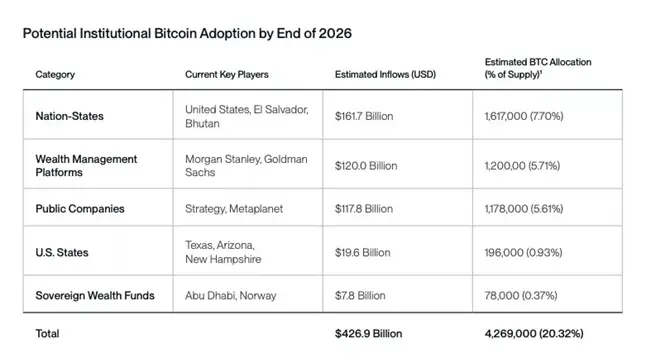

This year, analysts expect an influx in the first cryptocurrency at least $ 120 billion funds of institutional funds, and in 2026 – about $ 300 billion.

“Public companies using Bitcoin as a treasury asset have become a long -term source of customer demand for the first cryptocurrency, increasing its effectiveness compared to others,” Bitwise explained.

According to experts, over the next few years, the number of organizations with reserves in bitcoins will double, as well as the popularity of exchange products based on the first cryptocurrency.

“Sprint ETF on Bitcoin are the first step in a much larger transformation of the financial landscape. With the advent of the administration friendly to the cryptocurrencies in the United States and the new SEC leadership, ready to introduce innovations, the market is aimed at more cryptopr products. In 2025, there is a potential for the emergence of a wide range of new proposals, ”experts emphasized.

While corporate implementation is in full swing, institutional investments through capital management platforms are gaining momentum. They strengthen the role of the first cryptocurrency in the global financial system, the experts summed up.

Previously, the leading podcast The Wolf of All Streets Scott Melker said that this year the bitcoin exchange rate could sharply grow to $ 250,000 due to the increased interest of institutional investors in cryptocurrency.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.