- Investors expect the Bank of England to cut its policy rate by 25 basis points.

- Disinflationary pressure in the UK intensified further in September.

- The 200-day SMA near 1.2810 supports the decline in GBP/USD.

Market consensus points to further easing in the upcoming Bank of England (BoE) interest rate decision on Thursday. The BoE held rates steady at 5.00% at the previous meeting, but the change in investor sentiment now suggests a possible 25 basis point cut this week.

No surprises expected at BoE meeting

At the bank’s Sept. 19 meeting, policymakers stuck with quarterly rate cuts for now, with a November cut the most likely outcome. On quantitative tightening, the committee voted unanimously to maintain the pace of reduction in bond holdings by GBP 100 billion over the next 12 months, which was again in line with expectations.

The only moderate elements were the slight downward revisions to Q3 GDP and Q4 CPI, although this is more of a case of market adjustment, which is of course subject to change depending on incoming data.

Looking ahead, indicators of inflation persistence—labor market tightness, private wage growth, and the services CPI—should continue to guide policy.

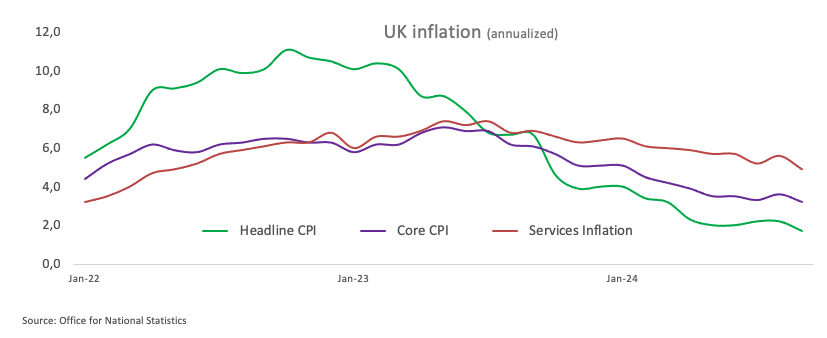

Turning to inflation, the headline Consumer Price Index (CPI) fell to 1.7% year-on-year in September, while the core CPI (which excludes food and energy costs) fell to 3.2% over the last twelve months, and Services inflation remained high at 4.9% compared to the previous year.

Following the BoE event in September, policymaker Catherine Mann expressed a cautious stance on the likelihood of multiple interest rate cuts in the coming months, emphasizing the importance of maintaining tight policy.

However, in early October, Governor Andrew Bailey indicated that the Bank of England could take a “more activist” approach to rate cuts if there is continued positive news on inflation. Aligning with Mann’s approach, Chief Economist Huw Pill stated that the British central bank should take a gradual approach in reducing interest rates.

Ahead of the BoE meeting, analysts at TD Securities noted: “We anticipate a 7-2 majority to cut Bank Rate by 25 basis points and little change from September guidance. Incoming growth and inflation data have been softer than the CPM expected in its August projection, but the budget will force some adjustments to the projection (but these will be less positive than the market expects). We do not expect any signal on the December policy decision.”

How will the BoE interest rate decision impact GBP/USD?

Although inflationary pressure slowed its pace in September, market participants still appear to favor a rate cut at the BoE policy meeting on November 7 at 12 GMT.

FXStreet Senior Analyst Pablo Piovano notes that a rate cut could put more pressure on the British Pound, which could see further decline if GBP/USD falls below its November low of 1.2833 (Nov. 6). . In that case, next contention should emerge at the key 200-day SMA at 1.2811, ahead of the July low of 1.2615.

“On the upside, bulls will initially be eyeing the provisional 55-day SMA at 1.3119. The breakout of that region could put a possible visit to the 2024 peak at 1.3434 (September 26) back into focus,” Pablo concludes.

economic indicator

BoE interest rate decision

He Bank of England sets the interbank interest rate. This interest rate affects a range of interest rates set by commercial banks, building societies and other institutions towards their own savers and borrowers. It also tends to affect the price of financial assets, such as bonds, stocks and exchange rates, which affect consumer and business demand in a variety of ways.

Next post:

Thu Nov 07, 2024 12:00

Frequency:

Irregular

Dear:

4.75%

Previous:

5%

Fountain:

Bank of England

The BoE FAQs

The Bank of England (BoE) decides the UK’s monetary policy. Its main objective is to achieve price stability, that is, a constant inflation rate of 2%. Its instrument to achieve this is the adjustment of basic loan rates. The BoE sets the rate at which it lends to commercial banks and at which banks lend to each other, determining the level of interest rates in the wider economy. This also influences the value of the British Pound (GBP).

When inflation exceeds the Bank of England’s target, it responds by raising interest rates, which makes access to credit more expensive for citizens and companies. This is positive for the British Pound, as higher interest rates make the UK a more attractive place for global investors to invest their money. When inflation falls below target, it is a sign that economic growth is slowing, and the Bank of England will consider lowering interest rates to make credit cheaper in the hope that companies will borrow to invest in projects that generate growth, which is negative for the Pound sterling.

In extreme situations, the Bank of England can apply a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit into a clogged financial system. QE is a policy of last resort when lowering interest rates does not achieve the necessary result. The process of QE involves the Bank of England printing money to buy assets, typically government bonds or AAA-rated corporate bonds, from banks and other financial institutions. QE usually results in a weakening of the British pound.

Quantitative tightening (QT) is the reverse of QE, and is applied when the economy is strengthening and inflation begins to rise. While in QE the Bank of England (BoE) buys government and corporate bonds from financial institutions to encourage them to lend, in QT the BoE stops buying more bonds and stops reinvesting the maturing principal of the bonds that you already own. It is usually positive for the British pound.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.