For the first time since the launch of spot Bitcoin ETFs in the United States, the BlackRock fund recorded negative dynamics.

On May 1, the outflow from spot Bitcoin (BTC) ETFs reached $563.8 million. The iShares Bitcoin Trust (IBIT) fund of the world's largest asset manager BlackRock lost $36.93 million, data shows. Farside Investors.

Spot Bitcoin ETFs see record outflows

The outflow of funds for yesterday's trading day was a record since January, when the US Securities and Exchange Commission (SEC) approved the launch of the tool.

The largest losses were suffered by Fidelity's Wise Origin Bitcoin Fund (FBTC). More than $191 million flowed out of it, followed by Grayscale Bitcoin Trust (GBTC), which lost $161.4 million.

Fund flows into spot Bitcoin ETFs. Source: Farside Investors

Fund flows into spot Bitcoin ETFs. Source: Farside Investors

The total net amount of inflows into the new Bitcoin-based instrument is currently $11.2 billion. The largest amount of capital flowed into IBIT – $15.4 billion. At the same time, more than $17.4 billion were withdrawn from GBTC in three months.

Bloomberg analyst James Seyffarth urged investors not to worry too much. In a post on X (formerly Twitter), he emphasized:

Impact of ETF Flows on Bitcoin Price

The crypto community continues to debate how spot ETF flows affect the price of BTC. Well-known Bitcoin investor Kush Alemzadeh, for example, argues that the impact of instrument dynamics on market trends is exaggerated.

Record outflows from funds for the first cryptocurrency coincided with a drop in its price. On May 1, the price of Bitcoin fell below $57,000 for the first time since February and is now trading at around $58,000, according to CoinGecko. However, the decline is associated not only with negative dynamics in the ETF market, but also with a decrease in demand from cryptocurrency whales.

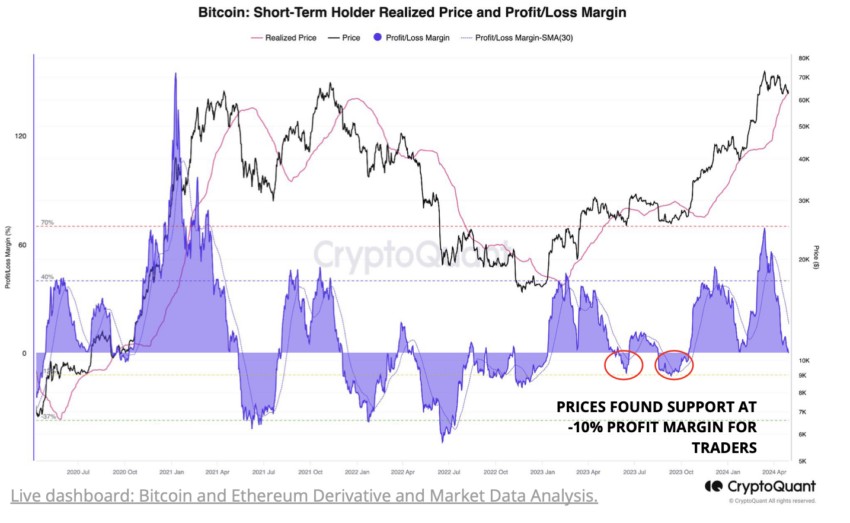

The latest report from CrytoQuant states that the figure has dropped from over 200k BTC at the end of March to 96k BTC currently. The current BTC rate is below the selling price of short-term holders, which is approximately $63 thousand.

According to experts, in the near future the value of the asset may find its bottom.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.