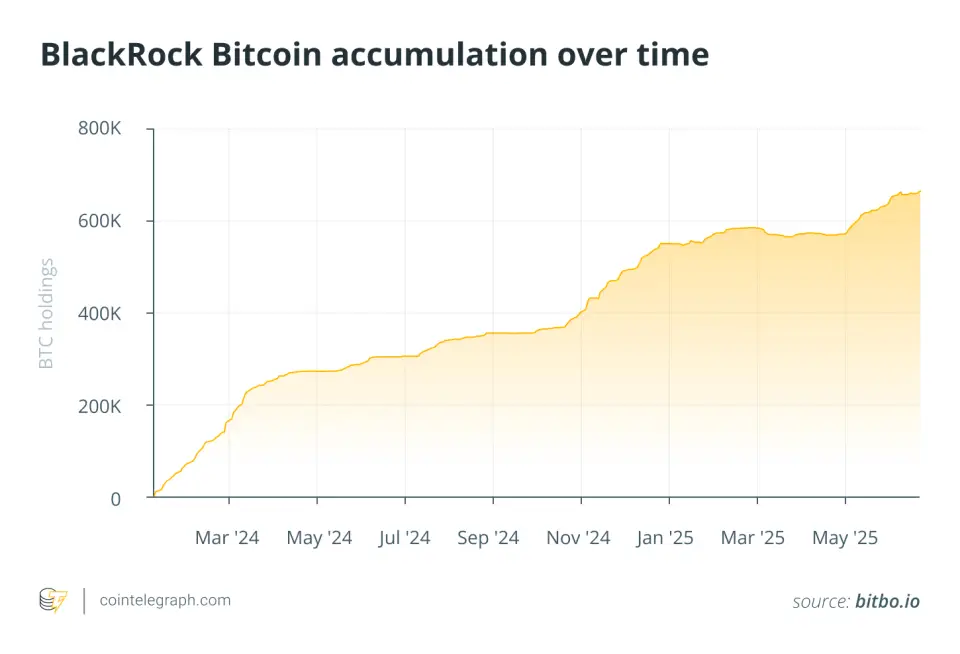

According to the results of the first half of the year, the iShares Bitcoin Trust, launched on January 11, 2024, reached $ 72.4 billion. It took ibit only 340 days, which made the Funder growing ETF in history.

For comparison, the SPDR Gold Shares gold fund took over 1600 days to achieve a similar result. BlackRock went around the volume of Bitcoin owners of many centralized exchanges, as well as large corporate asset holders like Marathon Digital, Metaplanet or Strategy.

BlackRock said that the company sees in bitcoins protection against fiat risks caused by growth of public debt and foreign policy instability, and also recommended corporate investors to allocate up to 2% of the portfolio for the first cryptocurrency, comparing its volatility with shares of large technological companies.

Earlier, the BlackRock investment company has submitted an application to the US Securities and Exchange Commission (SEC) to launch the ether stake for its Eth-ETF.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.