- USD / JPY bulls are closing in and looking towards 115.20.

- On the downside, 112.50 is an important level worth noting.

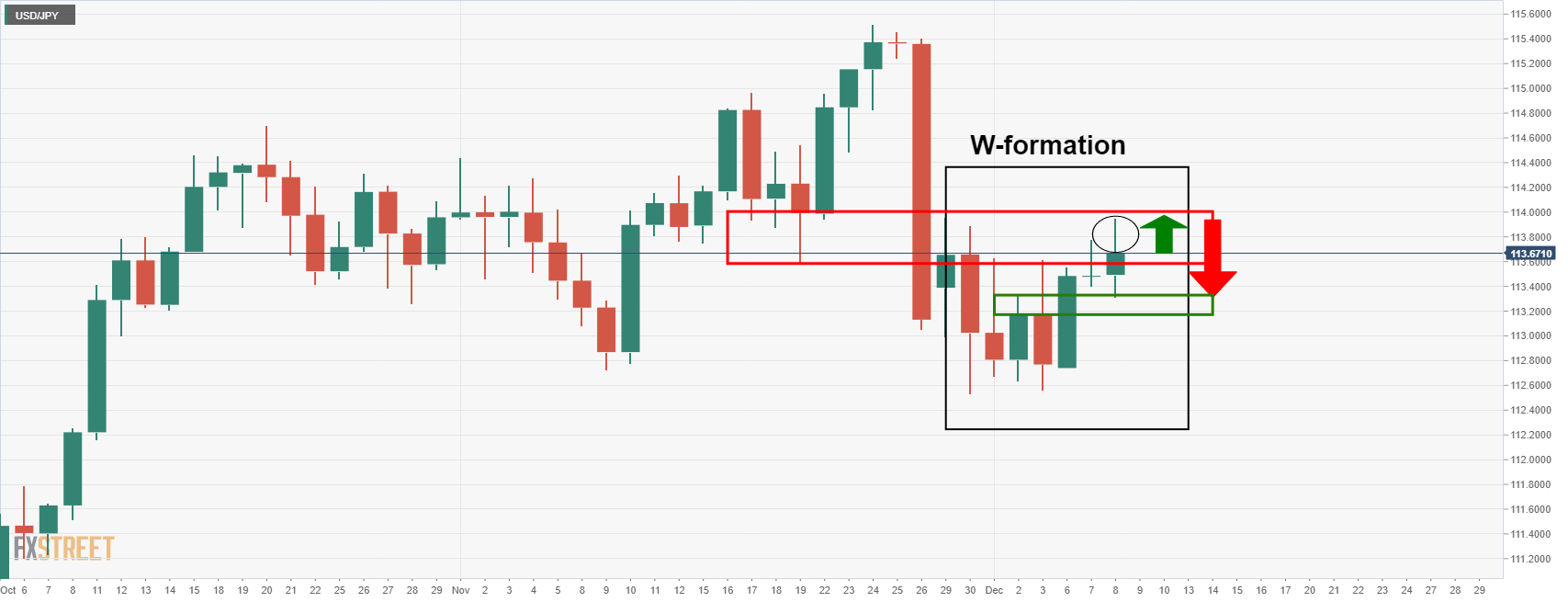

The USD/JPY has corrected to hourly support, leading to bullish outlook for the upcoming sessions. The following illustrates, in a top-down analysis, the potential for a retest of the 114 area towards 115.20.

USD/JPY Weekly Chart

According to the weekly chart, the price has broken past the opening level of last week and the support of the previous week. This has given the bulls the upper hand and a continuation of the rally could be expected for the next few days. An upward close for the week will shore up the bullish bias.

That said, a break out of the lows near 112.50 will likely lead to a continuation to the downside. This will bring the July highs near 111.65 which has a confluence with the 61.8% Fibonacci retracement of the weekly bullish momentum and the 21 EMA.

USD / JPY daily chart

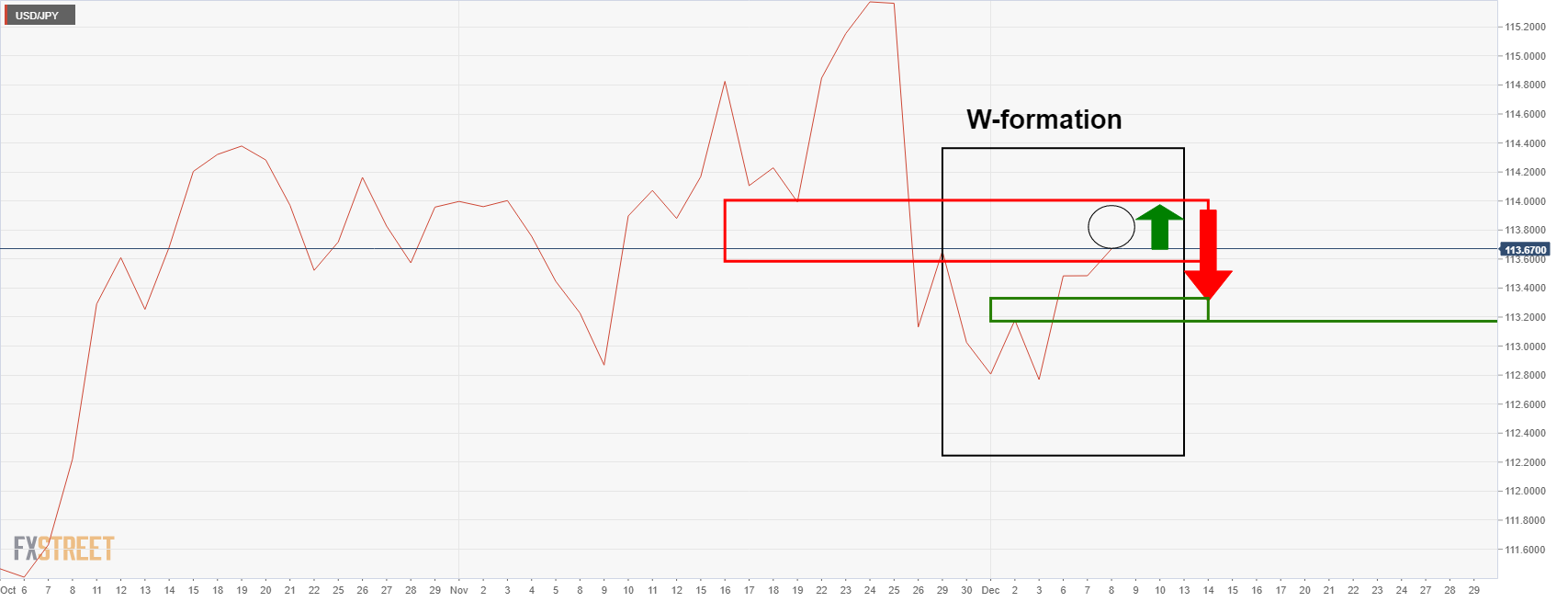

The daily chart shows that the price has formed a W formation, which is most easily displayed on a line chart, as follows:

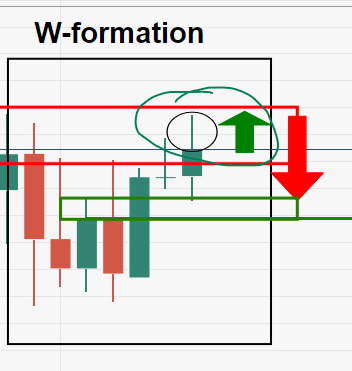

The W formation is a bearish reversal pattern, and the price would be expected to retest the W-shaped neckline approaching 113.20 / 35.

However, there is a possibility that the current business wick and candle will fill in the lower time periods, as the eclipse shows in the images above:

This gives rise to the possibility of a retest of resistance in the next sessions as follows:

However, the last hourly bearish candle was a strong move and a close, so the bulls would be cautious to wait on the sidelines to see how price action plays out in the hours ahead. If the price recovers significantly, the imbalance in the daily chart’s pre-sale is due to the upside potential clearing through the low supply area between 114-115.20.

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.