- Canada’s Consumer Price Index is expected to lose some traction in June.

- The BoC reiterated that inflation is heading toward target.

- The Canadian Dollar remains trapped within the 1.3600-1.3800 range against the US Dollar.

Canada is set to release the latest inflation data on Tuesday, with Statistics Canada publishing the Consumer Price Index (CPI) for June. Forecasts predict that disinflationary pressures will resume in both the headline CPI and the core CPI following the stumble in May.

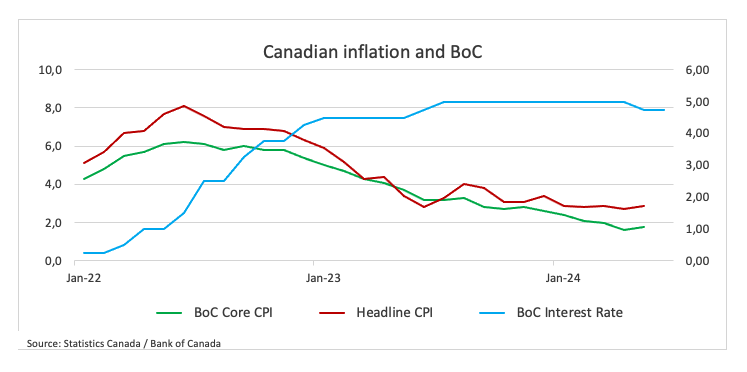

In addition to the CPI data, the Bank of Canada (BoC) will release its core consumer price index, which excludes volatile components such as food and energy. As noted, the BoC’s core CPI showed a 0.6% monthly increase and a 1.8% year-over-year increase in May, while the headline figure rose 2.9% over the past twelve months and 0.6% from the previous month.

These figures are closely watched as they could influence the Canadian dollar (CAD) in the short term and affect perceptions about the Bank of Canada’s monetary policy, particularly after the central bank cut its policy rate by 25 basis points to 4.75% in June.

Looking at the global currency market, the Canadian Dollar continues to navigate the 1.3600-1.3800 range against its US counterpart, while the bottom of this range still seems supported by the ever-relevant 200-day Simple Moving Average (SMA) (1.3596).

What can we expect from Canada’s inflation rate?

Analysts expect price pressures in Canada to ease marginally in June, although still well above the bank’s target. That said, consumer prices should mirror the recent performance seen in the US, where weaker-than-estimated CPI data has rekindled expectations of an earlier-than-anticipated interest rate cut by the Federal Reserve (Fed).

If upcoming data aligns with these predictions, investors could consider that the BoC could ease monetary policy further and opt for another quarter-point interest rate cut, taking the policy rate to 4.50% at its July meeting.

According to minutes of its June meeting, the BoC has expressed concerns that progress in reducing inflation could stall, adding that officials considered the merits of delaying interest rate cuts for an additional month before ultimately deciding to ease monetary policy on June 5.

Turning to inflation, the BoC’s statement following the June interest rate cut said, “With continued evidence that underlying inflation is declining, the Governing Council agreed that monetary policy no longer needs to be as restrictive and lowered the policy rate by 25 basis points. Recent data have increased our confidence that inflation will continue to move toward the 2% target. Nevertheless, risks to the inflation outlook remain. The Governing Council is closely monitoring developments in underlying inflation and is particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate price behavior.”

TD Securities analysts argued: “Markets are pricing in a 70% chance of a cut, and we expect CPI… to add to the easing case with headline/core CPI pushing 0.20/0.15pp lower (y/y)…”

When will Canadian CPI data be released and how could it impact USD/CAD?

On Tuesday at 12:30 GMT, Canada is set to release the Consumer Price Index (CPI) for June. The reaction of the Canadian dollar will largely depend on changes in the monetary policy expectations of the Bank of Canada (BoC). However, unless there are significant surprises in either direction, the BoC is expected to maintain its current cautious monetary policy stance, similar to the approach of other central banks such as the Federal Reserve (Fed).

The USD/CAD has started the new trading year with a strong uptrend, which eventually turned into yearly highs north of the 1.3800 figure in April. However, that initial uptrend has gradually lost steam and has prompted the pair to embark on a consolidation phase between 1.3600 and 1.3800.

According to Pablo Piovano, Senior Analyst at FXStreet, there is a high probability that the USD/CAD will maintain its sideways trading for the time being as market participants remain focused on the policy divergence between the Fed and the BoC as the almost exclusive driver of price action. “This range-bound pattern appears to be supported by the ever-relevant 200-day simple moving average (SMA) at 1.3596 so far. On the upside, there is immediate resistance at the June high of 1.3791 (June 11) before the 2024 peak of 1.3846 (April 16),” Piovano said. “Conversely, if USD/CAD breaks below the 200-day SMA, it could face further losses, potentially falling to the January 31 low of 1.3358. Beyond this, notable support levels are few and far between until the December 2023 low of 1.3177, recorded on December 27.”

Pablo emphasizes that significant increases in CAD volatility would require unexpected inflation numbers. A CPI below expectations could strengthen the case for another BoC interest rate cut at the next meeting, thus boosting USD/CAD. On the other hand, a CPI rebound could offer limited support to the Canadian dollar. A higher than anticipated inflation reading would increase pressure on the Bank of Canada to hold rates for a longer period, which could pose prolonged challenges for Canadians dealing with higher interest rates.

Economic indicator

Consumer Price Index (MoM)

Statistics Canada The Canadian dollar is the body responsible for publishing the consumer price index, which is a measure of price movement through a comparison of retail sales prices of a basket of representative goods and services. The purchasing power of the Canadian dollar is undermined by inflation. Bank of Canada targets a range of inflation (1% – 3%). A high reading would anticipate an increase in interest rates and is bullish for the Canadian dollar.

Latest Post: Tue Jun 25, 2024 12:30 PM

Frequency: Monthly

Current: 0.6%

Dear: 0.3%

Previous: 0.5%

Fountain: Statistics Canada

Canadian Dollar FAQs

The key factors determining the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of oil, Canada’s main export, the health of its economy, inflation and the trade balance, which is the difference between the value of Canadian exports and its imports. Other factors include market sentiment, i.e. whether investors are betting on riskier assets (risk-on) or looking for safe assets (risk-off), with risk-on being positive for the CAD. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian dollar.

The Bank of Canada (BoC) exerts significant influence over the Canadian dollar by setting the level of interest rates that banks can lend to each other. This influences the level of interest rates for everyone. The BoC’s main objective is to keep inflation between 1% and 3% by adjusting interest rates up or down. Relatively high interest rates are generally positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former being negative for the CAD and the latter being positive for the CAD.

The price of oil is a key factor influencing the value of the Canadian dollar. Oil is Canada’s largest export, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD rises as well, as aggregate demand for the currency increases. The opposite occurs if the price of oil falls. Higher oil prices also tend to lead to a higher probability of a positive trade balance, which also supports the CAD.

Although inflation has traditionally always been considered a negative factor for a currency, as it reduces the value of money, the opposite has actually occurred in modern times, with the relaxation of cross-border capital controls. Higher inflation typically leads central banks to raise interest rates, which attracts more capital inflows from global investors looking for a lucrative place to store their money. This increases demand for the local currency, which in Canada’s case is the Canadian dollar.

The released macroeconomic data measures the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.