The BNB price has increased by almost 14% over the past 30 days and recently reached a new historical maximum at $ 881. Now it is only 2% below this mark.

Over the past 24 hours, BNB added another 3.4%, which indicates a stable interest of customers. Two key canchain shows that the rally can continue.

Hodler buy on growth

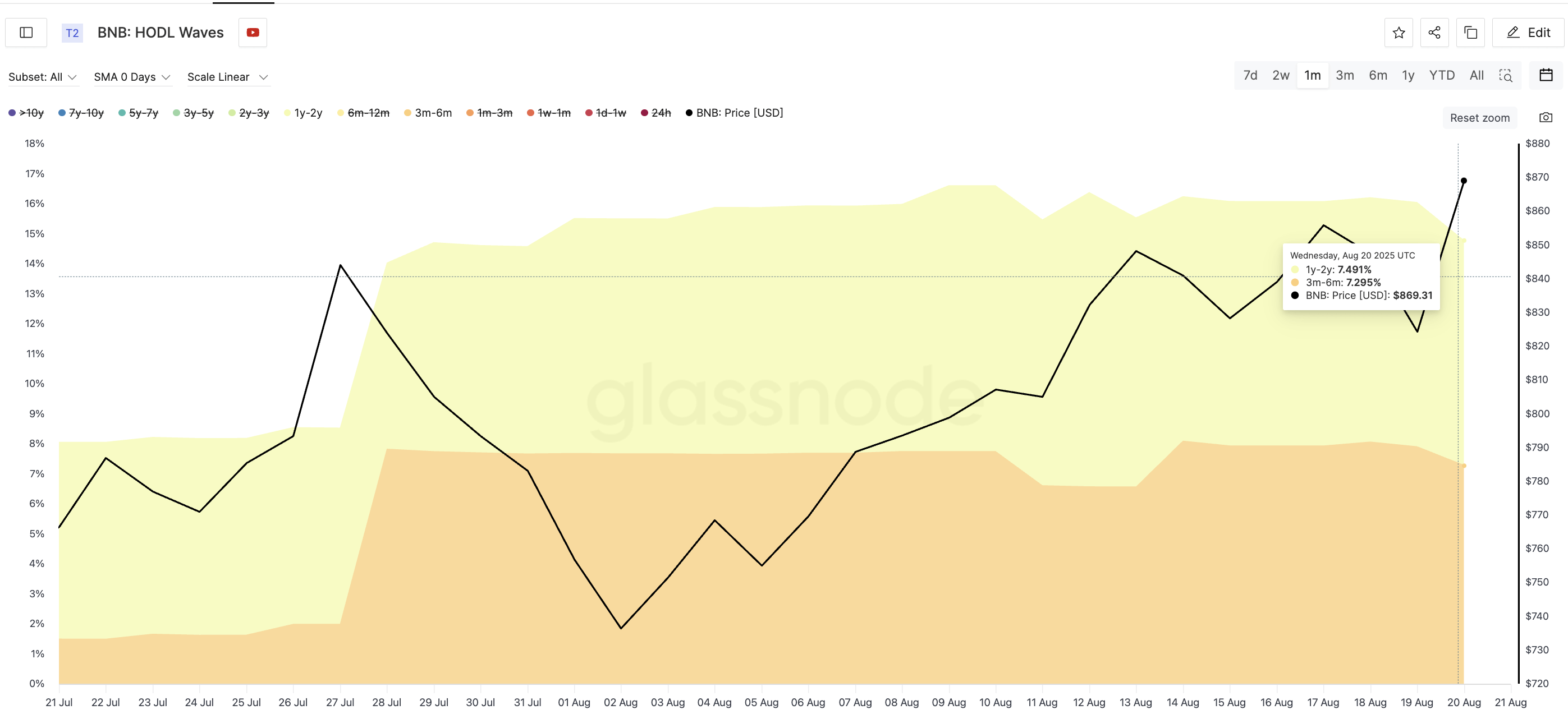

The chart below shows Hodl BNB waves – a metric that measures how long investors keep their tokens. She divides all BNB holders into age groups. Attention is concentrated on two groups: long -term holders (1-2 years) and medium -term buyers (3-6 months).

On July 21, the group of 1-2 years owned 6.56% of the offer. By August 20, this figure increased to 7.49%. The share of the group 3-6 months increased from 1.5% to 7.3%. This is a significant increase, especially considering that the price of BNB grew at this time.

The accumulation was recorded not during the recession, but during the BNB price – this means that holders are not waiting for a rollback. They buy against a background of growth.

From 19 to August 20, the price of BNB rose from $ 824 to $ 869. At the same time, exchanges on exchanges decreased from 31.91 million to 31.38 million BNB – a decrease by 530 thousand tokens per day.

This suggests that the traders did not sell coins, but rather brought them out. Such stakes of accumulation clearly show that BNB holders are expected to increase prices.

BNB forecast: where the next barrier expects

BNB price increase is not accidental. It follows a clear ascending trend, with kickbacks that correspond to the levels of Fibonacci correction. The schedule shows the expansion of Fibonacci based on a recent impulse: $ 730 (beginning) to $ 864.95 (peak), with a rollback of up to $ 812.

The level of 0.5 – $ 881 – became clear resistance and was tested almost perfectly, indicating the historical maximum BNB. If you manage to overcome it, the following levels of Fibonacci will open at $ 897 and $ 920, which will become new historical maximums.

However, there is a risk: if the BNB price falls below $ 812, the structure of the trend will weaken. This level served as a key correction area, and its loss will change the mood of the market. Until this happened, the mood remains on the side of growth.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.