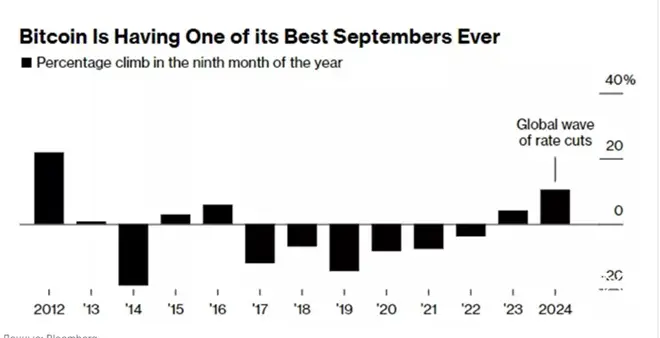

According to market experts surveyed by Bloomberg, Bitcoin’s price dynamics in September sharply contrast with the coin’s classic behavior for this month—an average drop of 5.9%

Arbelos Markets chief trading officer Sean McNulty said Bitcoin’s correlation with the US Federal Reserve’s (Fed) monetary policy continues to be the highest, and lower interest rates provide further support for the cryptocurrency.

However, the Bitcoin rate, frozen at just above $65,000, may be unstable due to the expiration of a large number of options contracts, said Caroline Mayron, co-founder of digital asset derivatives liquidity provider Orbit Markets.

Now the crypto market is awaiting the finale of the presidential election race in the United States, and many market participants expect an increase in investor sentiment after the new White House administration forms clear rules for regulating cryptocurrencies, Bloomberg experts said.

Earlier, analysts from the international financial corporation Standard Chartered pointed to a number of factors that could support Bitcoin growth next month. According to them, investor expectations have improved after the Fed cut.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.