Even after the recovery of the Bitcoin price, the hash price remained at levels barely exceeding $40 per PH/s.

“In the current environment, mining remains a ‘challenging environment,’ especially for those without access to competitive electricity prices,” BlocksBridge Consulting analysts noted.

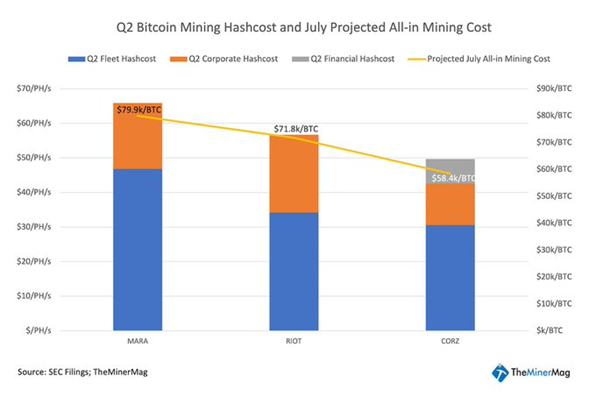

According to experts, independent mining is unlikely to bring net profit before taxes in the context of rising electricity costs. The financial reports of three large companies, MARA (Marathon Digital), Core Scientific and Riot, indicate that the cost of mining Bitcoin in July exceeded $60,000 per coin.

MARA and Riot have adopted a policy of accumulating Bitcoin reserves, including purchasing the first cryptocurrency on the market. A Core plans to sell 100% of the mined coins to cover its expenses.

The chosen strategies have their advantages, BlocksBridge Consulting noted, as companies can ignore short-term price movements of cryptocurrencies, counting on future price increases. BTC.

Since the beginning of 2024, companies have been able to raise more than $1.5 billion through share placements, but capital expenditures in the first six months have also amounted to more than $1 billion.

Earlier, analysts at the Bitfinex crypto exchange said that Bitcoin is an effective safe-haven asset. According to experts, the value of the first cryptocurrency increases even more during an economic recession.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.