Cryptocurrency exchange ByBit has reached 10.6% of the spot trading market, making it the second-largest platform for the fifth month in a row, behind only Binance, according to data CoinGecko.

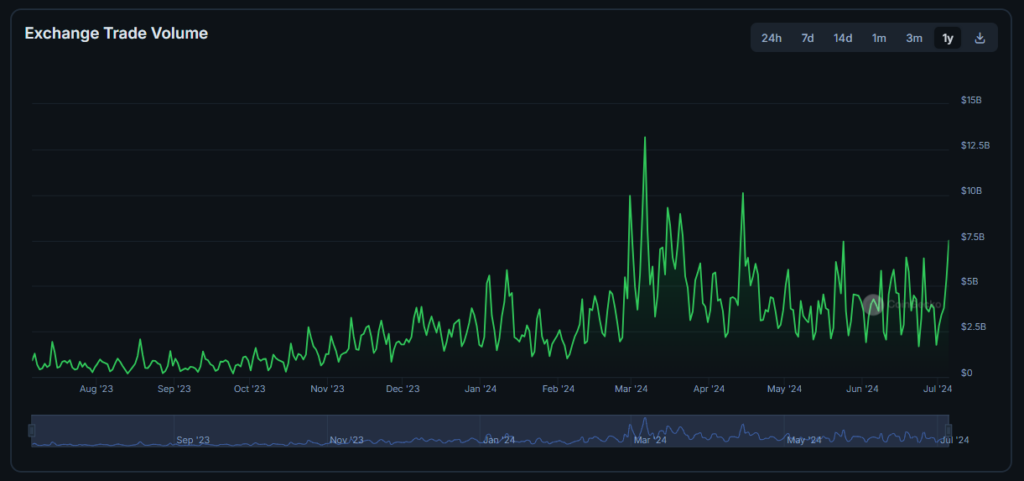

Monthly chart of trading volume on the ByBit exchange. Source: CoinGecko.

Monthly chart of trading volume on the ByBit exchange. Source: CoinGecko.

ByBit CEO Ben Zhou admits that the platform’s rise was partly due to the collapse of the FTX exchange. The said company is still working to raise funds to compensate customers, and its former CEO Sam Bankman-Fried was sentenced to 25 years in prison in March 2024.

ByBit management points to the migration of FTX’s user base to their platform. This is due to the possibility of margin trading, as well as the exchange’s geographical coverage, the company believes. ByBit is available in similar regions where the Bankman-Fried firm previously dominated.

Another factor in the growth was Binance’s dispute with the US authorities. As a result, the exchange entered into an agreement with the US government, agreeing to pay a fine of $4.3 billion, as well as to dismiss the then CEO of the platform, Changpeng Zhao.

Amid this process, Binance’s share of the global spot market has fallen from 45.4% to 38%, according to The BlockAccording to a number of analysts, ByBit was one of the companies that benefited most from the platform’s dispute with the US authorities.

Experts note that in September 2022, ByBit’s share in spot trading volume did not exceed 3%. In less than two years, the exchange has managed to triple this figure, strengthening its position as one of the leading platforms in the crypto industry.

According to ByBit’s official website, the company’s services are used by over 30 million users in over 230 different countries and regions. The platform’s average daily trading volume exceeds $25 billion.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.