BNB

The BNB cryptocurrency, a coin of the Binance exchange, grew by 18% in seven days, from May 31 to June 7. On June 6, the cryptocurrency set its new all-time high, which is now $725.6. It is worth noting: the entire week passed in the green zone, with the exception of the last trading session on June 7.

Source: tradingview.com

Interestingly, BNB’s all-time high came the week that former Binance CEO Changpeng Zhao was jailed for four months. The court ruled that the period begins on June 1. It would seem that this is not the best advertisement for BNB, but here’s how it all turned out. What was behind the rise of the coin?

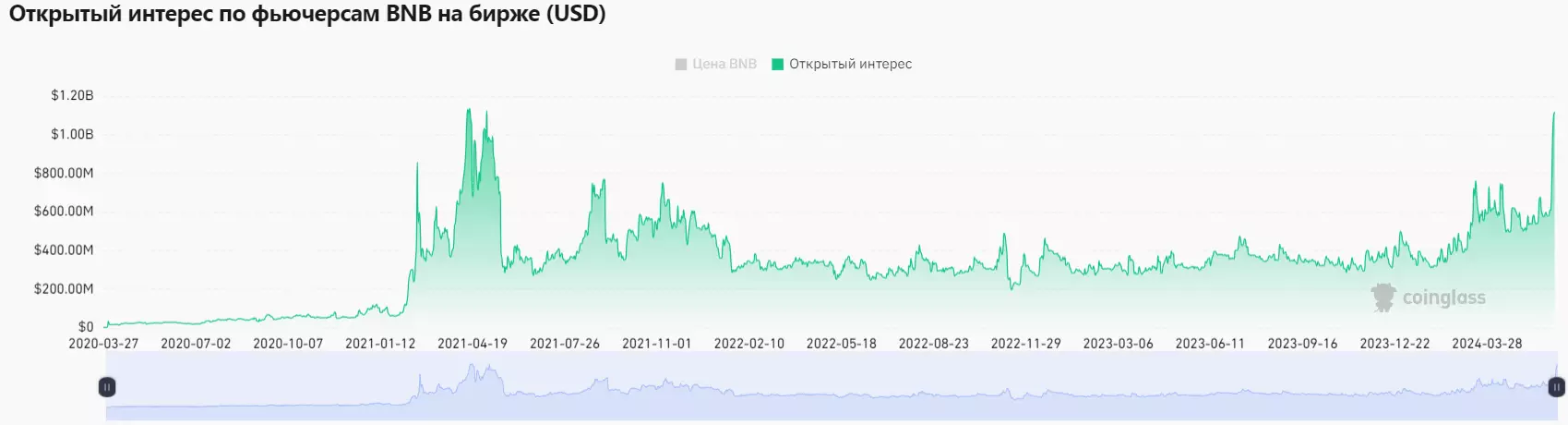

For example, the explosive growth of open interest (the number of open futures and options) in BNB. If on May 31 the figure was $580.33 million, then on June 6 it was already $1.1 billion. Thus, open interest increased by 1.89 times. The figure has not been this high since the beginning of May 2021, that is, for more than three years.

Source: coinglass.com

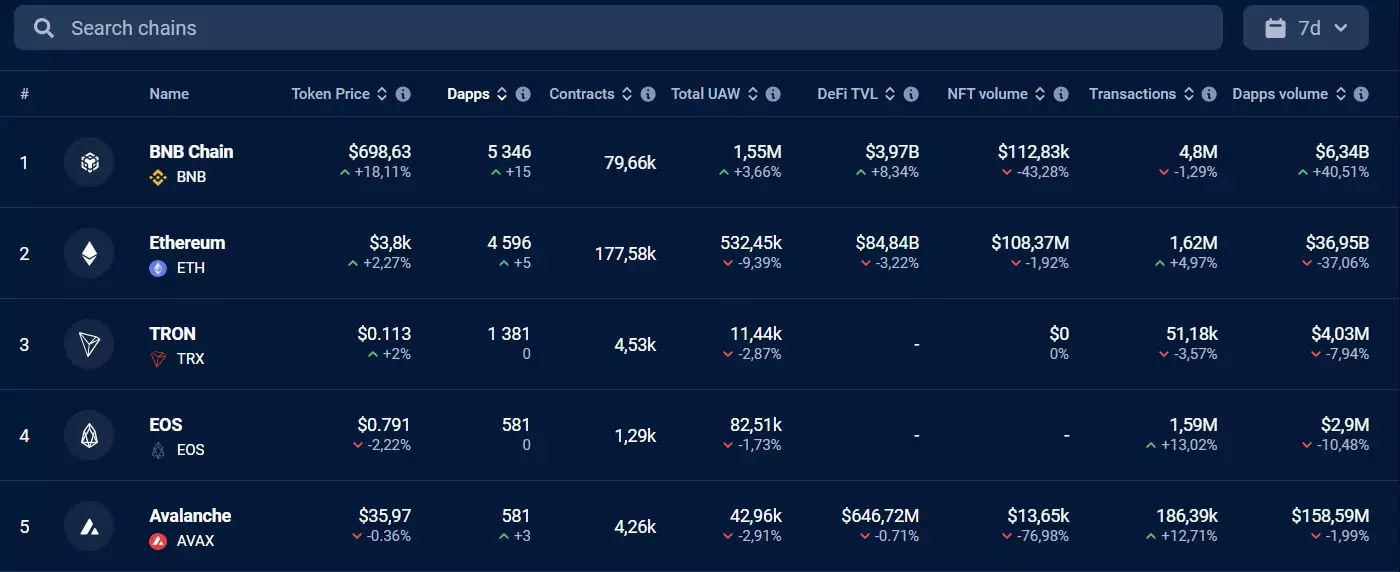

Growth was also driven by activity among decentralized applications (DApps). BNB Chain was already the leading blockchain in terms of their total volume, and this week added 15 more. The Ethereum system, which is in second place, lags behind in this indicator by 750 applications.

Source: dappradar.com

According to technical analysis, BNB has broken the upper boundary of the symmetrical triangle (indicated by pink lines). This is a bullish signal. In addition, the price is above the 50-day moving average (indicated in blue). Worrying factors include the RSI entering the overbought zone and the beginning of a fall. Further growth is possible after overcoming the current historical high of $725.6. Support level = $645.

Source: tradingview.com

Bitcoin

Bitcoin grew by almost 5.5% in the week from May 31 to June 7, 2024. The largest cryptocurrency by capitalization is again trading above $71,000. Five of seven trading sessions over the week ended in positive territory.

Source: tradingview.com

June 6 European Central Bank (ECB)

reduced interest rate by 25 basis points. This is not an ordinary event for the EU, since the previous decrease took place five years ago. Earlier, on June 5, it became known that the Bank of Canada

reduced key rate from 5% to 4.75%. Such actions by regulators caused obvious positivity among crypto investors. In addition, there is a belief that in the US a rate cut is just around the corner. This means that people will be able to take out loans more often.

BTC Growth Potential

visible and analysts of the CryptoQuant platform. From their point of view, large players (whales), who are now in a state of secondary accumulation, will play a big role. However, buying pressure is already being felt and will only intensify in the coming weeks.

Positive dynamics are also observed in spot Bitcoin ETFs. June 5 marked the 17th consecutive day of inflows into these exchange-traded funds. Such a successful series has been observed for the first time since January 2024, when, in fact, trading in BTC-ETF shares began.

The Lookonchain analytical platform also shared interesting information about spot Bitcoin ETFs. Exchange-traded funds continue to accumulate bitcoins. This is especially true for the BlackRock investment company ETF (IBIT). The reserves in the wallets of this financial giant increased by 3,894 BTC ($276.18 million). Another giant, Fidelity with the FBTC fund added 5,378 BTC ($381.42 million) to its treasury. A total of nine exchange-traded funds

increased their assets worth 12,165 BTC ($862.79 million).

From a technical analysis point of view, there is a predominance of bulls among Bitcoin investors. This is confirmed by indicators: the price is above the 50-day moving average (indicated in blue), the RSI indicator exceeds 50 (62.71) and is growing. The support and resistance levels have not changed since last week: $65,513 and $73,794, respectively.

Source: tradingview.com

Fear and Greed Index increased, compared to last week, by five points. Now its value is 78. This indicates extreme greed among Bitcoin investors.

Ethereum

The growth of ether from May 31 to June 7, 2024 turned out to be symbolic – 1.5%. Over the course of seven days, the second largest cryptocurrency by capitalization unsuccessfully stormed the $3,900 mark. The maximum that was achieved was $3,887.9.

Source: tradingview.com

Despite the frankly weak price movements of ETH, a number of major players remain positive. The monitoring and forecasting platform PricePredictions, using artificial intelligence algorithms, estimated the price of ETH at the end of June 2024. WITH

points of view site specialists, the air price on June 30 will be $3,927.66. This is almost 3% higher than now.

VanEck went even further in its forecasts. They believe that in a base scenario, the cost of ether by 2030 will be $22,000, that is, almost six times more than in 2024. Interestingly, the company’s bullish forecast is completely

assumes the cost of ETH at $154,000 is 40 times higher than at the beginning of June 2024.

Well, the head of the Securities and Exchange Commission (SEC), Gary Gensler, discussed the issue of approving spot ETFs for ether. According to him

opinion, the process will take some time. Obviously, the head of the SEC is hinting at agreeing on the terms of the waiver of staking and the S-1 form that all exchange-traded funds will be required to provide.

And on June 3 there was a very interesting

report, which was prepared by Galaxy Digital Vice President of Development Christine Kim. The expert claims that most decisions in Ethereum are made “off-chain”. Typically this process is implemented on forums on Discord, GitHub, and so on. By

Kim’s opinionoff-chain solutions avoid centralization and preserve nuances that are difficult to verify and objectively evaluate.

According to technical analysis, the ether has formed a sideways trend. At the same time, finding the price above the 50-day moving average (indicated in blue) is a bullish signal. Also, over the past two weeks, volatility has decreased significantly, as evidenced by the fall in the ATR indicator. The support and resistance levels remained unchanged from last week: $3,531 and $3,974.1, respectively.

Source: tradingview.com

Conclusion

Major cryptocurrencies rose in price during the week from May 31 to June 7. The best performer was BNB, which not only gained more than 17%, but also broke through its all-time high. Compared to this asset, the successes of BTC and ETH turned out to be more modest.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.